Vulnerability Indicators enable a range of sectors to identify and support vulnerable populations by providing them with the proper assistance. In doing so, improved outcomes for these populations can be achieved.

Struggling to identify and target vulnerable customers?

Better identify groups of vulnerable customers to target them with the appropriate assistance.

Unaware of how best to interact with & deliver services to vulnerable customers?

Devise enhanced communication and engagement strategies that will help you prioritise and deliver services that meet the needs of vulnerable populations.

Identifying vulnerable populations requiring assistance

Vulnerable populations are particularly susceptible to harm or disadvantage because of their situations, especially where someone’s position means that they struggle to access essential services.

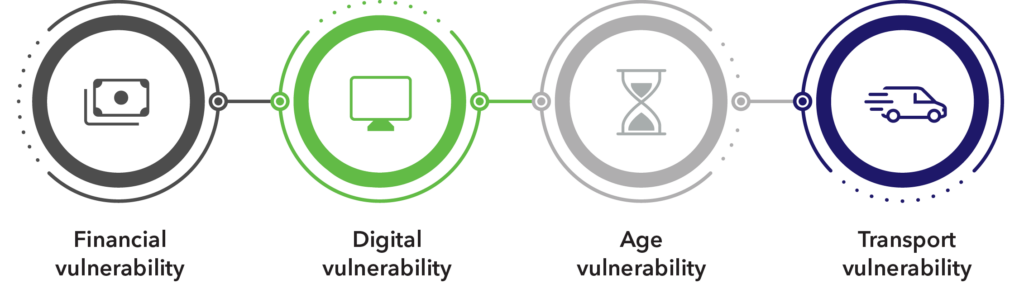

To mitigate this, CACI has developed Vulnerability Indicators that better identify these populations and enhance the decision-making associated with providing services, adhering to social responsibility and improving outcomes for these populations

Robust dimensions & scoring assessment

These dimensions are available at both individual and postcode level as a series of scores for each variable contained within the dimension and an overall score.

Helping a range of sectors support vulnerable populations

Financial Services

Vulnerability Indicators serve to enhance experiences for financial organisations and vulnerable customers they may serve. They help ensure customers are being asked the right questions and that vulnerable customers pay fair prices for services.

They also help service providers assess the number of vulnerable customers to monitor how actions are affecting outcomes, especially those customers who may not have access to digital services and require alternative methods of access or who may be affected by changes to services, such as branch closures.

Utilities

Utility organisations can better identify groups of vulnerable customers and ensure they receive the right services for their needs by leveraging Vulnerability Indicators.

Customers at risk of disconnections due to debt, eligible for inclusion on the Priority Services Register (PSR), may not have access to a bank account to receive the best pricing or those less likely to be aware of the benefits of switching or changing tariffs can be accounted for.

Public Sector

Vulnerability Indicators help public sector organisations improve service delivery and

identify residents who may struggle to access products and services digitally. As a result, the necessary support and communication can be provided when engaging with vulnerable groups and help staff ask the right questions.

Those who may not have access to a bank account and therefore unable to receive benefits electronically or make use of online payment channels, at risk of non-payment of rent or council tax can also be accounted for. The number of vulnerable residents who may be affected by closure of Council run services or buildings can also be considered.

Related Datasets

Data Portals

Our hosted data portals provide a centralised hub for real-time and historical data, making it easier to extract insights, support compliance and streamline operations.