A Customer Personalisation Platform to deliver change for financial services brands

Change within the financial services sector is complex. There are multiple stakeholders, regulatory needs, and often a base of legacy data and technology to unpick.

From our work with major brands, we know that the change is achievable and worthwhile. Investing in customer centricity will pay dividends in the long-term by reducing competitive threats, winning new customers, and ensuring retention of base customers.

To succeed in an increasingly competitive market, financial services brands need to establish change that encompasses:

- A coherent data-driven strategy – where customer data is of a high quality and securely democratised to enable meaningful messaging to the individual

- Establishing the right business targets and success measures – moving from short-term outcomes to long-term value for the customer and the organisation

- A focus on your customers and the market context – understanding the needs and behaviours of both customers and prospects to better engage them

- Maximising data and tech ROI – having the right tools to deliver the outcomes the business needs and then sweating the technology assets to deliver long-term ROI

- Measure and optimise what matters – ensuring accurate reporting is fed through the business and that teams are empowered to act on those insights to optimise performance

Our challenge to leaders within financial services is to create a vision and become an agent of change. We want to work with brands who care about their customers and are making changes to show it. Therefore, our catalogue of services is developed to do amazing things with data and connect your brand with the individual.

At CACI, we can improve marketing ROI through detailed attribution modelling. Our customer demographics and bespoke segmentations provide a more accurate profile of customer needs, market size, and even financial vulnerability. Technical decisions around investment in AI, decisioning or identity resolution are made by defining clear use cases for technology and designing future technical architectures.

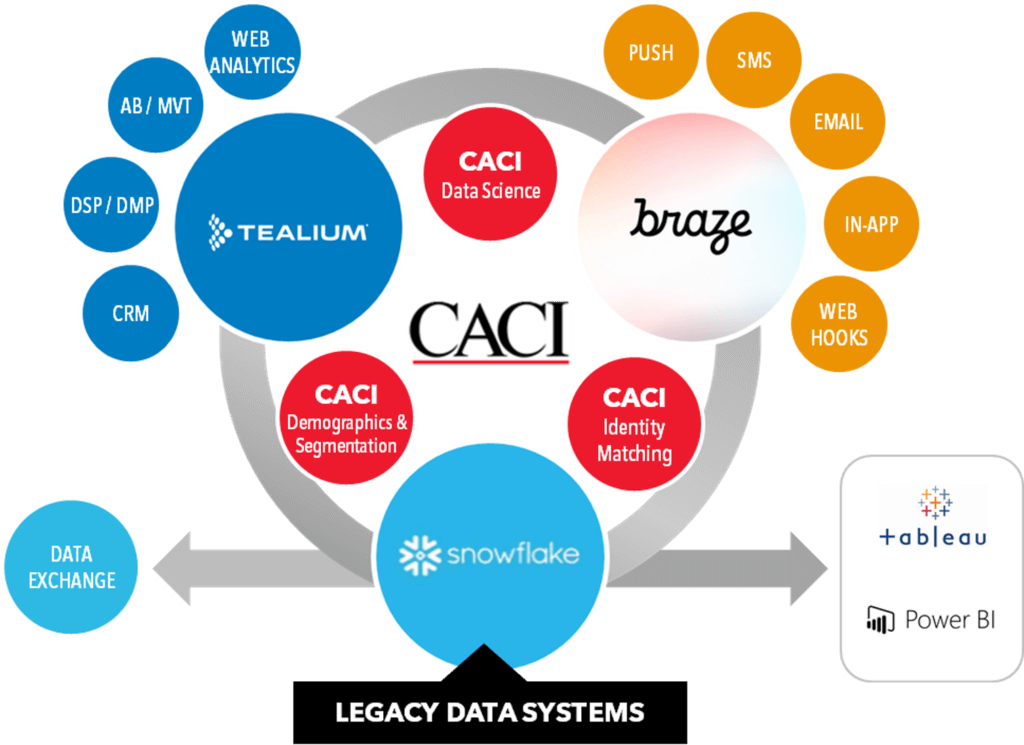

This work led to CACI developing a framework for customer personalisation at scale. Working with leading vendors Tealium, Braze and Snowflake, we created a technology blueprint that can achieve full integration between enterprise data and the omnichannel experience.

To find out more about the CACI Customer Personalisation Platform or to discuss issues related to customer transformation, please get in touch.

You may also be interested in downloading this report which uncovers a surprising disconnect between what banks think and how customers feel about the customer experience, with statistics and insight gathered from 1,500 marketing leaders and 5,000 consumers.

You can also check out the previous parts of this blog series below:

Blog 1 – How the banking and financial services sector can lean into a changing market

Blog 2 – Creating human banking experiences through data-led marketing

Blog 3 – Three ways to stand out in a crowded insurance market