Summary

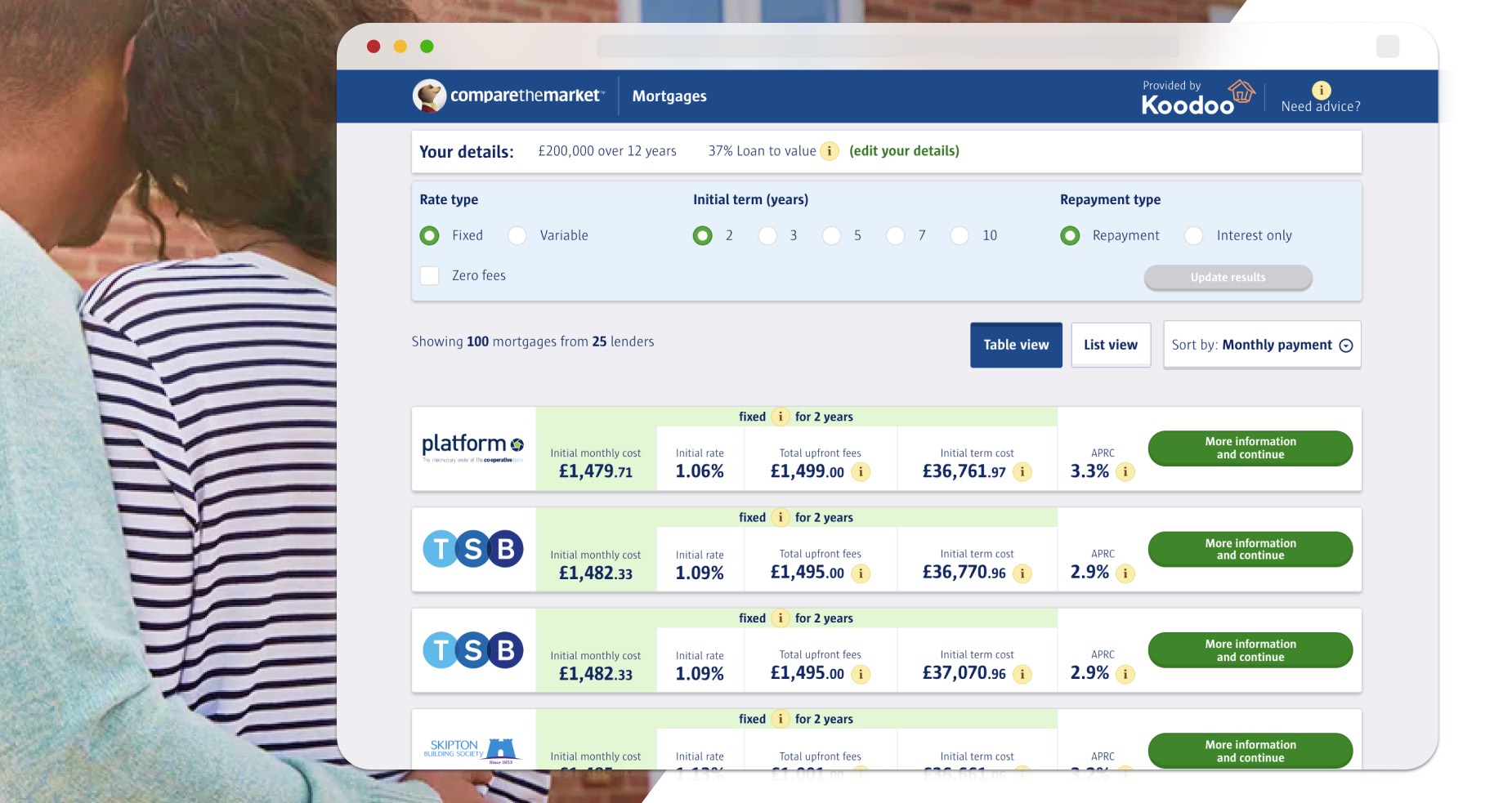

Compare the Market is a leading UK price comparison service and one of its most well-known brands. They wanted to improve their mortgage comparison service’s user experience and product to improve its performance and reduce the rate of users dropping off without completing the process. Collaborating with CACI, the joint team initiated a series of design sprints to address specific user, web technology and data-driven challenges. The initial project’s success led to a comprehensive redesign of their digital mortgage proposition, resulting in significant improvements in user engagement and completion rates.

Company size

1,000+

Industry

Financial Services

Challenge

Compare The Market’s had launched an end-to-end mortgage comparison service on their website which saw customer provide their financial information, review mortgage options from different lenders and then ideally apply for a mortgage via the site. However, results were below expectations with a 50% user drop-off rate before completion.

We needed to understand and identify measurable improvements to different user journeys including first-time buyer, remortgage, buy-to-let and mover to make the necessary UX recommendations that would enable the Compare The Market in-house team and senior stakeholders to understand and implement the changes needed.

As the service was already ‘live’, there was a need for an Agile and iterative UX design approach, supported by effective product management and backed by user research and usability testing, that could deliver the service changes without disruption and to work within Compare The Market’s existing design system.

In addition, as Compare the Market was implementing a wider UX-driven digital transformation, it was crucial for us to share our knowledge, UX processes and best practice to support Compare The Market’s wider long-term aspirations around user research and testing.

Solution

CACI commenced with an intensive discovery sprint, collaborating closely with Compare the Market’s team to identify and address key user experience issues. By analysing user data and feedback, we pinpointed areas causing friction in the mortgage comparison journey.

We then followed with a collaborative design discovery and ideation workshop, grouping customers by behaviour and need types, and conducted a UX audit on the service’s existing interfaces.

From this, we crafted proto-personas and empathy maps, backed up with customer research including 60 hours of user interviews that identified the reasons behind the high drop-off rate: apprehension and form fatigue. We then prototyped, developed and user tested a more streamlined, intuitive, and user-friendly journey, implementing iterative design improvements based on real user interactions ensuring enhancements effectively addressed the identified challenges.

The partnership evolved into a long-term collaboration, supporting the continuous refinement of the mortgage proposition to better serve users’ needs. Documenting UX processes and best practice in a digital playbook, covering everything from how to create research study guides, recruiting participants and managing consent; to conducting ethical research in-line with MRS’ code of conduct.

Results

Through our 200+ hours of qualitative service and user research and UX design approach, we reduced the number of user facing questions by 70% and users presented with actionable results much earlier in the process.

After further optimising the user experience over 10 design sprints, the improvement comparison tool now had 80% of users completing their remortgage calculator submissions, surpassing our initial target of 65%.

In terms of Compare The Market’s objectives around UX transformation in the business, when surveyed, the client rated our communication and knowledge sharing at 100%. The playbook and support enabling them to scale their design and user research practice.