There has been a lot written in the past 18 months about how the pandemic realigned the way we were living. A moment in time that stretched into a phase that was different for literally everyone, affecting us all in different ways; young and old, key workers through to shop staff, blue collar workers and office employees. Just think for a moment about how different life is now, how you think it might have affected the above groups and how such a seismic shift defines who we are today, what we want from our lives, our relationships, our jobs and our future.

Key reflections in the new year

As we move into a New Year, even if we don’t make wholesale changes, I always find it to be a good time to reflect on where you are at, force a change – even a small one – and move into the New Year in a new gear.

In the last few years, those changes for me have been about reflecting on how we are conducting ourselves on a day-to-day basis and resetting into what is needed in the year ahead rather than drifting along with an adopted behaviour that you inherited post-Covid. I have been very keen to try to get colleagues to do the same.

Go out and see clients face to face, walk around the places we work on and have delivery meetings on client sites rather than on the dreaded Teams. While I’m fully aware of the benefits in time and travel that Teams has brought, I think it is incumbent on us all to ensure we use the channel in the right way, not just because it is the easiest thing to do. There will always be instances where face to face does make a lot more sense – think about it and make the effort!

Understanding the impact of consumers’ changing values and priorities

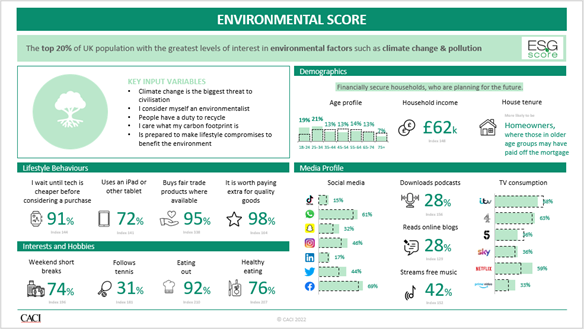

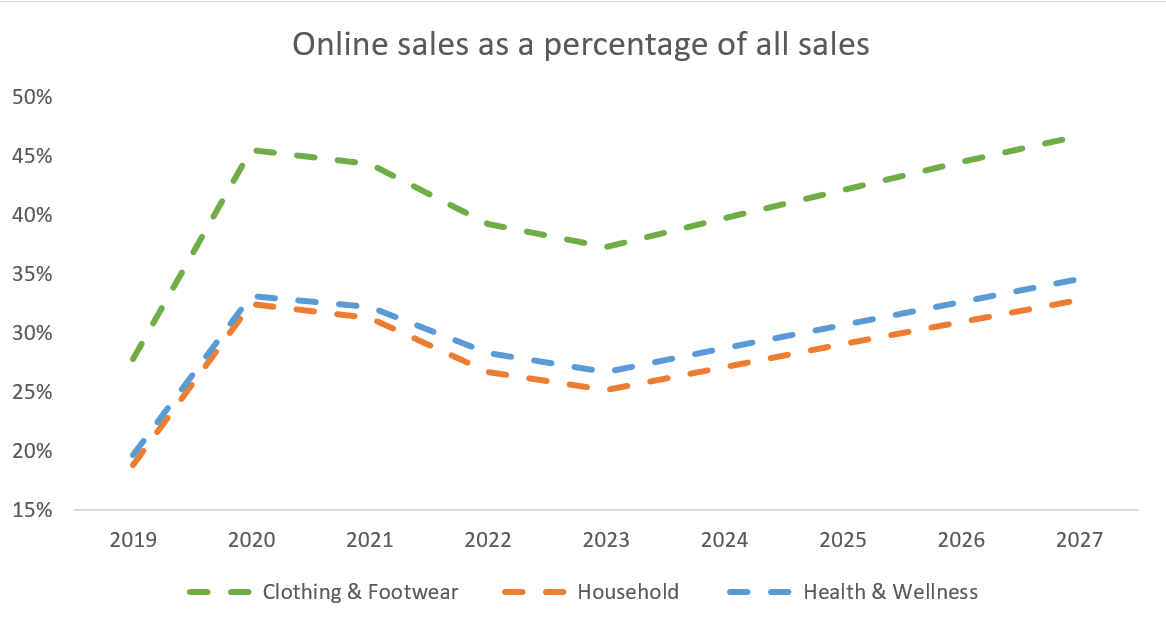

Working in consumer understanding at CACI, I’ve found myself reflecting a lot over the past 18 months, not just about the behavioural changes the pandemic has instilled in us, but how it has altered our values. In general, we have become much more particular about what we choose to do with our time away from home. Some groups, because of what home is to them (singles in smaller shared accommodation versus families in larger, out-of-town homes for instance), will have wildly different values based on that home set up, their life stage, affluence, etc. which maybe, or may not, be like their pre pandemic selves. However, how they value their time, effort and disposable income has definitely shifted.

The impact of the Cost of Living crisis has further evolved everyone’s position, with disturbing situations becoming everyday concerns. Simple things such as keeping warm, having a hot shower, or saving on electricity bills are driving the younger cohorts back to the office now more than the Boomer generation. That, and the realisation that without real face time with their peers and seniors, their careers may be stunted.

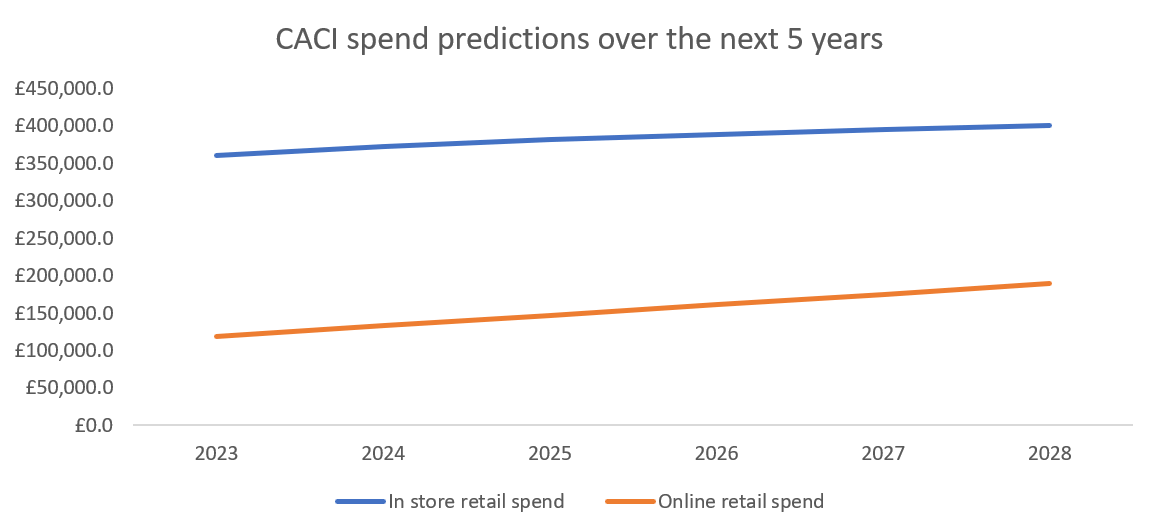

CACI Cost of Living tracker 2023

Applying these learnings in real time: Revo takeaways

Beyond this change in ourselves, we have seen huge changes in the businesses and organisations we work with.

In this last year, I became a board member of the industry body, Revo – an organisation that has gone through wholesale change, not because of Covid per se, but because of what the market needs out of such industry groups. In the past, it was famed for a large-scale conference, held over three days in a regional city, overlapping with many other similar events and organisations. Today, it is very much reset as a not-for-profit organisation, run by the members, for the members.

It is focused on providing a community platform to connect next generation Revo Hub members with those who have a few years under their belts. Instead of a huge annual conference, we now provide smaller events, including the very recent Revo Awards ceremony at Control Room A in Battersea Power Station. On this night, we celebrated the achievements of the best in the business across marketing, asset management, regeneration and leasing. As Revo evolves, those members who contribute will do the same, with a focus on getting out into the market to explore and learn from these winning best practice examples.

Predictions for the future of our working world

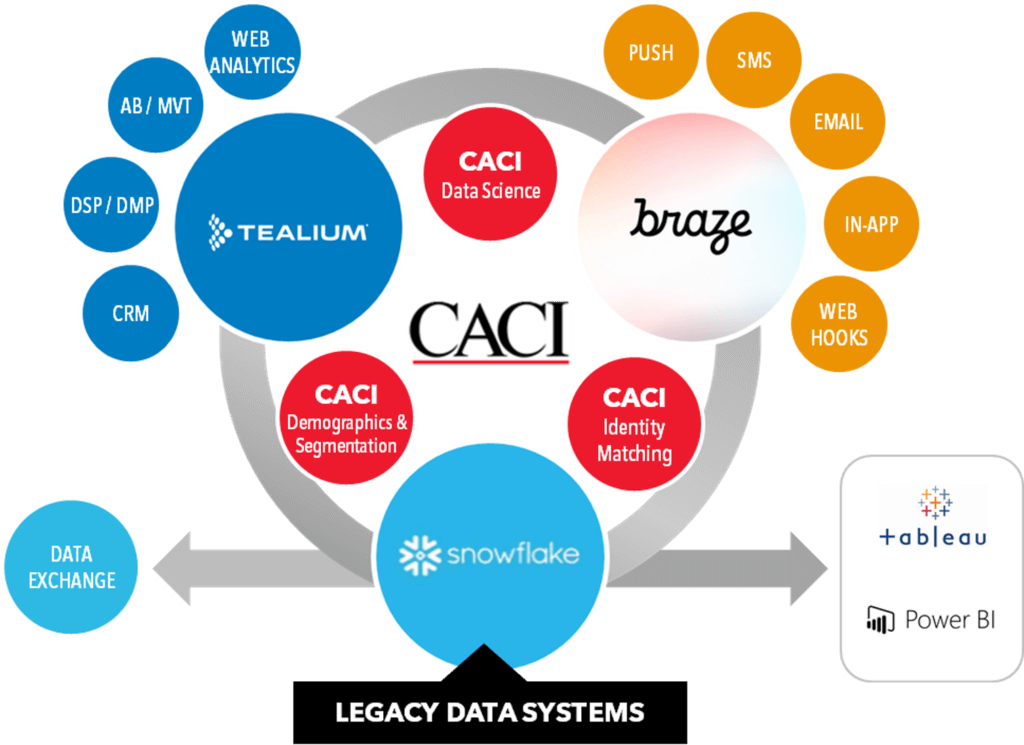

So, thinking about the future changes; in our work world, 2023 was centered around the birth of generative AI, albeit over thirty years after the business world started using all forms of AI (under a different name). I no longer struggle to answer the question ‘What do you do for a living?’. While our world at CACI isn’t as straightforward as saying you work in Finance or Retail, with Generative AI for the masses now, I can (relatively) easily explain that I work in consumer data to support businesses like banks, using natural language in AI to categorise large volumes of calls data to better direct enquiries. Or, using AI on satellite imagery to create spatial wealth distribution indices for far flung places. Or, put more simply, use behavioural data (like GAI can) to enable better actions and interactions with customers and prospects.

My biggest goal moving into 2024, and one I would encourage colleagues and friends alike to adopt, is to just get out there and see places again. Make sure you are putting a value on that travel and time, but also make a concerted effort to get away from your screen (office or home), force a new experience, and share that. In a world where AI will take away the mundane tasks, it is even more important to enjoy the new experiences that these new repurposed places bring.