Looking for more insight into retail finance markets?

Access granular data so you can size and profile the markets that matter to you.

Want to know where things are heading?

Gain a clear understanding of the latest products and consumer trends.

Need to benchmark against the market?

Get an objective, independent view of your market share and performance.

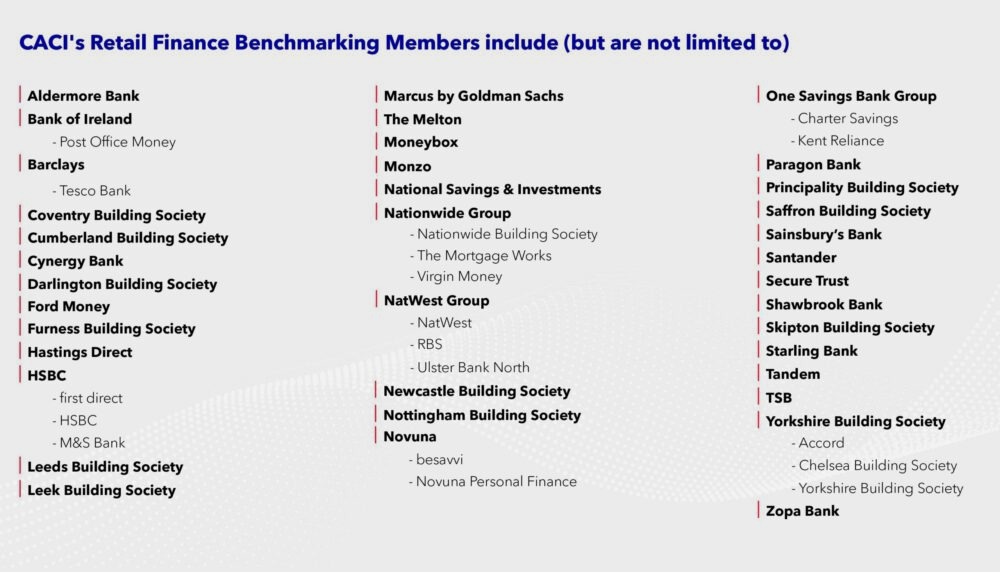

We are trusted by more than 50 of the UK’s banks, building societies and fintech providers for our market insight.

We bring our expertise to you

Leading companies choose Retail Finance Benchmarking for a reason

Trustworthy

Our data is reliable and objective. More than 50 of the UK’s banks, building societies and fintech providers trust our data and insights.

Timely

Our data is frequent, which makes it powerful. You can see the impact of your decisions earlier and spot shifts in retail demand sooner.

Tailored

Our data can be customised to members’ needs. Our data analysts can supply bespoke outputs. You also get personal advice and dedicated support.

FAQs

Answers to common questions about retail finance benchmarking.

Retail Finance Benchmarking is a CACI service that aims to give subscribing members a clear view of opportunities and trends in the UK’s current account, savings, mortgages and unsecured personal loans sectors.

We operate a series of exclusive, member-subscribed databases used by leading banks and building societies. Members contribute data anonymously and get insight not just into their own data, but also a pooled, anonymised view of the rest of the market.

Retail Finance Benchmarking gives you the critical information you need to make better business decisions. We also analyse and report on member performance so you can benchmark against the market.

You can access information and insight via interactive dashboards in a secure online portal, with full training provided by your dedicated relationship manager. Members are also invited to exclusive conferences and webinars.