Summary

Hertfordshire County Council serves a population of 1.2 million residents and offers a range of services including Adult Care Services, Children’s Services and Public Health Initiatives. The council is responsible for administering the Homes for Ukraine scheme across the county, via a dedicated team working with partners to manage the scheme’s requirements of Ukrainians fleeing conflict. These requirements focus on the safety, suitability and support for those arriving to hosted accommodation in Hertfordshire. The team also provide a service to support guests moving on from a host, including rematching Ukrainian guests with new hosts if their existing arrangement can no longer continue.

Company size

10,000+

Industry

Non-Profit

Products used

Challenge

Rematching Ukrainian guests with new hosts is a substantial part of the council’s Ukraine Sunflower Campaign, as it is aimed at encouraging more rematch hosts to come forward while retaining those already in place. Due to the conflict continuing, some hosts are unable to house guests longer term. It is also preferable for guests to remain hosted within their original vicinity, district or area, both from a cost perspective to the council and for guests’ wellbeing, as they may have formed relationships and begun settling in.

With a key message being “you only need a spare room”, the council operated under the assumption that the ability to host and likelihood of having a spare room fundamentally came down to affluence. This prompted conversations around the impact that more targeted efforts could have on campaign outcomes rather than operating on a scattered approach and the powerful role that data could play.

Solution

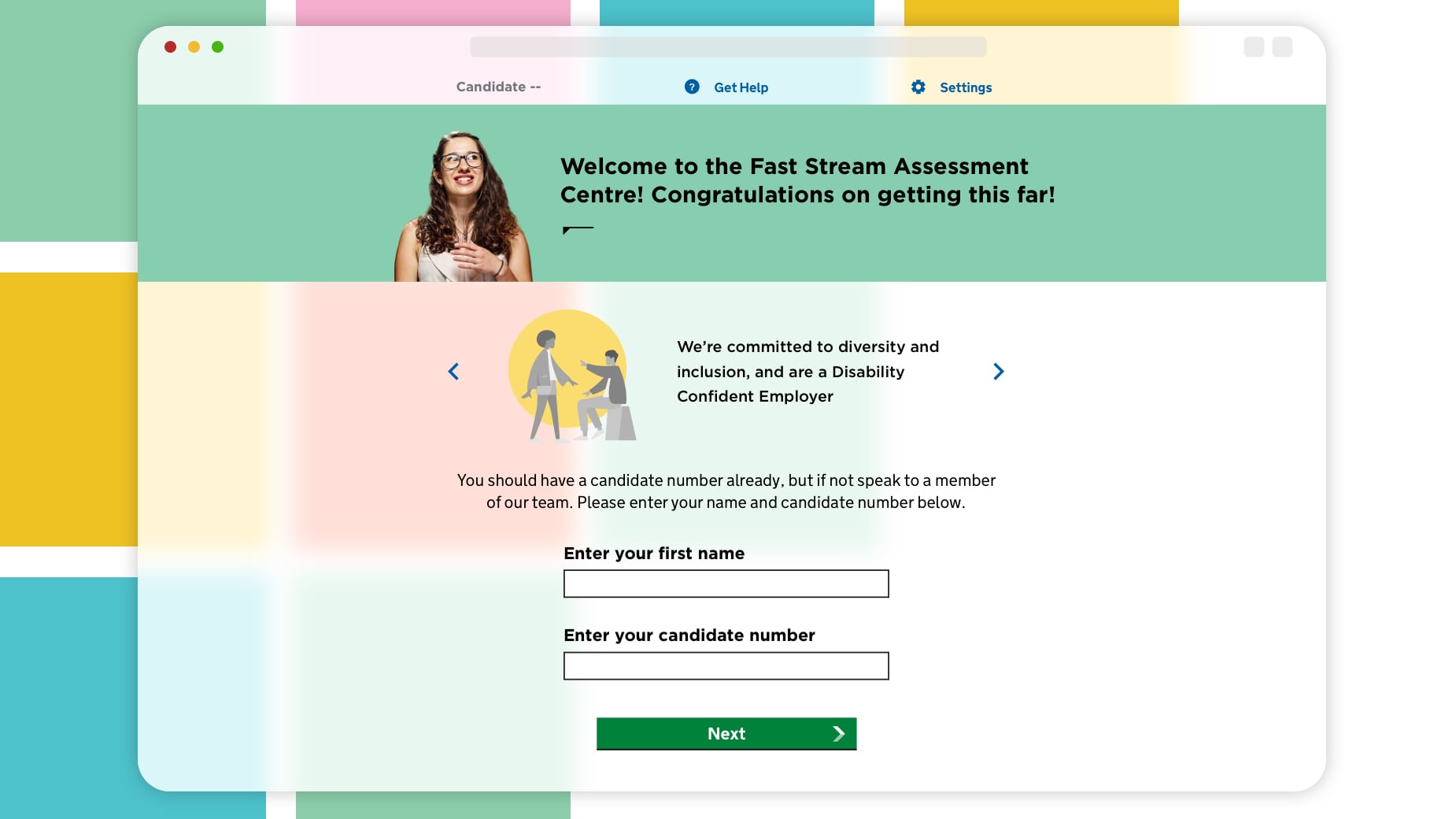

The council decided to concentrate an early phase of their rematch campaign in St Albans, a district within Hertfordshire. Through a blended data approach that leveraged segmentation insights from CACI’s Acorn data, persona profiles from Acorn’s Pen Portraits and HCC records, the council was able to pinpoint St Albans as the area with the highest concentration of likely hosts with the help of Laurel Smithson, Strategic Communications Manager. These typically comprise households with adult children who had moved out or were living in larger properties with spare rooms available, making them an ideal demographic for hosting.

Brianna Schubert-Mordey, Intelligence Analyst and Geodemographic Lead at Hertfordshire County Council, initiated an integrated data strategy by merging Acorn’s demographic data with Hertfordshire-specific datasets. This enabled the creation of a customised segmentation model and development of seven unique personas tailored to reflect the characteristics of the Hertfordshire population. An algorithm, K-modes, was used to analyse data for each postcode and determine the optimal number of clusters, allocating each postcode to one of seven defined clusters. This would eliminate human bias when identifying similar types of residents, with each cluster becoming a persona.

The composition of each segmentation and each of the seven personas was then assessed using the data available. This enabled naming conventions for each persona that represented respective key factors. These 7 Personas are as follows — Young and Financially stretched, Stretched Families, Comfortable Neighbourhoods, Affluent Families, Financially Secure Maturity, Highly Affluent Maturity and Struggling Elders, and have been created to reflect Hertfordshire’s local population. CACI Data has been used along with proprietary data the council reported on about council tax bands, dwelling values based on sold house prices and the likelihood of individuals calling into their call centre compared to other households within Hertfordshire.

Following this, Laurel approached Brianna and the HCC Homes for Ukraine team regarding the Homes for Ukraine project. Their goal was to identify target households that could potentially host a family based on these seven personas. Brianna’s team sent Laurel a list of postcodes to be aligned to these specific segments to assess the affluence, financial maturity and security of various areas across Hertfordshire, with a particular focus on identifying comfortable neighbourhoods and affluent households to gauge the affluence maturity and financially security of various areas in Hertfordshire, as well as postcodes containing comfortable neighbourhoods and affluent families.

St Albans and its vicinity was ultimately targeted with Royal Mail leaflet drops and digital advertising, with trackable links set up for each form of communication. The leaflets were most one of the most successful in leading people to the council’s rematch website.

Due to the success of the St Albans pilot, the council was inspired to execute this rematch campaign once again in East Hertfordshire, another higher affluence area where the target demographic of potential hosts for displaced Ukrainians is situated. Due to feedback received on the reliance of Royal Mail delivery, including some households within the targeted postcode being considered inappropriate (such as care homes), this phase of the campaign took an even more targeted approach. Colleagues from the Homes for Ukraine team undertook the hand delivery of leaflets, allowing for higher reliance and feedback on the ground. This initiative has seen a higher uptake than the St. Albans targeting.

Summary

Through Household Acorn and Acorn, Hertfordshire County Council have been able to:

- Help Adult Care services identify where to target leafleting and outreach work

- Allow the Customer Service Centre to identify the Acorn segmentations that are over/underrepresented in terms of calls

- Highlight the areas most likely to be able to host Ukrainian families

- Understand the types of residents in an area

- Profile current foster carers and patrol crossing staff and use this information to communicate with potential new carers/staff.

This initiative has brought many more rematch hosts forward and has even inspired council staff to become hosts. In fact, the Ukraine Sunflower Campaign won a comms2point0 award in December 2024 for being “…a campaign that used insight, data and measurement to deliver high impact and change people’s lives.” A comms2point0 ‘UnAward’ honours “creativity, innovation and results in the comms industry”.

With devolution, local government will be changing in the coming years, and Acorn could be used to help Hertfordshire County Council understand the needs of residents throughout this change. Using CACI’s data to map and pinpoint hard-to-reach individuals facing health inequalities would also support the council’s future endeavours.

Summary

In today’s hyper-connected, data-driven world, marketing teams are under more pressure than ever to deliver personalised, timely and measurable campaigns. Legacy systems, fragmented data and unsupported platforms can quickly become roadblocks to innovation, however.

For Skipton Building Society, a long-standing client of CACI, the need to upgrade their Adobe Campaign platform was not just about compliance, but unlocking the full potential of their marketing strategy. With Adobe sunsetting support for their existing platform, Skipton seized the opportunity to reimagine their marketing infrastructure for the future.

Company size

2,500+

Industry

Financial services

Services used

Partners used

Challenge

Skipton Building Society faced a number of common challenges that we are seeing across the market:

A legacy data model that restricted campaign agility

A data solution that did not enable Skipton to be customer-centric

Missed data during daily processing, impacting decision-making

A looming deadline with Adobe’s end of support

The need to coordinate across multiple stakeholders and systems.

Solution

The timing of this project was critical, and strategic.

- Adobe product sunsetting: With Adobe confirming that support for Skipton’s existing Campaign platform would end after 2024, the risk of operational disruption and compliance issues was growing.

- Rising customer expectations: Customers now expect seamless, personalised experiences. Skipton’s legacy data model was limiting their ability to deliver on this, and competitors were already moving ahead.

- Data as a differentiator: In a world where data drives marketing performance, Skipton needed a platform that could process, transform and activate data in real time.

- Cloud momentum: The broader shift to cloud-based marketing platforms is accelerating. By acting now, Skipton avoided the pitfalls of rushed migrations and positioned themselves ahead of the curve.

This was not just a technical upgrade, it was a strategic transformation, taken at exactly the right moment.

This transformation was not delivered in isolation. It was the result of a close, collaborative partnership between CACI, Adobe and Skipton, each bringing unique strengths to the table. From the outset, the project was shaped by a shared vision and a deep commitment to joint success.

CACI led the programme of work, particularly in the design and architecture of the solution, by creating a design that delivered Skipton’s requirements and providing the personnel that could deliver that plan. Adobe played a central role as a strategic partner, offering platform expertise, innovation and direct support throughout the journey. Skipton brought critical insight, ambition and a clear understanding of their organisational needs and goals.

Together, this tri-party team operated as a single, integrated unit. Our four-phase approach was co-developed and co-delivered, ensuring the transformation was not only smooth and secure, but designed to scale and evolve with the organisation’s needs.

1. Discovery

In-depth analysis of Skipton’s SQL Server and Adobe Campaign setup

2. Design

A reimagined architecture tailored to modern marketing needs

3. Implementation

Rebuild of the data platform to create a customer centric solution, enabling better personalisation

4. Migration

Seamless transition of workflows and data to the cloud

5. Testing & handover

Rigorous Q&A and collaborative enablement.

Outcomes

- Full re-implementation of Adobe Campaign v8 on Adobe Cloud Managed Services

- Legacy components eliminated, streamlining operations

- New data staging and transformation processes to overcome Helix migration issues

- Helix is Skipton Building Society’s cloud-based data platform designed to centralise, govern and orchestrate marketing and customer data across the organisation. It plays a foundational role in enabling the migration to Adobe Campaign v8 in the Cloud and supports the broader digital transformation strategy.

- Delivered on time and within budget, a rare feat in complex migrations.

With their new platform, Skipton is now positioned to:

Launch campaigns faster and with greater precision

Leverage real-time data for personalisation

Scale marketing operations without infrastructure or data constraints

Have a future-proof solution designed for future business needs

Stay ahead of compliance and vendor support timelines.

Summary

The Money and Pensions Service (MaPS) is a statutory

body sponsored by the Department for Work and

Pensions dedicated to helping people – particularly

those most in need – make well-informed decisions

about their money and pensions and improve their

Financial Wellbeing and resilience to build a more

secure future.

CACI has worked in partnership with MaPS for a

decade, delivering a range of analytical solutions

that have enhanced MaPS’ understanding of the

UK’s financial wellbeing. This work has included the

development of MaPS’ current Financial Wellbeing

segmentation solution, which supported the

understanding and underpinning of their national

strategy.

To fulfil their remit, MaPS must understand the

varying financial needs of UK consumers and the

characteristics, features and locations of consumers

with lower Financial Wellbeing. This insight is critical

for targeting the right groups of consumers and

offering them the necessary support.

Company size

0-500

Industry

Financial Services

Products used

Challenge

The UK’s economic landscape has changed since the development of the previous Financial Wellbeing solution in 2019-2020, with many households’ finances having been and continuing to be affected. As such, MaPS needed CACI to review and refresh the existing segmentation to ensure it remained fit-for-purpose in reflecting the Financial Wellbeing of the UK population and would distil a complex array of characteristics into one cohesive solution.

Solution

The UK’s economic landscape has changed since the development of the previous Financial Wellbeing solution in 2019-2020, with many households’ finances having been and continuing to be affected. As such, MaPS needed CACI to review and refresh the existing segmentation to ensure it remained fit-for-purpose in reflecting the Financial Wellbeing of the UK population and would distil a complex array of characteristics into one cohesive solution.

A blended data approach was instrumental in the innovative development of this segmentation. MaPS’ flagship Financial Wellbeing survey (known as “MoneyView” from 2025) and scoring methodology was used to inform the clustering algorithms alongside CACI’s UK-wide datasets to define the segments and add further colour and context into who these people are. Consolidating research with Fresco, CACI’s powerful individual-level financial services segmentation, and Ocean, CACI’s attribute-rich consumer database, ensured segments and sub-segments would be accurately rolled out across the UK at various geographic levels. This ranged from more granular postcode sectors to local authority area or region and can be applied to financial service providers’ customer databases. Through the range of data inputs, segments and sub-segments could be profiled across over 900 characteristics to enhance understanding and drive ongoing strategy through data-driven insight.

As a result, this refreshed solution is helping MaPS define, describe and outline a set of characteristics of those most in need, as well as who to target and reach. It will also enable the opportunity to profile service users and whether users with lower financial well-being were adequately supported.

Outcomes

MaPS’ refreshed Financial Wellbeing segmentation offers a range of new benefits, including:

- An enhanced understanding into how consumers’ needs differ and the areas of greatest need.

- An accurate representation of the current population’s financial situation, given changes to the market.

- Aligning to MaPS’ Financial Wellbeing scoring for consistency with internal methodologies.

- Ensuring reach is applicable to the whole of the UK.

- Underpinned by Fresco, enabling its use by wider financial service organisations to bolster their understanding of Financial Wellbeing (which can be particularly helpful in the context of Consumer Duty).

The refreshed segmentation has been fundamental in aspects of MaPS’ operations, from content design to communications activity. For example:

- Informing MaPS’ UK strategy for Financial Wellbeing.

- Identifying the target audience for MaPS’ cost of living campaign

- Participant recruitment in user research when developing new tools and services.

- Understanding local regions and areas across the UK most in need of support for partnerships.

- Understanding needs, issues and policy innovation.

To find out more about the Money and Pensions Service Financial Wellbeing strategy, click here

A leading media company* operating multiple radio brands had successfully deployed Machine Learning (ML) models to optimise ad selection and predict customer churn. Run on scheduled batch processes producing static outputs, the LM models were manually monitored and maintained. As the models became more business-critical, the client wanted to move from time-intensive manual oversight to a more automated, scalable approach for managing and retraining them.

Leveraging the client’s existing use of the data platform Snowflake, CACI designed a Machine Learning Ops (MLOps) architecture that enables continuous ML improvement through automated testing, version control, and human-gated deployment workflows. Delivered as a scalable blueprint, the solution is being trialled on the ad optimisation model as a proof of concept, with the potential to be applied across the client’s wider ML estate.

Industry

Media & publishing

Partner

Snowflake

Challenge

While the client’s ML models delivered value initially, scaling, reliably maintaining and improving them became increasingly complex. The in-house team had the technical capability but not the operational headroom to design a solution and faced issues that collectively slowed innovation, increased operational costs, exposed the business to risk and limited the company’s ability to respond to fast-changing business needs.

Lack of observability

No real-time visibility into model performance or data quality, meant the team couldn’t detect issues early and struggled to answer fundamental questions like “Is our model still working correctly?” or “Has our data changed significantly?”, creating uncertainty.

Infrastructure scalability constraints

On-premises virtual machines struggled under growing workloads, causing regular failures and downtime. The team required reliable, scalable hosting infrastructure that could provide them with autonomy over its deployment.

Manual deployment risks

Data scientists developed improved model versions but deploying them to production was high-risk in the absence of systematic testing or comparison frameworks. Each update felt like a leap of faith.

Inflexible batch processing

Scheduled batch jobs could not meet urgent business needs, such as real-time campaign optimisation or reacting to breaking news events.

No testing framework

Without automated quality assurance, silent data drift and undetected model degradation posed serious risks to business outcomes.

Solution

To address this, the client engaged CACI to design a MLOps (Machine Learning Operations) architectural blueprint – a structured framework of practices and tools to automate and streamline ML workflows – and support a proof-of-concept (POC).

Working closely with the in-house data science team, CACI mapped operational requirements, tested theories and validated approaches. The result: a robust MLOps architecture built on four core pillars:

- Observation – Four-tier monitoring for data quality, performance, drift, and infrastructure health. Threshold-based alerts linked to business KPIs trigger proactive responses like investigation, enhanced monitoring, or retraining.

- Reproducibility – Full version control across datasets, features, models, and configurations. Each model traceable to its training data and transformations, enabling fast troubleshooting and clear audit trails.

- Automation with oversight – CI/CD pipelines standardise testing, deployment, and model serving. Quality gates enforce performance thresholds, APIs enable real-time predictions, and monitoring informs retraining – while humans make the final call.

- Continuity – Challenger model versions run in parallel using shadow scoring, A/B testing, or seasonal rotation. A centralised serving layer manages selection, logging, and complexity, allowing better models to be adopted without disrupting stability.

Designed on the client’s Snowflake data platform, the blueprint leverages our strategic dataTech and cloud partnership. It powers data ingestion, feature engineering, versioning, model serving, and observability.

A central metadata store governs configurations and guardrails, with automated checks at every stage. Models are validated and served on-demand or scheduled, with outputs logged to downstream systems. Snowflake’s native monitoring tracks freshness, validity, and custom rules – establishing a pathway to scalable, governed automation.

Results

The client is now using the MLOps blueprint to implement the proof of concept on their ad-serving model, with the intention to scale the approach across their wider ML estate. Early feedback shows the in-house team confident the design will reduce manual effort, improve reliability, and accelerate innovation.

The blueprint provides a clear automation framework to move from reactive model maintenance to proactive, evidence-based improvement – allowing them to test and deploy improved models with faster-time to value, greater confidence and less risk.

Real-time model serving – previously out of reach due to infrastructure and process constraints – is now within reach. The challenger model framework enabling safe experimentation, while the metadata-driven design ensures flexibility as business needs evolve: all with improved auditability and compliance via full traceability.

Crucially, the architecture supports trust-building: alerts and retraining triggers are reviewed by humans before any automated action is taken. Over time, as confidence grows, the client can choose to enable full automation on their own terms.

The blueprint not just enables a powerful technical upgrade from a mostly manual ML implementation, but also the strategic and operational step change needed to move from: “Is our model working?” to “How can we make our models work even better?” A mindset shift laying the foundation for scalable, future-ready ML deployment can deliver business value over time.

*This case study describes a proof-of-concept architecture design and implementation support engagement. The client organisation is not identified to maintain confidentiality.

Summary

National Rail Open Data (NROD) provides the public with access to a large number of operational data feeds to encourage both greater interest in rail and the development of innovative products that are of use to passengers and the rail industry. CACI processes and manages the NROD platform with the aim of providing continual and easy access to users.

Company size

42,000

Industry

Transport

Products used

Challenge

Network Rail provides a variety of data in different formats from XML, JSON and rail proprietary data structures. These are received with varying levels of frequency from static data to real-time data updated at up to 100 messages per second during peak hours. Our instruction from Network Rail was for the data to be made available with no obfuscation or filtering applied to make it as accessible and easy to use as possible.

Varied data formats

Inconsistent frequency

Need accessibility

Solution

To achieve this, we offered options for users by providing some conversions (such as to JSON) and enriching data with metadata. We also used AWS infrastructure and highly available components like AWS ECS (Elastic Compute Service) and S3 (Simple Scalable Storage) to improve access and availability.

Users were provided a portal for account management, allowing them to change details such as their username and password and access links to documentation and endpoint information for the data to aid their use and interpretation. A separate portal manages access for industry clients invited by Network Rail, allowing them to connect to a more stable platform for use in industry applications.

Results

NROD is now used by an engaged, passionate community of over 600 registered users who apply the data in a variety of ways. Since the data was first made available, a range of websites and apps have been created, including Open Train Times, which provides real-time arrival and departure information for each train company and helps passengers plan their journeys, along with Recent Train Times, demonstrating individual trains’ performance and helping users assess the punctuality of different train services to plan their journeys accordingly.

CACI has been collaborating with industry clients and representatives of the broader public client community in a working group to give updates and receive feedback on how best the community can be served. We also discuss enhancements and how to collaborate to address users’ needs at quarterly meetings.

A Grafana dashboard has been developed to keep users informed on the system’s status, including message rates, message latency of the main feeds and an update field showing system downtime updates.

To ensure NROD is accessible to as many audiences as possible, we have worked with Network Rail to provide the same data within the Rail Data Marketplace (RDM), adding to the 100+ other rail data products now available on this platform.

Summary

The HMCTS Court Store and Bench applications have historically been hosted on the UKCloud’s elevated platform, managed and supported by CACI. In 2021 however, the decision was taken to move the hosting of these projects onto the

AWS platform, with ongoing support in the new environment. CACI was tasked with ensuring the move was achieved in as short a time frame as possible whilst observing the highest level of security.

Company size

18,500

Industry

Government

Services used

Challenge

Due to the complexity of the UKCloud solution and application software stack, we decided to migrate the solution in its existing state from UKCloud to AWS. The environments consisted of four AWS accounts and eight Virtual Private Cloud environments. The approach was to split the project into two stages.

In view of the tight timescales, the order of this migration was to first focus on production, with the pre-production environment to be established after go-live. This order was acknowledged by all parties that whilst being far from ideal, there was no alternative. One of the biggest challenges was the volume of data to be migrated from one cloud provider to the other: in excess of 20Tb.

Stage one environments

Production, sandbox and performance

Stage two environments

Pre-production

Solution

The migration project consisted of several phases:

- Provisioning a base AWS Infrastructure and protective monitoring setup

- Export of Virtual Machines in UKCloud and import into AWS as AMIs

- Provisioning/cloning of AMIs

- Re-configuration of the application stack, on-VM protective monitoring/backups and internal operability testing

- Intersystem Connectivity and Operation, Connectivity Testing

- Configuration of G-Suite and novation of domain from MoJ to CACI

- End-user testing

- IT Health Check

- Operational Readiness Testing

- Data Migration

CACI’s role was as follows:

- Solution design

- Migration plan

- Infrastructure and protective monitoring

- Import of Virtual Machine images and data transfer

- Testing: OAT, ITHC

- Cutover

- Overall project management, including other parties: SopraSteria, HMCTS and other MoJ departments

Results

HMCTS can now continue to run its Court Store and Bench operations in the knowledge there is little likelihood of a breakdown in service.

Based on CACI’s experience of migrating similar workloads, this move to AWS also achieved other improvements such as:

- Use of infrastructure as code: better change management, less human error, increase of delivery quality and reduction in build time

- Use of AWS security services to increase view of security posture and simplify implementation of some security controls (e.g. encryption, identity and access management)

Other highlights:

- Completed the project two months ahead of time

- Ongoing data storage cost savings are in the region of 65%

Summary

Muzzle Movement UK is a purpose-led pet accessories brand focused on changing perceptions around dog muzzles. Their mission is to make muzzles more accessible, better understood, and stylish — helping dog owners feel confident and supported. The brand is known for its community first approach and strong presence at consumer events.

Company size

1 – 50

Industry

Manufacturing

Services used

Products used

Challenge

Prior to working with CACI, Muzzle Movement UK relied heavily on broad awareness campaigns and internal assumptions about their audience. There was a lack of clarity around who their customers were, how they behaved, and what messaging resonated. This led to guesswork in campaign planning and limited targeting capabilities. They needed a way to validate their hypotheses and build a more strategic, data-led marketing approach.

Solution

CACI provided Muzzle Movement UK with detailed audience segmentation data, enabling the marketing and sales teams to better understand their customer base, tailor messaging, and optimise campaign strategies across multiple channels.

Results

The team at Muzzle Movement UK were surprised by the depth of insight and the level of differentiation between segments. The project has exceeded expectations, providing clarity and confidence across marketing and sales functions.

Improved ad performance

Smaller, targeted campaigns are delivering early success, answering customer questions earlier in the journey and reducing pressure on customer service along with marketing cost savings.

Enhanced messaging

Ads now highlight specific service features (e.g. fast refunds, easy exchanges) that resonate with segmented audiences.

Sales enablement

The segmentation has empowered the sales team with tailored materials and a deeper understanding of customer motivations, especially useful at events and in-store conversations.

Product development

Insights have influenced new product launches, ensuring sizing and features align with target demographics.

Strategic planning

The segmentation is already shaping Black Friday campaigns, with tailored messaging for both price-conscious and affluent audiences.

What’s next

Looking ahead, Muzzle Movement UK plans to explore segmentation within the trade channel, helping them approach pet shops with data-backed recommendations on what to stock based on local demographics. They also aim to apply segmentation to post-purchase campaigns, identifying upsell opportunities and improving retention. The team is keen to continue using segmentation to refine awareness campaigns and explore ROI improvements in ad spend. They’re also interested in competitor analysis tools to stay ahead in a growing market.

Summary

Over 76 million passengers a year make over 130 million crossings through the mission-critical applications that CACI have delivered. Our solutions have improved both the security and efficiency of the border at over 270 ports of entry (so helping to keep more bad people out while ensuring that legitimate travellers have a safe, fast experience) and made a demonstrable difference to the availability and resilience of the UK border systems.

Company size

50,000

Industry

Government

Products used

Challenge

Identifying a solution capable of automated entry decision-making at e-gates.

Ensuring successful business transformation

amidst decommissioning legacy systems

Solution

To enable this, CACI:

- Scaled up to 80 highly skilled resources across nine multi-disciplinary teams (initial ramp-up to 60 within six months).

- Built a rules-based decision engine for border

entry. - Integrated novel critical services to mitigate threats

to UK security.

- Implemented upgrades for accessibility, zero

downtime deployment, high availability and robust

resilience. - Aligned CACI project delivery with Home Office

programme governance. - Participated in a joint leadership governance

structure, working alongside client-side teams,

to make joint priority calls and ensure that no

protectionist silos built up.

Results

Citizen-facing benefits included:

- Enabling >130m border crossings per year.

- Enhanced UK protection by digitally transforming

border security procedures. - Facilitated more expedient travel across the border

through electronic integration of the previously

manual passenger locator form information during

the COVID-19 pandemic

Additional results included:

- First live release delivered on time and under

- budget, with positive feedback from the client community and significantly higher availability and reliability than the previous pilot release.

- Rapid delivery (from concept to delivery in eight

weeks) of the Passenger Locator Form (PLF)

integration. - PLF integration was an urgent operational

requirement, which made an immediate

impact on the UK borders, easing congestion

and improving the security of health measures

at the border. - Introduced enhanced passport authentication,

which, according to one customer expert,

delivered “the single most important thing we can

do to improve security at the UK border”. - Maintained an average cadence of over two

releases per month, supporting continuously

evolving customer requirements

Summary

RAF Digital is a key component of the RAF, driving digital transformation and innovation. As the RAF becomes more data-centric, there is an increasing demand for mapping information flows, understanding the technology used to consume this data and managing associated costs.

The RAF Digital Architecture Function (AF) provides assurance and actionable guidance to programmes and projects from an Information Defence Line of Development perspective. As it continues to evolve in support of Air’s digital transformation, there is a growing need to enhance governance, collaboration and consistency across programmes while operating within a broad and complex stakeholder landscape. Documenting artefacts and fostering a culture of reuse that reduces time, risk and cost are crucial as the AF matures, which led to the development of the Digital Services Register: a comprehensive repository of architectural patterns, services and standards for reference.

Company size

30,000+

Industry

Defence

Products used

Challenge

Historically, architectural artefacts were often developed in isolation, resulting in duplicated efforts and inconsistencies. This prompted the AF to adopt a more structured approach to knowledge management and improve continuity, decision-making and the reusability of architectural artefacts.

As the function matures, its ways of working will naturally evolve to meet new demands and challenges. During this transition, external expertise will be vital in shaping best practices, refining methodologies and contributing to the development of architectural artefacts. Collaborating with industry partners will also help ensure that the AF remains agile, effective and well-positioned to support Air’s long-term digital strategy.

Solution

To address the challenges faced by the RAF Digital Architecture Function (AF), the Digital Services Register was created to ensure the RAF would maintain consistency and efficiency in developing and deploying their digital solutions. Supplementary SME knowledge was also provided on the scoping and costing of new services, including offering guidance on best practices, identifying risks and aligning new projects with the RAF’s digital strategy to further support this.

Experienced solution architects with a solid background in the Air Domain were also employed, working closely with desk officers and collaborating with other industry partners to refine the definition of Information Defence Line of Development (DLoD) services. A key focus was determining how these services, along with architectural patterns and standards, could be effectively documented within the Digital Services Register.

Throughout this process, the solution architects utilised a range of industry-standard tools to develop and manage architectural artefacts. However, after careful evaluation of various solutions, Mood’s no-code software was identified as the most suitable platform for the development of the Digital Services Register. This decision was driven by Mood’s ability to provide an intuitive and user-friendly interface while maintaining the rigour of formal architectural modelling.

Although the Digital Services Register adhered to the ArchiMate notation, its accessible design allowed end users to create ArchiMate-compliant artefacts without requiring prior knowledge of the notation. Additionally, through the use of a Model Exchange File, data could be seamlessly imported or exported into other tools.

Results

The Digital Services Register documents over 60 services and nearly 80 standards, creating a comprehensive knowledge repository. Supported by a robust governance model, it allows different permission groupings to perform specific functions within the tool. Administrator privileges have been granted to desk officers within the Architecture Function, enabling them to manage and maintain the tool independently without relying on support from CACI.

Initially rolled out to architects, the tool has since been expanded to include desk officers and programme stakeholders. The Digital Services Register is accessible via MODNet laptops, with login facilitated through seamless single sign-on technology. This means that users can collaborate cross-boundary, fostering an interactive and engaged user community.

Each service in the register is accompanied by metadata, including completeness and confidence scores, as well as point-of-contact details, equipping users with insight into the reliability and thoroughness of the information. Additionally, the tool features graphical representations that illustrate the relationships between services, highlight their specialisations and demonstrate how they connect to relevant standards. These visual aids further enhance the tool’s usefulness for users across the RAF.

Now that the tool has been handed over to the desk officers, it has entered a phase of continuous improvement. To ensure the information remains accurate and relevant, monthly workshops are being organised by the desk officers. These workshops will focus on updating and refining the content, fostering ongoing collaboration and ensuring the tool evolves with the development of new services and standards.

Summary

Since 2001, CACI has been a trusted partner of the Central Statistics Office (CSO), Ireland’s national statistical agency. We’ve successfully delivered the Census Processing System (CPS) for five consecutive Irish censuses: 2002, 2006, 2011, 2016, 2022, and are currently contracted for Census 2027, Ireland’s first online census.

CACI plays a vital role in enabling the CSO to design, manage and process millions of census returns through innovative form design, advanced data capture and secure IT infrastructure. Our work ensures that every response, paper or online, is processed accurately and efficiently, delivering trusted data that powers national decision-making.

Company size

1,000+

Industry

National Statistics & Public Data

Products used

Census Processing System (CPS)

Challenge

The Irish census is a major national operation, requiring four years of planning, a six-month processing window and publication of initial results within a year. In 2022, the CSO expanded its workforce by approximately 5,500 temporary staff to support the distribution and collection of over two million census forms across Ireland.

High-quality form design and printing were essential, not only for public confidence, but for accurate and efficient data capture. Once collected, the data was processed using CACI’s Census Processing System, which handled over 48 million completed page images with speed, precision and confidentiality.

Solution

CACI delivered a structured, end-to-end solution through five integrated workstreams: Print, Infrastructure, Data Capture & Coding, Training, and Support & Maintenance, each with clear deliverables, milestones and governance.

Key elements included:

- Infrastructure & system delivery: Designed, installed and tested scanning and server infrastructure for CSO, alongside a robust processing system tailored to the 2022 census requirements.

- Rigorous testing & support: Extensive system testing and onsite support throughout live census processing operations (Jan 2022–Mar 2023).

- Data readiness & training: Database preparation and tailored training for CSO staff.

- Print & data capture services: Managed typesetting, printing and delivery of over 2 million high-quality census forms.

- Comprehensive system capabilities: Delivered a full suite of tools covering all stages of the census workflow:

- Warehouse & document handling: Form registration, box management, re-scribe processing, scanning, image correction and intelligent character recognition (ICR).

- Automated & operator-driven coding: Modules for Dwelling, Person, Communal Establishment, Family Nucleus, Industry & Occupation, Statistician-led data repair, Derived Variables and Statistical post-processing with automated clean-up rules.

Results

All contractual milestones and service levels were met or exceeded. The CSO confirmed the successful delivery of high-quality data outputs, supporting timely and accurate publications.

Looking ahead to Census 2027, CACI aims to continue delivering excellence, supporting the CSO with reliable systems, trusted data and domain expertise that inform government decisions and public spending.

Summary

In the airline industry, where customer experiences can be impacted by factors outside of the airline’s control, communication is crucial to maintain satisfaction and loyalty, especially during operational disruptions. In fact, the impact of disruption to annual global air passengers will increase to 7.3 billion by 2034, more than double the 3.5 billion passengers that will travel this year.

Disruption management is therefore becoming increasingly important, demanding greater investment in the cost-to-serve and improved collaboration to enhance the industry’s ability to respond effectively. The topic must be considered with the commercial realities of improving sales and seasonal offers through marketing, however, which was a key component of CACI’s project with easyJet.

The business case centred on reducing the cost of disruption, improving retention and increasing revenue through personalisation. With disruption estimated to cost airlines up to 8% of annual revenue due to refund requests, brand damage and customer churn, investing in a unified customer communications platform would help easyJet dramatically reduce these losses.

Company size

17,000+

Industry

Travel

Challenge

Operating in an extraordinarily complex and competitive category, easyJet was experiencing a significant reduction in customer satisfaction and was losing customers and shares to competitors. EasyJet’s own analysis showed CAST (Customer Satisfaction Score) scores declining significantly within only minutes of a disruption event, and the first hour is key to securing satisfaction.

While the airline understood that reversing this trend and mitigating losses would only be possible by overhauling their customer communications, they needed help prioritising and executing this transformation. The most significant challenges were improving the consistency of information between customer communication channels, targeting communication more effectively and quickly, improving accuracy through automation and enhancing their MarTech stack and data strategy.

Solution

EasyJet endeavoured to address critical gaps in the consistency, personalisation and timeliness of customer communications across all stages of the travel journey, along with the following KPIs:

- CAST score increasing to 13% over the next three years

- Reducing the amount of refund requests through better communications (50% of easyJet claims for refunds being rejected).

- Improving communications as 37% passengers are reportedly unhappy during disruption events.

At the heart of this initiative was a holistic service design methodology that fused MarTech, a data strategy and operational transformation into one cohesive solution. To make such changes, CACI helped develop and implement easyJet’s customer-facing strategy, with three primary goals:

- MarTech implementation:Identify, assess and implement the MarTech solution to enable customer-centric communications including marketing, service and disruption.

- Customer-led campaign optimisation: Improving marketing campaign targeting and messaging, reducing email volume and ensuring sales and disruption messages do not overlap.

- Disruption management: Developing a strategy to improve and unify communication around flight disruptions across multiple channels (from email to airports).

Alongside this, CACI had to consider the operational service and business plan to ensure that processes, back-office systems and staff could deliver the new ‘to-be’ strategy while considering stakeholders’ vision and real user data based on interviews and surveys.

CACI’s approach was to run the following series of connected workstreams:

- MarTech & customer strategy audit: Unpack challenges and limitations across the existing landscape, identifying areas of improvement and streamlining across data and tech, customer comms strategy and operating model, during which 17 workshops with easyJet stakeholders took place.

- Customer data foundations strategy: Defining the aspirational architecture to resolve data challenges and enhance data processing, management and communications.

- Customer marketing contact strategy: By delving into a range of behavioural, attitudinal and demographic data that had rarely been used for customer insight and targeting, CACI could identify and quantify the value of multiple cross-sell and upsell opportunities.

- Operational & disruption customer journey: Designing the blueprint of the easyJet end-to-end customer journey to understand expectations, performance analysis and opportunities for experience optimisation. CACI also developed an aspirational customer journey, showing an improved, consistent, multi-touch experience for disrupted travellers as they prepare for their flights.

- MarTech implementation: CACI helped easyJet select new MarTech platforms (mParticle and Braze) and implement the new solutions, including campaign migration and activation. Working collaboratively with MarTech partners, CACI and easyJet stakeholders defined requirements that would help power personalised customer communications.

- Operational & disruption contact strategy: Leveraging new MarTech and customer journeys, designing contact strategies to increase relevancy and accuracy through personalised messaging.

- Operational change: Understanding the current design and team structures across the marketing function, identifying challenges and bottlenecks in processes, skills gaps and capabilities, leading to a defined operating model that would enable easyJet to fully leverage the new capabilities, redirect core skills to higher-value activities and create efficiencies by redefining roles and responsibilities across core teams.

The use of Miro, a cloud-based visual collaboration platform designed to help teams brainstorm, plan and execute projects in a shared digital space, was also critical in the delivery of this project. Finally, easyJet was supplied a Socialisation Pack to consolidate findings, strategies and tactical actions to be shared across the business.

Results

This initiative has already delivered measurable commercial and experiential impact, helping easyJet become more resilient, customer-centric and operationally efficient.

Through the setup and implementation of the new MarTech stack, CACI enabled a real-time customer communications platform for easyJet that moved away from legacy systems and technical debt, including:

- 10+ data and system integrations, with web, warehouse, analytics and automated GDPR management

- 200+ customer and behavioural events/data points that can be used for targeting and personalisation

- Migrating over 40 million customer profiles, taking them through a process of IP warming to ensure campaign deliverability

- Deploying 500+ campaigns, including real-time behavioural triggers and data processing campaigns

- Training and support for easyJet development and communications teams.

CACI was also tasked with proving the value of a customer-first communications approach against the existing trade-led strategy. The team designed multiple contact strategies around different audiences to bring the new strategies to life while utilising easyJet’s price-led messaging. The resulting Winter Sale Campaign delivered:

- 57% fewer emails sent (but more personalised)

- 5% increase in email open rate

- 21% increase in click through rate

- >2x revenue generated per email sent.

Furthermore, CACI developed a comprehensive toolkit that, when implemented, will enable easyJet to lead the category in disruption management. Complete with 203 data-driven, actionable recommendations, the airline can significantly improve passenger experiences during disruption events across three distinct categories of opportunities. These either directly depend on or enable communication management capabilities in the near-mid-term.

These results demonstrate how strategic transformation, when paired with service design and data-driven insight, delivers value at scale. EasyJet is now positioned not only to weather disruption but win customer loyalty.

Summary

Third party mobile geolocation data can accurately track where domestic visitors live and shopping behaviours, however low sample rates mean it is less reliable in understanding the movement of international visitors.

The International Tourist Model has been developed to address the inherent limitations of mobile geolocation data in accurately capturing the proportion of international tourist visits to specific locations. By integrating VisitBritain data with CACI’s Local Footprint dataset, this model offers a comprehensive and robust solution.

Industry

Technology

Products used

Challenge

Mobile app data, which relies on location “pings” from smartphones to analyse customer behaviour and footfall patterns, is a powerful and highly accurate tool for identifying domestic visitors. However, due to lower adoption of UK-based apps among international tourists, the use of VPNs, and varying data protection regulations across countries, mobile app data struggles to reliably identify international visitors.

To overcome this, CACI has developed the International Tourist Model with three core objectives:

- Accurately represent the proportion of international tourist footfall at different locations.

- Provide insights into the continental origins of international tourists.

- Report these data points across different time periods.

Third-party mobile geolocation data is less reliable for tracking international visitors due to low sample rates.

Mobile app data struggles to identify international visitors because of lower app adoption, VPN usage, and varying data protection regulations.

The International Tourist Model integrates third party data with CACI’s Local Footprint dataset to accurately represent international tourist footfall.

Solution

By leveraging government-published data on inbound and domestic tourism and blending with CACI’s Local Footprint data, and third-party geolocation data enabled us to infer the relative presence of international tourists through a data cleansing and modelling process.

Results

The model has demonstrated clear value and has already been implemented across multiple projects, delivering tangible benefits to clients to allow these to understand the true mix of user groups interacting with their assets.

Summary

CACI’s Ocean database contains variables relating to consumer attitudes and behaviours of the UK population at individual and household level.

Whilst already providing a market leading solution, a major update gave CACI the opportunity to rebuild many of the associated predictive models using AI techniques to even further improve the modelling, and to make predictions more balanced and “fair” across demographic subgroups such as sex and age groups.

Industry

Technology

Products used

Challenge

Traditional classification techniques optimise “mathematical accuracy,” which measures the number of predicted labels that match the true labels; however, optimising solely for this measure can result in an imbalance in prediction quality across Yes and No labels (as to whether particular behaviours, interests or attitudes are exhibited), and unfairness across demographic subgroups such as sex and age, especially when there is a natural imbalance in the true Yes/No label proportions, i.e. where behaviours have a strong skew towards a particular sex or age group.

Addressing these deficiencies is an area of ongoing research within the AI community.

Ocean enhances clients understanding of their customers by indicating their likely attitudes and behaviours

Traditional modelling methods can be biased in terms of prediction quality for different sexes and/or age groups

The challenge was to remove this bias, achieved by developing new AI based techniques that can optimise across both sex and age groups

Solution

Advances in machine learning science and computational power allow Ocean to use a targeted technique for each variable rather than a one-size-fits-all approach.

CACI has developed new in-house classification techniques that significantly improve standard methods to ensure balanced prediction quality across both Yes and No predictions and demographic subgroups.

For fairness, various measures can be used. CACI specifically optimises its predictions as measured by the Equalised Odds Difference, across sex (Male/Female/Unknown) by default or across age bands or both.

Results

Fairness has been implemented across age and sex to ensure we are more accurately predicting attributes and behaviours whilst eliminating bias.

In addition, a set of insightful driver variables has been added, enabling the modelling to achieve a better understanding of the real world, and over 100 new variables have been introduced for the latest version of Ocean.

Summary

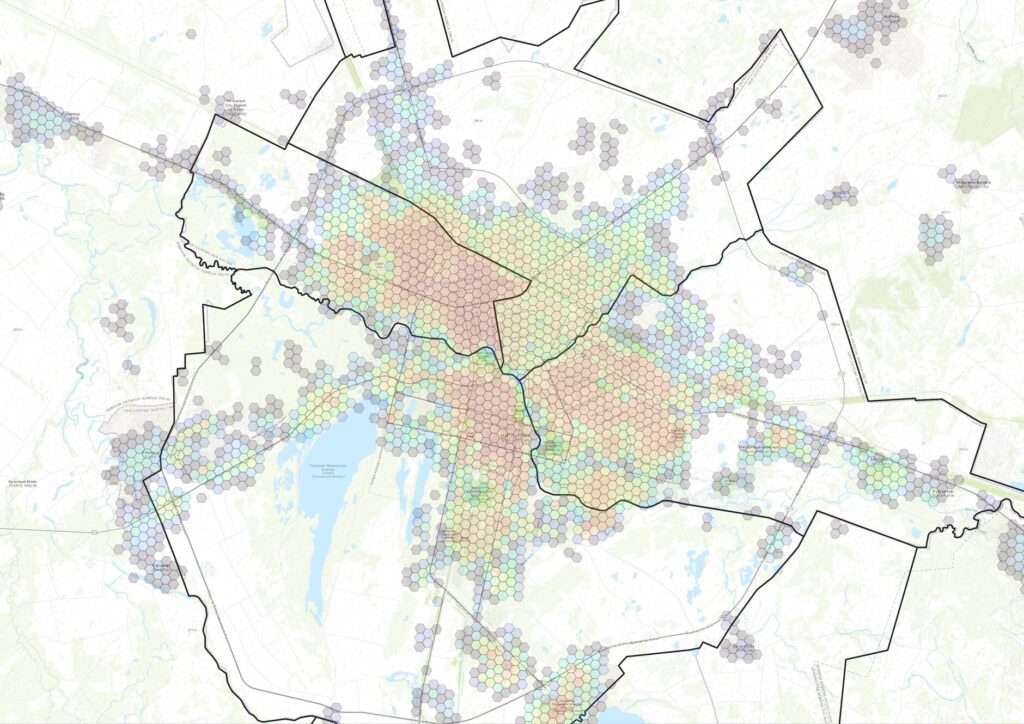

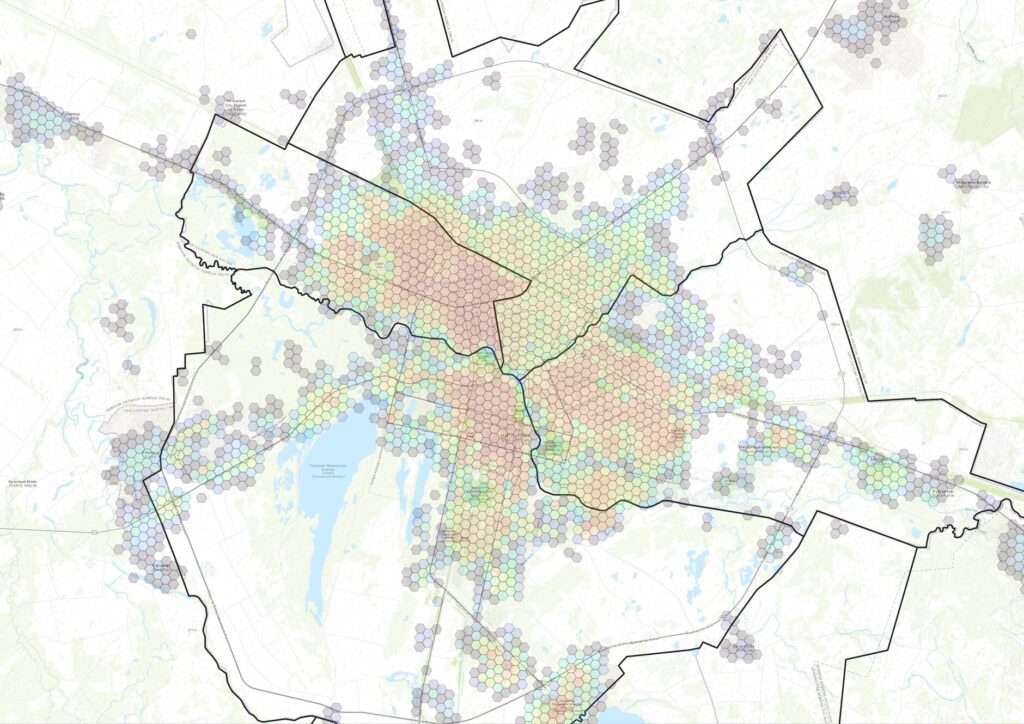

A method has been established by CACI that uses a hexagonal tiling system to disaggregate demographic and other population-based data down to small scale to enable more accurate and precise location modelling and forecasting, particularly in countries where such data is only available at a high geographic level.

Industry

Technology

Products used

H3 Geospatial Tiling System

Challenge

CACI have data for over 250 markets covering 95% of the world’s countries. However, the detail of data available varies from country to country. One of the limitations for certain use cases is the size of geographic area at which demographic data is available, as this data drives understanding of locations and consumer demand at a local level. In countries such as Kazakhstan, Saudi Arabia, and parts of Middle East Asia, the granularity of data is such that there may be only one geographic area with one set of figures for a whole town or municipality, so understanding demographic and spend dynamics in different parts of that town is not possible.

The challenge was to find a way to disaggregate high level geographic data to smaller areas.

CACI provides data for 95% of the world’s countries

In some countries available demographic and spend data is high level, and a methodology was sought to disaggregate such data to make it more usable for understanding local markets

This methodology would be applicable across all countries providing comparable levels of detail worldwide

Solution

CACI resolved this challenge by combining the source data with two geographic datasets.

The first is H3, which is a discrete global grid system for indexing geographies into a hexagonal grid, developed at Uber. These hexagons are available at a range of scales, but the one considered most suitable for the majority of CACI’s client market applications is “Level 9”, which provides hexagons approximately 400m wide.

These hexagons could be overlaid onto the supplied data boundaries to disaggregate the data equally across all hexagons within each boundary. This would assume that the population was evenly distributed in each area, which is a very simplistic approach. Better to weight this by the population across the area, and to do this a second dataset was used; population estimates based on official sources as well as other sources such as satellite imagery of buildings, giving very granular results.

By combining this with the H3 hexagons we could assign demographic and spend data to each hexagon using the distribution of total population as a weighting function, so that those hexagons containing higher population would receive a proportionally larger share of the source data.

Scale is a challenge due to the computational requirements for these calculations, but with an optimised work flow, and using powerful data platforms this process has been highly successful.

Results

H3 has revolutionised how we are able to advise clients on consumer demand. We have taken what was previously high-level market data and disaggregated it to deliver more localised, insightful analysis. For example, in Saudi Arabia, we previously had a view of just 8 broad, high-level regions, which are now disaggregated into over 30,000 hexagonal zones, unlocking a level of detail never before possible in the region.

By using H3, we apply a consistent geographic lens across the world. This allows CACI to seamlessly blend multiple data sets, such as mobile data, with demographic data to create a single, unified view. This creates a reliable single source of truth that enables a more granular and accurate view of markets that can be compared across countries for more informed decision making.

This granular view is a game-changer for any organisation wanting to get a low-level view of market opportunity anywhere in the world.

Summary

The CACI team has developed a method using Amazon Bedrock Agent to respond to customer queries.

Industry

Technology

Products used

Challenge

CACI has multiple software products and most of these products have their help pages. These help pages are hosted in different environments using different formats. When customers have any questions related to the products to related to how to do things, they go to these sites/documents, browse through the pages and finally find the answer. This process is not user friendly and often wastes a lot of valuable time. Some products have help pages saved in different files, which makes finding answers more difficult.

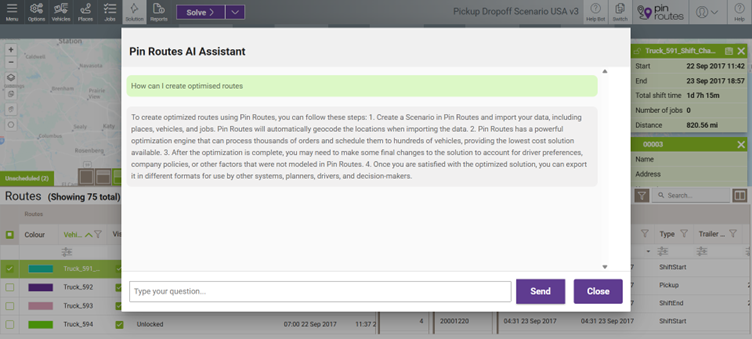

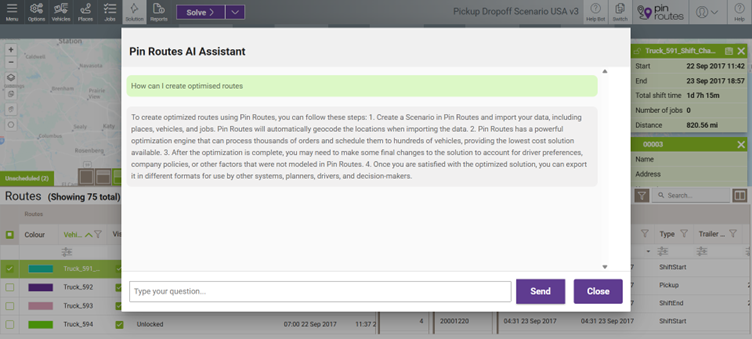

The challenge was to find a way to easily find answers to questions from the help manual(s).

Solution

CACI resolved this challenge using Amazon bedrock agent and demonstrated this in Pin Routes. Users can click on the icon and ask questions. The agent returns satisfactory answers. If the agent cannot find answers to the questions in the manual, it returns a message saying it could not find the answer to the questions.

Amazon bedrock agent has some advantages over other technologies that were investigated:

- Native AWS services. Low setup effort and maintained by AWS.

- Built in Guardrails, blocking harmful queries and inappropriate responses

- Well documented API and SDK support allowing for relatively easy integration

- Functionality can be extended as required

AI backend can be standardised across multiple products and services, the integration will vary.

Results

Amazon bedrock agent has revolutionised how customers access the help or retrieve answers to their questions.

This granular view is a game-changer for any organisation or product wanting to improve user experience and increase the usage of the products.

Summary

CACI has long advised its retail property clients on strategies to grow sales and footfall at their assets. The Centre Growth Model combines CACI, client and third-party dataset to give clients a clear direction on how, where and who to grow sales from across their customer base.

Industry

Property

Services used

Centre Growth Model

Challenge

CACI property clients need to grow customer sales at their retail destinations (e.g. regional malls, retail parks, outlet centres) to increase the value of their assets. Understanding how often a customer visits, how much they spend on a visit, and who doesn’t visit (but should), versus the performance of peer group locations allows clients to understand what good looks like, where to improve, and ultimately settle on the most appropriate strategy for growth.

Clients need to understand customer behaviour and benchmark against peers to develop effective growth strategies.

The Centre Growth Model combines various datasets to guide clients on growing sales and footfall.

The model uses geographic and demographic data to identify growth opportunities and optimize marketing efforts

Solution

Strategies for customer growth can be complex and will vary through both geographic location (how far away a shopper is from a retail destination) and demographic and economic factors (how much discretionary spend they have available).

The Centre Growth Model takes these complex issues into account and converts them into three simple metrics to drive growth:

- getting existing shoppers to spend more

- getting existing shoppers to visit more frequently

- getting new shoppers to visit the asset

By analysing geographic and demographic data, the model identifies the best growth opportunities. It compares client assets to benchmark retail locations to understand areas of over and underperformance, providing targeted guidance for leasing and marketing activities to achieve maximum impact.

Results

By leveraging the Centre Growth Model, our clients can now confidently pinpoint customers and geographies that offer the greatest potential for growth in both turnover and footfall. This insight enables them to strategically focus their marketing efforts on high-impact zones, ensuring optimal return on investment whilst also avoiding unnecessary spend in less effective areas.

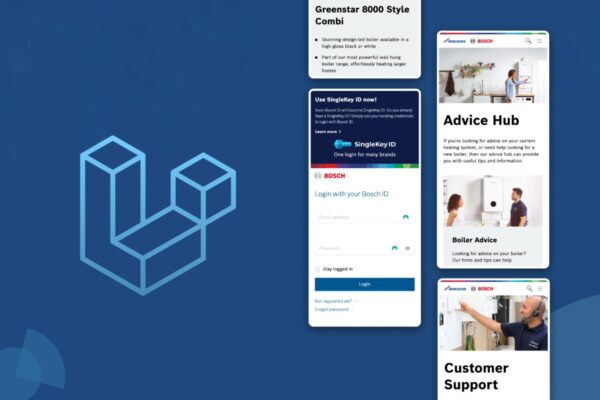

Summary

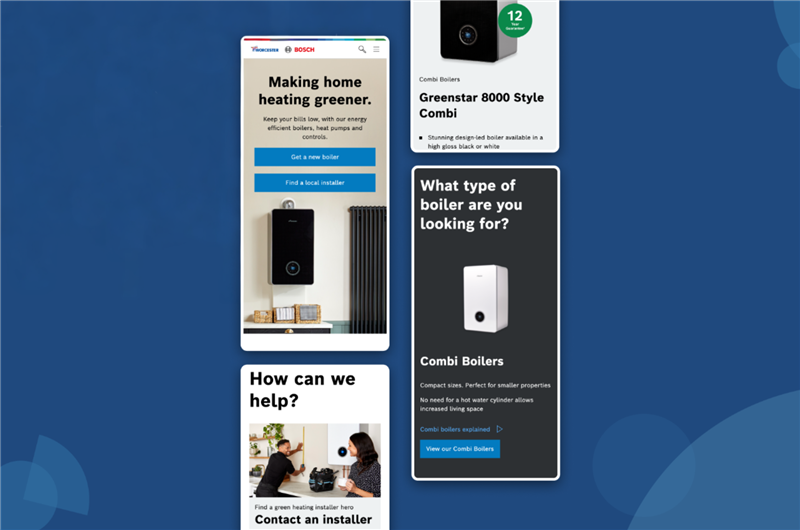

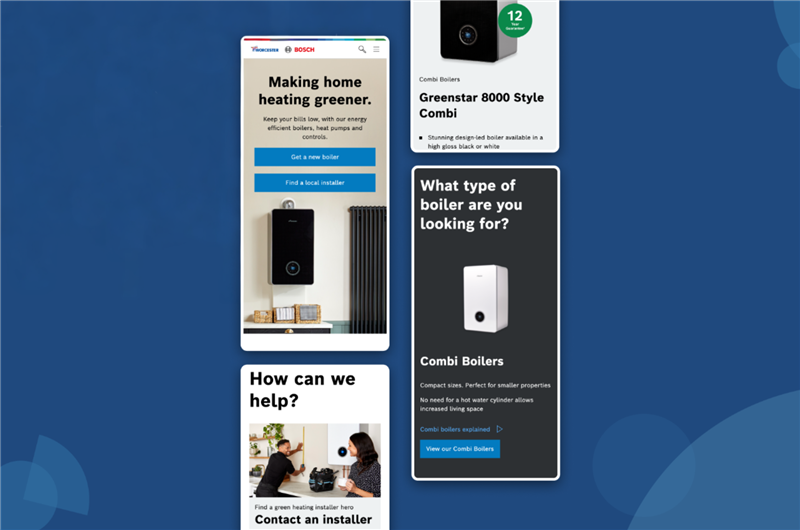

Worcester Bosch is one of the UK’s leading manufacturer of boilers and water heating products. As their extensive, business-critical digital ecosystem of websites, portals and applications has grown throughout the years, they required support to ensure that their platforms could continue delivering long-term value for the business. CACI became the lead agency for Worcester Bosch’s entire ecosystem of Laravel applications, supporting and scaling its ever-evolving requirements and realigning their digital roadmap.

Company size

500+

Industry

Manufacturing

Products used

Laravel

AWS

React Native

Challenge

Worcester Bosch has an extensive digital ecosystem built on the Laravel framework consisting of multiple websites, portals and applications, providing business-critical information and services across their complex operations. This includes their customer-facing website; a professional installer portal; the back-office system handling enquiries and content management, MyBosch where end users can undertake administrative tasks related to their products and many more.

The complex application was built on the Laravel framework in one large monolithic codebase that evolved iteratively and scaled in size in-line with business requirements over the past decade. This means that there are numerous interlinked dependencies in the ecosystem that all need to work in harmony. Worcester Bosch needed a team of experts who could breathe new life into the ecosystem and ensure it could continue delivering value for the business into the future.

To rejuvenate the project in this way and ensure it was development-ready for new features, including planned mobile app relaunches including its Professional app, CACI needed to assess the entire Laravel application architecture, hosting infrastructure, and codebase to generate a roadmap of for upgrade and development delivered through Agile methodologies to improve the application’s reliability, scalability and performance.

Solution

We first completed a technical audit of the entire digital ecosystem to understand and identify the bottlenecks and areas to improve around the long-term stability of the hosting infrastructure to enable the future vision of the application. Then, working in partnership with the Worcester Bosch team, we put new Agile methodologies in place, helping establish a new DevOps culture, complete with team training. Underpinned by a bespoke documentation system; empowering the team to resolve tickets quickly and efficiently.

We then upgraded the application to the most recent version of Laravel to stabilise and improve the resilience of the application and provide a solid foundation for renewed growth. We also rewrote outdated test cares that saw improved QA efficiency, fewer bugs being reported and reduced time required for user application testing.

We recommended a ‘lift and shift’ of the application to improve hosting costs, sustainability and overall resilience. Planning and carrying out an entire ecosystem reprovisioning and migration in AWS in just 3 months; now maintaining a dedicated team that supports with 24/7/365 monitoring, penetration testing and automated tests to ensure continuous system uptime and availability.

After the AWS migration and application upgrade enabled Worcester Bosch to resume business as usual and restart their roadmap delivery, we then delivered an accessibility refresh of the main customer website, and built a new user-friendly, mobile Professional App in React Native in just three months. Something that Worcester Bosch had identified that would help it maintain its top position with installers against new market entrants.

Results

Our ongoing partnership with Worcester Bosch on their Laravel application transformation has delivered measurable improvements across its digital ecosystem.

After the full migration to AWS hosting, Worcester Bosch experienced a 95% reduction in downtime and incidents. Since we implemented improvements, the reliability of the application has increased by 32 times and the average page load time reduced by half.

We continue our work making sure the Laravel application is up to date, patching vulnerabilities found through pen testing and code audits, improving performance and security; on the latest pen test, there were no ‘Normal’ or ‘High’ priority issues. All helping the application reach its full potential, delivering on the diverse needs of Worcester Bosch’s internal and external stakeholders and their innovative product roadmap.

The new Professional App exceeded its download target of 10,000 downloads in the first six months and achieved a remarkable NPS score jump of +46 from the previous app, going from an average of -17 to +29. Installers praising the app for its ease of use and functionality: “really simple to use and now works for me” and the app recognised with a prestigious BIMA Award in the highly competitive Digital Product Build Category.

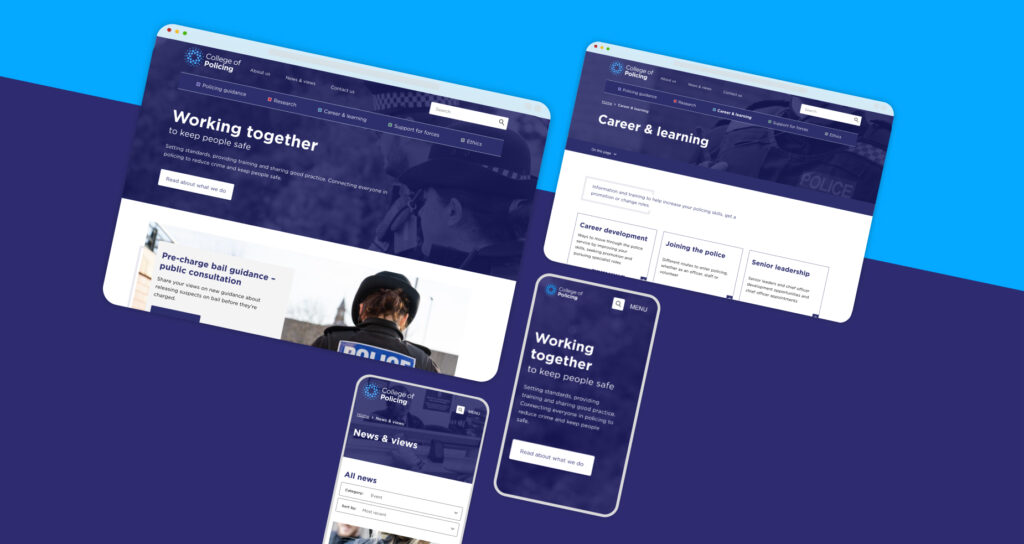

Summary

The College of Policing needed to consolidate and modernise its digital ecosystem to better deliver on its mission to support everyone working in policing with professional knowledge and skills. It had a variety of inflexible, poorly integrated and inconsistent microsites not designed with accessibility or user needs in mind. CACI delivered a comprehensive discovery, UX and content design, prototyping and build programme that resulted in a single future-ready learning experience — guided by extensive user research, accessibility best practices, and alignment with Government Digital Service standards.

Company size

600+

Industry

Education

Challenge

The existing legacy platform was fragmented across inconsistent multiple microsites that weren’t meeting the needs of the College’s internal teams or external users and learners. The sites were difficult to update, with limited integration and poor content management capabilities.

The platform wasn’t designed for users with diverse needs and had accessibility gaps which meant it did not meet WCAG compliance and was not consistent with the inclusive design approach required by Home Office-led service assessments.

Both internal and external users struggled with fragmented experiences, confused content architecture and unclear user journeys that could not be measured properly causing confusion and low engagement with digital learning content.

Solution

CACI led a full discovery phase, engaging 180+ users including officers, trainers, and internal staff through in-depth interviews. This user research surfaced diverse needs and shaped a prioritised delivery roadmap. We mapped the user journeys of different learner types, co-created detailed personas, and audited the content, accessibility and usability of the existing sites.

Working in Agile sprints in continual collaboration with the College team, we designed a service blueprint and structured information architecture for a single learning platform built on Drupal CMS. This was validated multiple prototypes through usability testing and prioritised flexible learning pathways.

As a major content strategy and design project, we ultimately restructured, consolidated and migrated millions of words of content relating to police best practise and devised clear content strategy, workflows and governance that ensured the site could quickly deliver the correct, consistent up-to-date content – a key user painpoint.

We embedded inclusive human-centred design principles – ensuring alignment with Government Digital Service (GDS) and WCAG standards. To support this approach, we upskilled College of Policing team members across the organisation through training to ensure that once the consolidated platform was live, this inclusive approach could be maintained.

Results

This project demonstrates how user centred design and technology can be used for genuine digital transformation, changing what our clients do and how they do it. This was not just about implementing a new Drupal CMS from a technical perspective – we tailored the publishing experience to the operational needs of its College.

To help the College realise their goal of becoming the go-to resource for information, learning and research in policing, we then implemented a powerful Algolia search that was 200x faster and could integrate sources from multiple external sources and British police for websites.

This was delivered via a truly accessible, scalable Drupal platform with a robust content and SEO strategy that passed Government Digital Standards assessments first time and achieved a 100 Google Lighthouse score for performance, accessibility and SEO at launch and 96% in an independent accessibility audit score against WCAG 2.1 AA.

As a result, our work has touched every single department of the College of Policing in some way, from user journeys and content strategy, to DevOps support, to upskilling their internal teams and inspiring cultural change. Reflected in the feedback from the Home Office that said it was “great to see the CACI and College’s cross-functional team positively tackling such a vast organisational/cultural challenge”

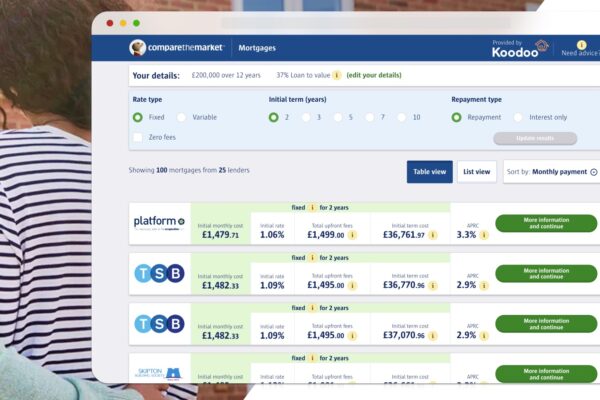

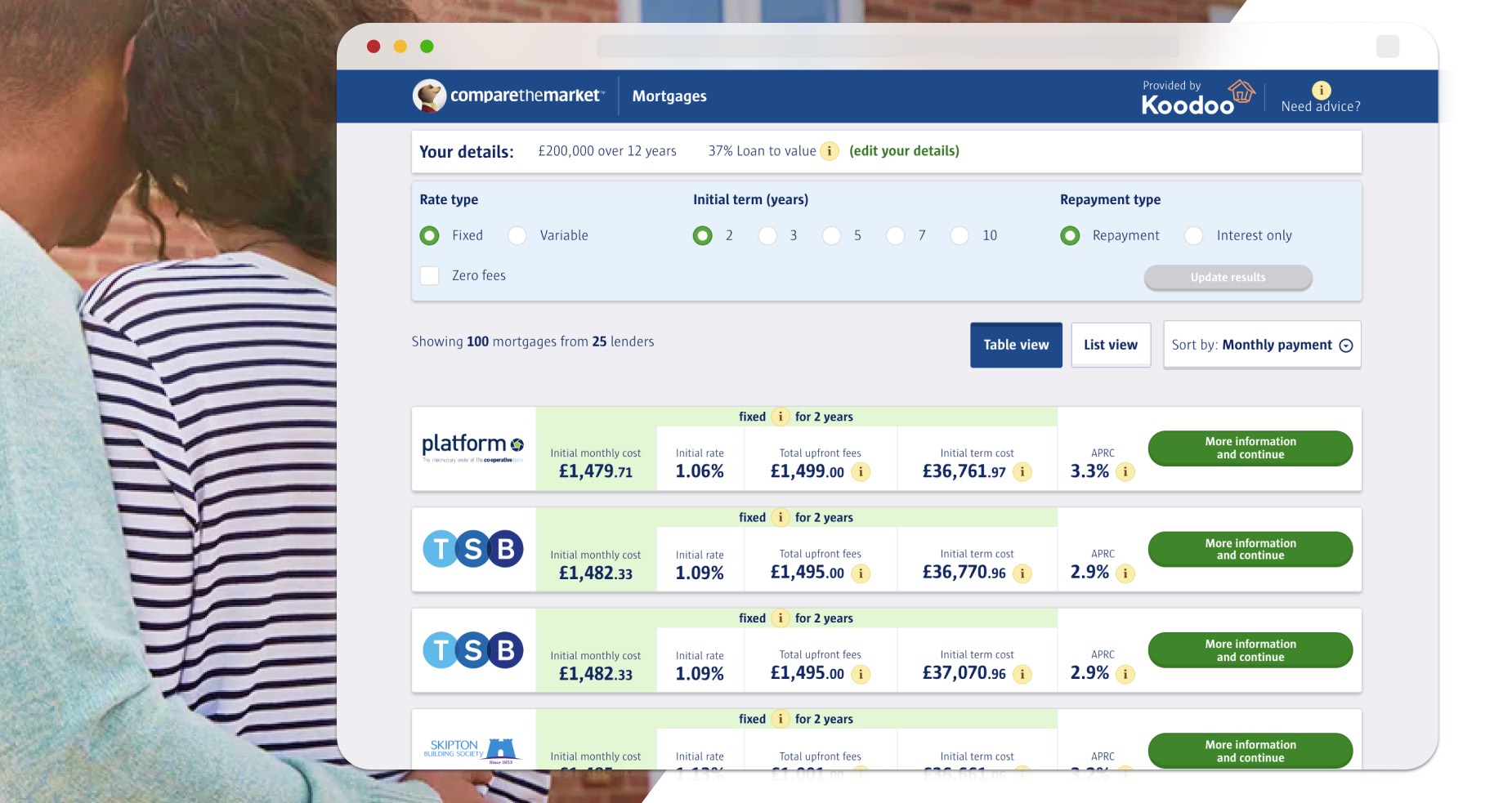

Summary

Compare the Market is a leading UK price comparison service and one of its most well-known brands. They wanted to improve their mortgage comparison service’s user experience and product to improve its performance and reduce the rate of users dropping off without completing the process. Collaborating with CACI, the joint team initiated a series of design sprints to address specific user, web technology and data-driven challenges. The initial project’s success led to a comprehensive redesign of their digital mortgage proposition, resulting in significant improvements in user engagement and completion rates.

Company size

1,000+

Industry

Financial Services

Challenge

Compare The Market’s had launched an end-to-end mortgage comparison service on their website which saw customer provide their financial information, review mortgage options from different lenders and then ideally apply for a mortgage via the site. However, results were below expectations with a 50% user drop-off rate before completion.

We needed to understand and identify measurable improvements to different user journeys including first-time buyer, remortgage, buy-to-let and mover to make the necessary UX recommendations that would enable the Compare The Market in-house team and senior stakeholders to understand and implement the changes needed.

As the service was already ‘live’, there was a need for an Agile and iterative UX design approach, supported by effective product management and backed by user research and usability testing, that could deliver the service changes without disruption and to work within Compare The Market’s existing design system.

In addition, as Compare the Market was implementing a wider UX-driven digital transformation, it was crucial for us to share our knowledge, UX processes and best practice to support Compare The Market’s wider long-term aspirations around user research and testing.

Solution

CACI commenced with an intensive discovery sprint, collaborating closely with Compare the Market’s team to identify and address key user experience issues. By analysing user data and feedback, we pinpointed areas causing friction in the mortgage comparison journey.

We then followed with a collaborative design discovery and ideation workshop, grouping customers by behaviour and need types, and conducted a UX audit on the service’s existing interfaces.

From this, we crafted proto-personas and empathy maps, backed up with customer research including 60 hours of user interviews that identified the reasons behind the high drop-off rate: apprehension and form fatigue. We then prototyped, developed and user tested a more streamlined, intuitive, and user-friendly journey, implementing iterative design improvements based on real user interactions ensuring enhancements effectively addressed the identified challenges.

The partnership evolved into a long-term collaboration, supporting the continuous refinement of the mortgage proposition to better serve users’ needs. Documenting UX processes and best practice in a digital playbook, covering everything from how to create research study guides, recruiting participants and managing consent; to conducting ethical research in-line with MRS’ code of conduct.

Results

Through our 200+ hours of qualitative service and user research and UX design approach, we reduced the number of user facing questions by 70% and users presented with actionable results much earlier in the process.

After further optimising the user experience over 10 design sprints, the improvement comparison tool now had 80% of users completing their remortgage calculator submissions, surpassing our initial target of 65%.

In terms of Compare The Market’s objectives around UX transformation in the business, when surveyed, the client rated our communication and knowledge sharing at 100%. The playbook and support enabling them to scale their design and user research practice.

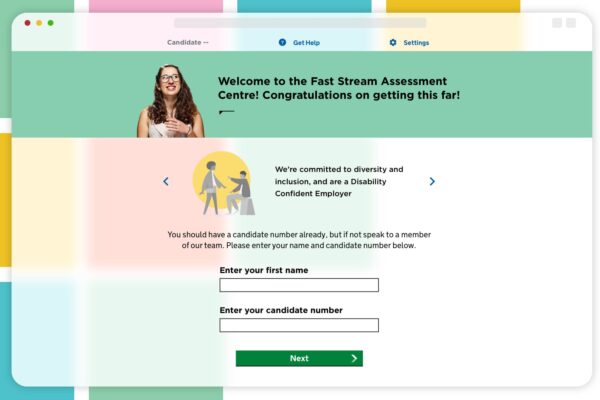

Summary

National Highways is the government organisation which builds, maintains and operates Britain’s motorways and major roads. They are responsible for the Dart Charge, a congestion charging system on the Dartford Crossing – the bridge and tunnels that crucially connect the M25 between Essex and Kent.

As a public service, National Highways needed to update and improve the Dart Charge service to reduce penalty charge notices (PCNs) and improve user experience. As the Dart Charge service had previously failed to meet UK Government Digital Service (GDS) standards, National Highways and the programme needed assurance and support from a team with in-depth knowledge and experience of working to GDS standards, as well as Service Design and UX, which is where CACI came in.

Company size

5,000+

Industry

Government

Challenge

The project plan and requirements stated that National Highways wanted the service to meet GOV.UK standards and pass its Alpha assessment, but there were no details on how this would be achieved by the contracted suppliers. CACI needed to help ensure a coherent, smooth, end-to-end user-centred project in this Alpha phase and guide the multi-faceted team to ensure the new digital Dart Charge met GDS standards for the first time.

We had to understand the existing end-to-end service and legacy platform to identify where it failed to meet diverse user needs and contributed to high PCN rates. These insights were needed to highlight UX/CX gaps, skills shortages—particularly around accessibility – and support procurement of the right people and services to build a successful multi-disciplinary team.

A final objective was to embed Service Design and user-centred design principles and working practices and oversee prototypes for the new service using the GOV.UK prototyping toolkit – refined through iteration and user testing- that Dart Charge service owners could use to meet user needs and resolve the pain points we identified.

Solution