As consumer expectations become more complex, and with brand loyalty increasingly more difficult to maintain, the need to deliver a personalised and tailored customer experience is crucial to your brand’s success. This is true across all industries, with consumers engaging across more channels than ever before, against a background of increasing competition.

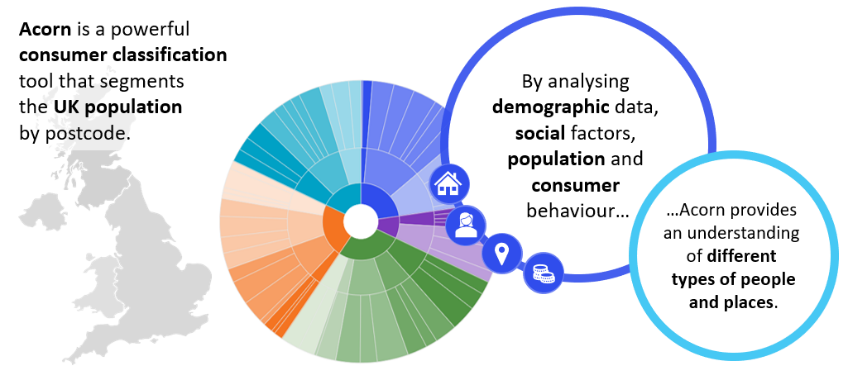

What is Segmentation?

Segmentation is a fundamental tool for marketers, helping you to understand your audience by dividing consumers into distinct groupings based on shared demographics, lifestyle behaviours and attitudes.

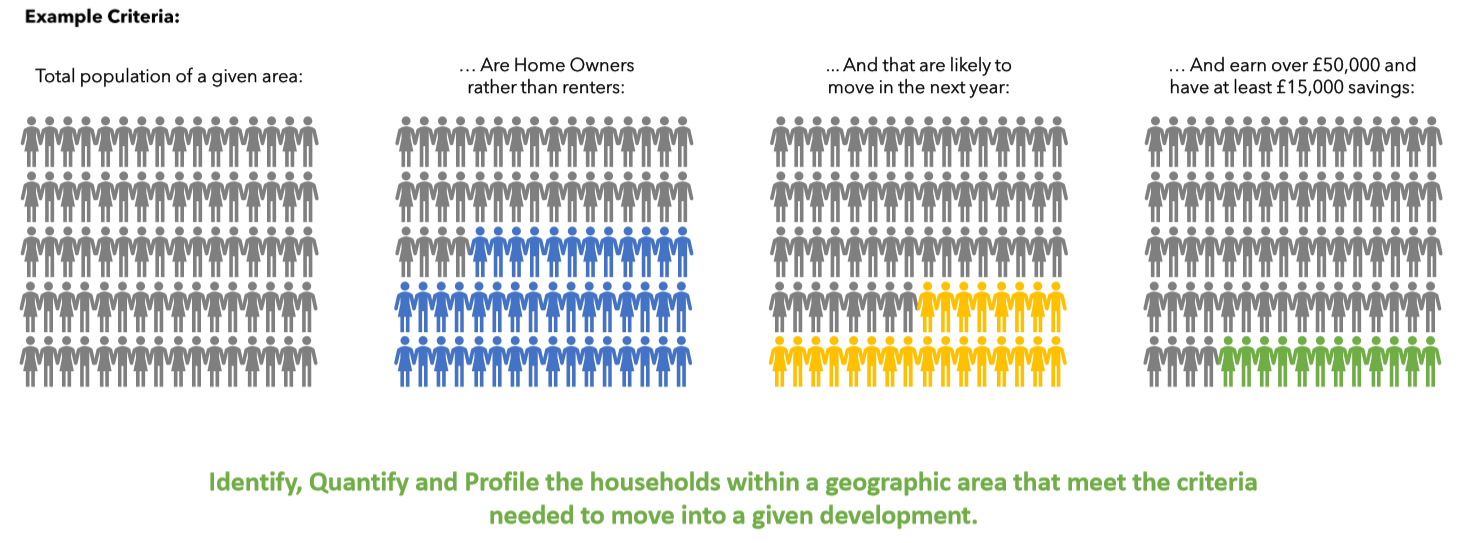

When we think of segmentation, it’s easy to simplify the process. Grouping customers by products or services purchased, or demographic factors such as age or gender or perhaps we may go as far as segmenting based on buying behaviour. Assuming that two customers will respond in the same way to the same offer, based purely on their prior purchase or route to purchase is not necessarily going to achieve your desired outcome. Instead, gaining deeper understanding of consumers and anticipating their needs as individuals is key.

Here we highlight the benefits of customer segmentation specifically for the financial services industry, however it is relevant across all industries and CACI can support all sectors with segmentation.

Financial Services Customer Segmentation

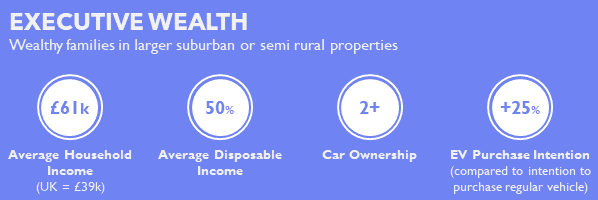

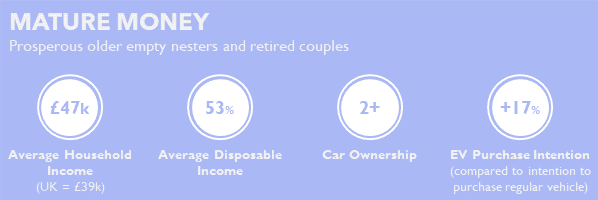

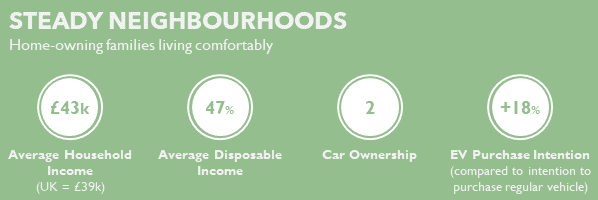

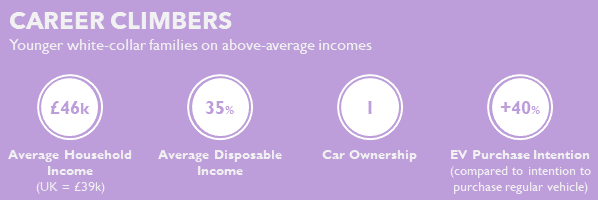

Fresco is an off the shelf segmentation created specifically for the financial services sector. It divides the UK into 12 segments and 45 sub-segments based on an individual’s life stage, affluence and attitude to money, providing a universal vocabulary with which to describe customers, prospects and the market.

Many clients have taken Fresco at micro segment level (134 segments) and combined transactional and market research data to reaggregate Fresco, building a powerful and bespoke solution tailored to their organisation.

Here are just 5 of the ways you can leverage segmentation to improve your customer experience.

1. Customer Insight

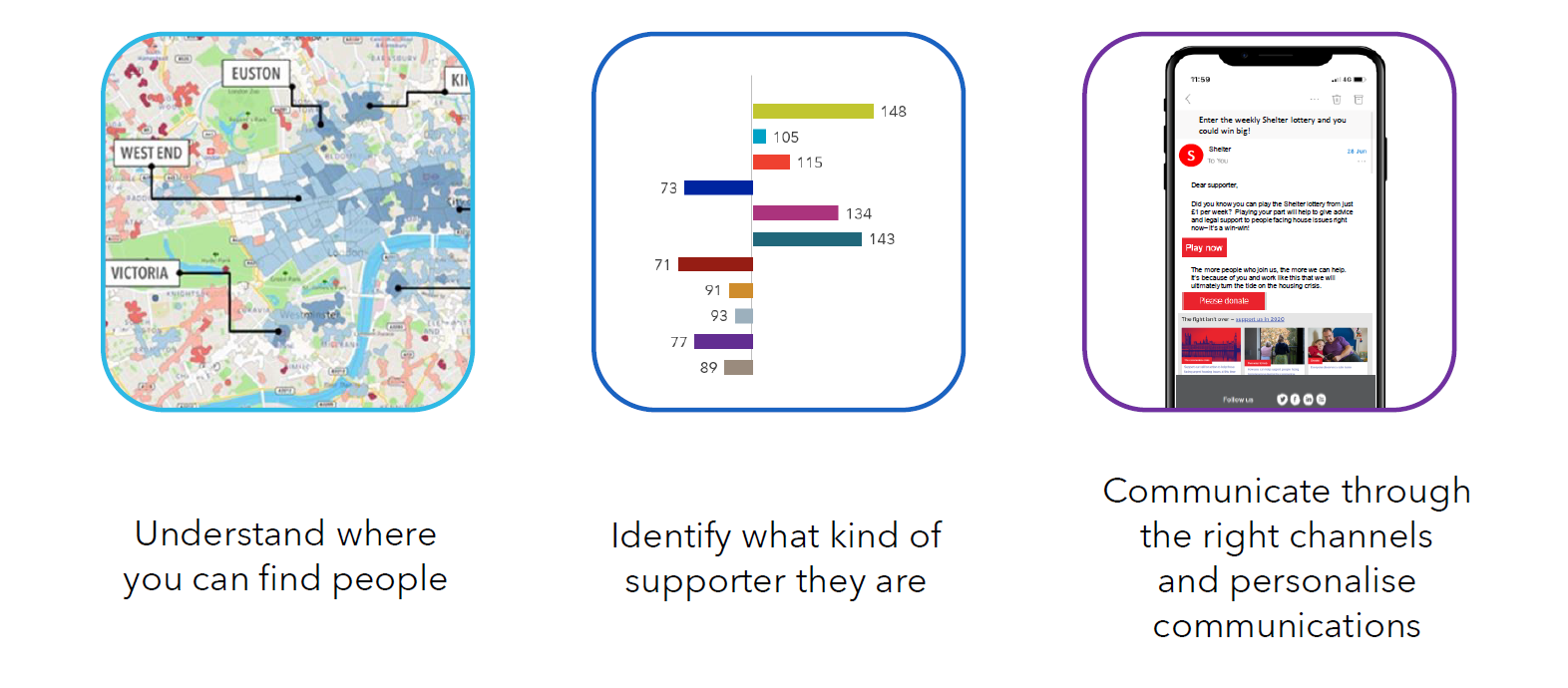

Financial marketers need insight to deliver the right message, about the most appropriate products, services and advice, to the right customers. Adding a segmentation to a new customer means you can immediately start to communicate to them in the right way whilst knowing limited transactional information about them.

Looking at customers solely through the products they hold could mean you are viewing two customers with similar mortgage products as being broadly the same type of person and communicating with them accordingly. But, when viewed in terms of the Fresco segmentation, those two customers might turn out to be two completely different individuals, with very different attitudes to life, money and risk.

Understanding whether your customer is a Successful Professional, a Stretched Renter or a Retired Homeowner informs the type of products and services they might be interested in and the types of channel and messaging they are most likely to respond to.

Fresco can provide strategic insights into your customers, enabling you to evolve communications to suit your audience at an individual level.

This detailed customer insight provides in depth analysis of your most valuable customers by Fresco segment, so you can start to find more like them. This could be anything from buying direct marketing lists or buying lookalike Fresco audiences using display advertising or connected TV to understanding area penetrations of Fresco segments for location of out of home advertising.

2. Proposition Development

The insights you gain when using a segmentation can also help you plan for the future. If you are attracting an older demographic and your customer database is dominated by segments such as Low Income Elderly and the Road to Retirement, you may need to review your proposition and develop products that are more suited to a younger audience, in order to expand your customer base.

Nationwide Building Society built a bespoke segmentation combining customer data, Fresco and market research allowing them to understand their individual members at a glance, and offer them the right products, services and advice to help them with their banking needs.

This new toolset helped Nationwide to better understand its customers’ needs, and develop compelling, targeted products, services and marketing messages, resulting in Nationwide winning significant new business among younger members.

3. Understanding the market

As well as understanding your individual customers, it’s also important that you have an overall understanding of the market in which you operate. Having a view of the UK population will help you to understand what share of the market you have and how your share is made up compared to the market as a whole.

Money Advice Service needed to understand the total UK market to ensure its advice services were reaching the right people, at the right time. To deliver accurate messaging, it was essential to Money Advice Service that they understood the different requirements of consumers and how to group them into addressable segments.

Fresco was used as a building block and mapped to research they had conducted, and the resulting segments have been used to help with targeting. This segmentation is used to build their engagement strategy and ensure support is focussed on the right customers, and that they’re targeting the core customer groups through appropriate channels.

4. Branch performance

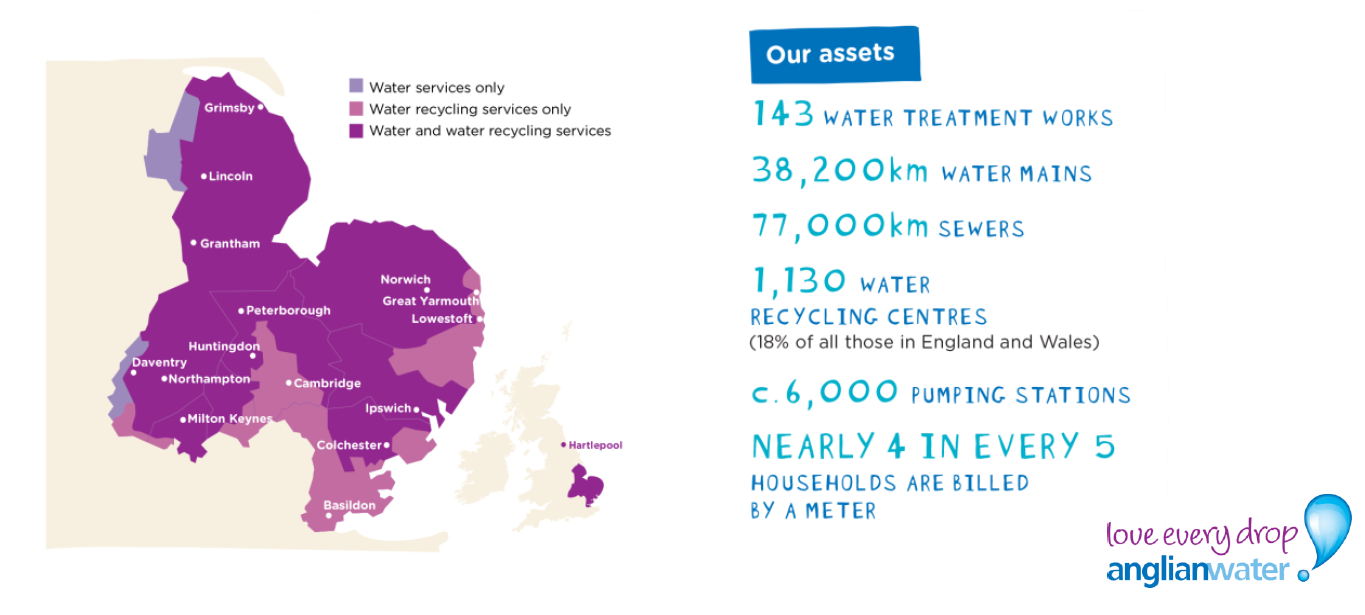

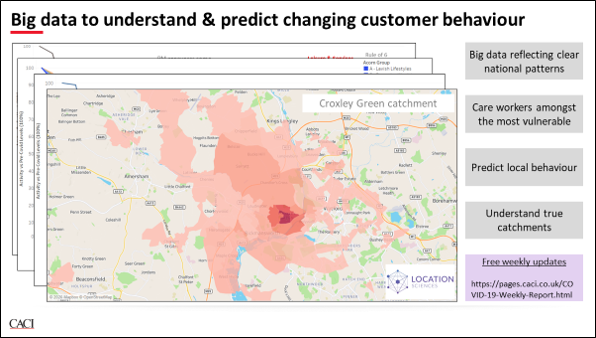

The same philosophy can be used to understand local area analysis and branch performance. Understanding the population in the catchment area of each of your branches helps when making decisions about whether the branches are serving the local population with the correct branch format in a more digital world.

Fresco’s segmentation allows you to answer fundamental questions that will help determine whether your branches are in the right areas and serving the needs of your customers. For example, do they need the same size of premises? Should they be on the high street and open more convenient hours? Should they be providing financial advice for a younger audience or assisting in the transition to digital channels for an aging population?

With Fresco you can start to understand the needs of your customers and ensure your branches are operating in a way that suits the customers in the area, as opposed to every branch simply working in the same way.

5. Understand your audiences’ digital behaviours

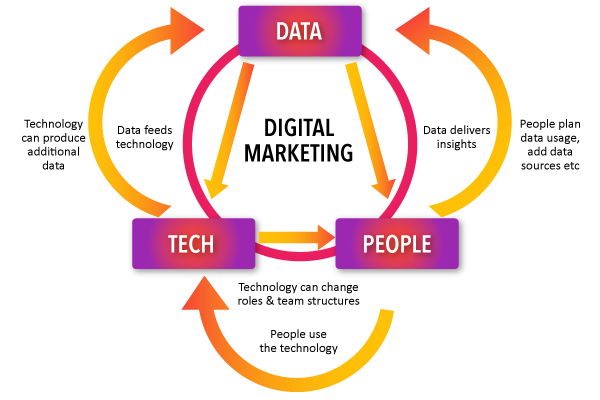

By combining segmentations with digital consumer insight data from the likes of Hitwise, you can align your digital marketing tactics with the behaviours of your target audience.

When cross-referencing online behaviours with Fresco segments you can gain a better understanding of exactly what your audience are searching for and dispel any preconceptions of who would be behind certain search terms.

For example, it’s easy to assume that young professionals would be the primary group searching ‘first time buyers’, but Hitwise found it can also be Asset Rich Greys, as it is likely parents may be helping their children get on the property ladder. Knowing what your audience are searching for will allow you to feed these common search terms into your PPC and content tactics to ensure you’re attracting your target audience.

Similarly, understanding your target market’s online journey will help you to know where to make yourself most visible. If Asset Rich Grey’s are visiting aggregator sites, you need to be sure that your brand is present across these sites with the right messaging, to enable you to reach that target market.

To find out more about how you can leverage off the shelf segmentations in your marketing and improve on your customer experience, contact us.