We’re excited to kick off this blog series by delving into the remarkable Sage AI suite within Braze, a game-changing toolkit that has transformed how brands engage with their audience.

One aspect that consistently captures attention and sparks curiosity is the components that make up the Sage AI suite. The potential of generative AI, the insights available through the Predictive suite and the brilliance of the Intelligent suite have already sparked incredible innovation within the realm of Braze. Personally, I find immense joy in highlighting these remarkable features, which truly stand out in their capabilities. So, what comprises the many layers of Sage AI and how does each component work?

In this blog, we’ll explore the intricacies that each Sage AI component has to offer as we journey through its captivating landscape and find out how Generative AI, the Predictive suite and the Intelligent suite are reshaping brand strategies to create new avenues for engagement.

Intelligent Suite

Within the realm of Braze’s cutting-edge capabilities, the Intelligent Suite takes centre stage. Comprised of three pivotal components that redefine how marketers connect with their audience, it encompasses:

Intelligent Selection:

As the epitome of efficiency and optimisation, this game-changing feature empowers marketers to conduct multivariate tests seamlessly. Picture this: the highest-performing variant automatically receives the remaining audience, streamlining the process and safeguarding customers from unproductive experiences.

Intelligent Timing:

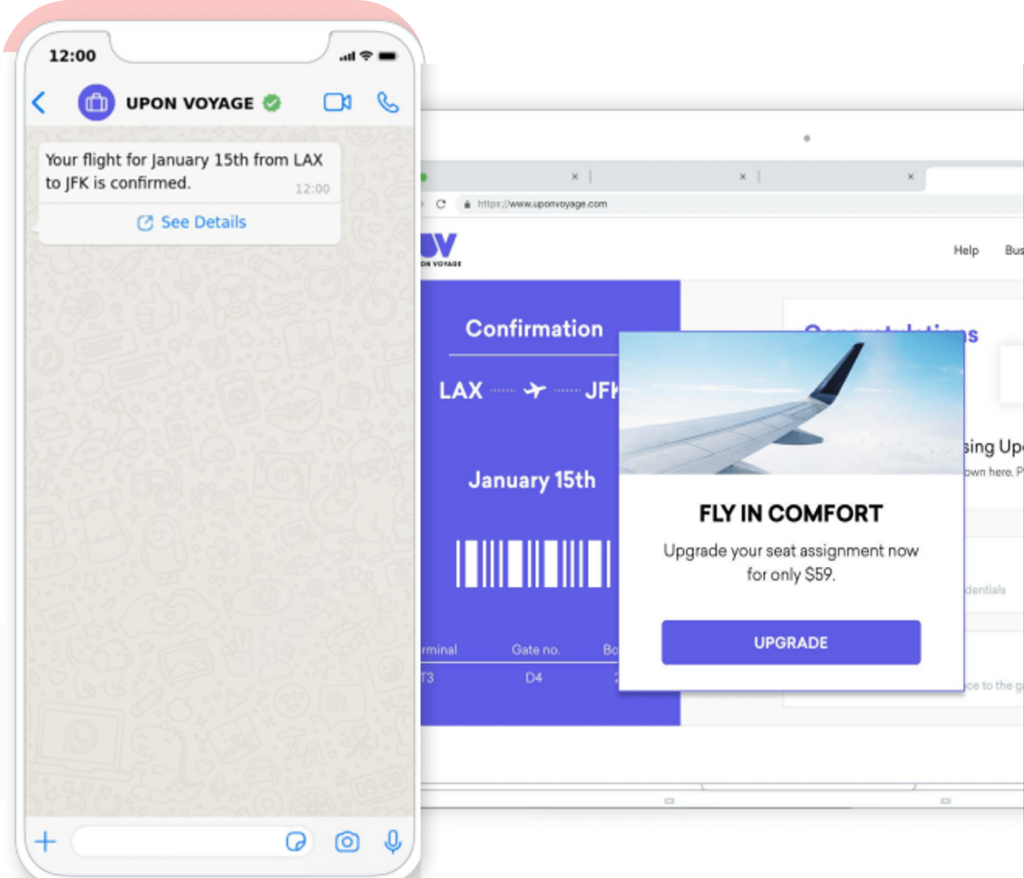

In the world of marketing, timing is everything. Imagine the impact that delivering your message at the exact moment when your audience is most receptive would have on outcomes. With Intelligent Timing, Braze marketers can reach customers precisely when engagement potential is at its peak.

Intelligent Channel:

Crafting personalised interactions is an art, and the Intelligent Channel component adds a stroke of genius to it. By analysing customer behaviour and preferences, Braze enables marketers to select the best channel for communication, maximising open rates and engagement.

Predictive Suite

In the ever-evolving world of marketing, predictive analytics take centre stage through the dynamic Prediction Suite. This suite helps Braze users predict customer behaviour and optimise strategies for impactful engagement. Let’s dive into two of its remarkable facets:

Predictive Churn:

Empowering brands with proactive insights, Predictive Churn enables Braze users to customise filters that detect potential churn. By training algorithms to assign churn likelihood scores to individual customers, brands can craft tailored communications aimed at mitigating churn risk. This personalised approach transforms challenges into opportunities for customer retention.

Predictive Events:

Unlocking users’ future behaviours is a holy grail for business growth. Enter Predictive Events, a remarkable machine learning model that unveils the likelihood of user actions, particularly purchases. As marketing teams decipher forthcoming behaviours, they can shape campaigns, vouchers and incentives for maximum ROI. This predictive prowess transforms marketing strategies from generic campaigns to customer-centric interactions, ensuring journeys resonate profoundly.

Generative AI

In the realm of innovative marketing, AI emerges as a dynamic partner, enhancing creativity and efficiency. Let’s explore three ground breaking AI-driven tools that are reshaping how brands can create, communicate and engage with users:

AI Copywriting Assistant:

A transformative approach to crafting compelling messages, the AI copywriting assistant seamlessly integrates with OpenAI’s GPT-powered copy generation tool. By simply inputting a brief product name or description, this AI marvel generates human-like marketing copy that resonates. This feature comes ready-to-use in most message composers within the Braze dashboard, revolutionising your messaging strategy.

AI Image Generator:

An OpenAI system that produces stunning images and artwork based on natural language descriptions on demand, DALL·E 2 unleashes visual creativity through AI magic Four unique variations of prompts are generated with each input request, enabling brands to generate images up to ten times daily and foster a new level of visual storytelling.

AI Content QA:

Content QA with AI, driven by ChatGPT and OpenAI, acts as a vigilant editor that ensures your messages meet impeccable standards and that your content’s quality reaches its highest potential through AI intelligence. Content QA meticulously identifies and flags elements such as spelling errors, grammar glitches, inappropriate tone and offensive language. Accessible from the Test tab during message composition, this tool reshapes content perfection within campaigns and Canvases.

Why your brand needs Sage AI

The Sage AI Suite within Braze unveils a realm of innovation that redefines brand engagement. Generative AI transforms messaging with human-like precision through the AI Copywriting Assistant and Image Generator. Meanwhile, the Prediction Suite empowers brands to anticipate customer behaviour, from averting churn with Predictive Churn to enhancing campaigns through Predictive Events. The Intelligent Suite elevates engagement by optimising selection, timing and channel choice.

This suite isn’t just technology; it’s a bridge to profound connections, resonant storytelling and empowered strategies that will shape the future of engagement. By embracing the transformative potential of Sage AI, your brand can confidently step into a new era of brand-customer relationships.

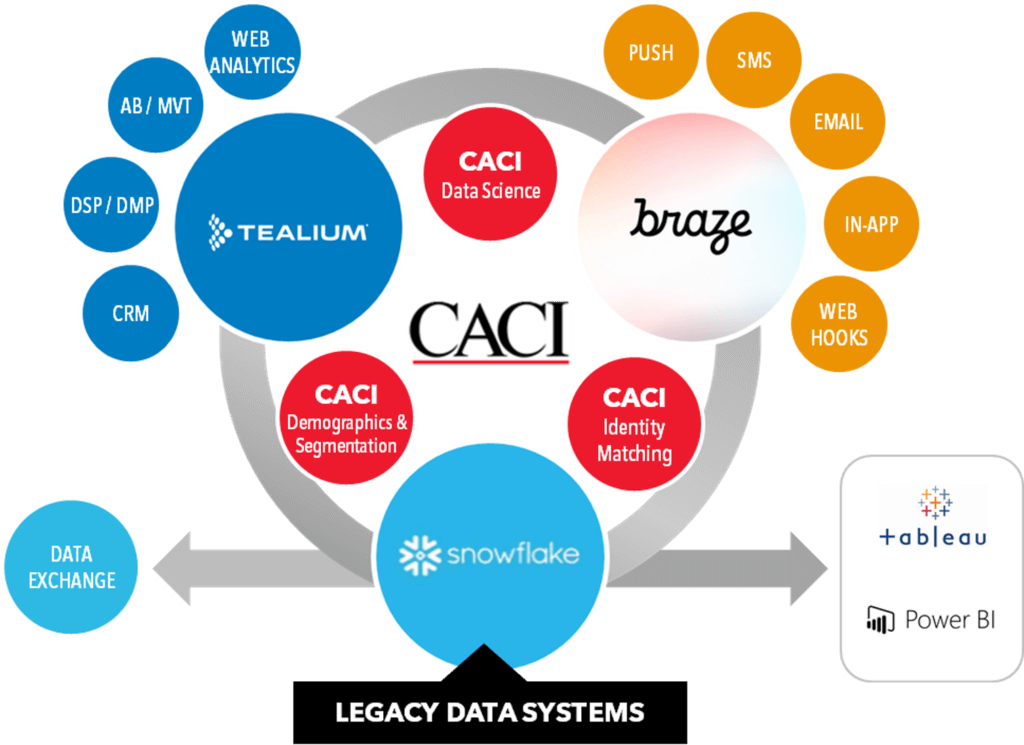

Our partnership with Braze

As a trusted Braze partner, our multidisciplined team can help you maximise your Braze experience value and help you customer engagement outcomes reach new heights. If you’re looking to adopt Braze or are already a Braze user, get in touch with us to find out how you can harness Sage AI’s new components to bolster your engagement strategy.

If you’re interested in learning more about Braze or you’re a Braze user looking to maximise value, be sure to get in touch with us to speak to one of our team.

Continue reading:

Blog 1 – Exploring Braze: optimising your CRM by leveraging key features

Blog 3 – Leveraging Braze’s Winning Paths to augment Canvas performance

Blog 4 – CACI’s Braze City x City 2023 takeaways

Blog 5 – How Braze’s Canvas components personalise marketing journeys