The Retail Footprint suite uniquely defines the catchments and opportunities of tens of thousands of retail locations across the UK and Europe, equipping users with transformative insights into how people interact with places and the opportunities within each retail centre.

Struggling to understand where people come from to visit your location?

Describe who, what, where, when and why people interact with retail centres by understanding how your catchment interacts with that of a competitor.

Lacking insight into the sales opportunities within shopping destinations?

Understand sales opportunities and gain unparalleled insight into the dynamics of each centre based on the spending power of those who live in the catchment.

Defining catchments to uniquely measure opportunities within retail centres

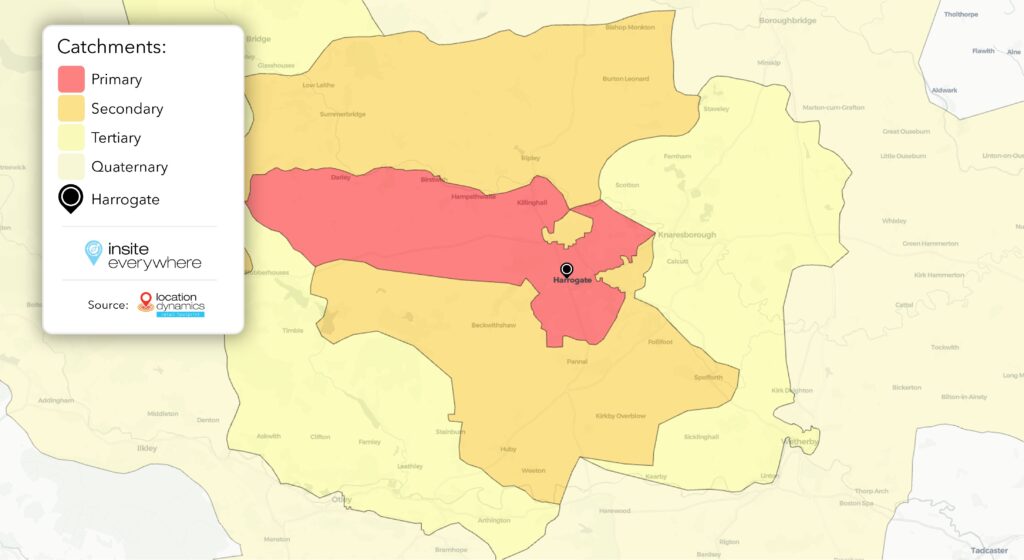

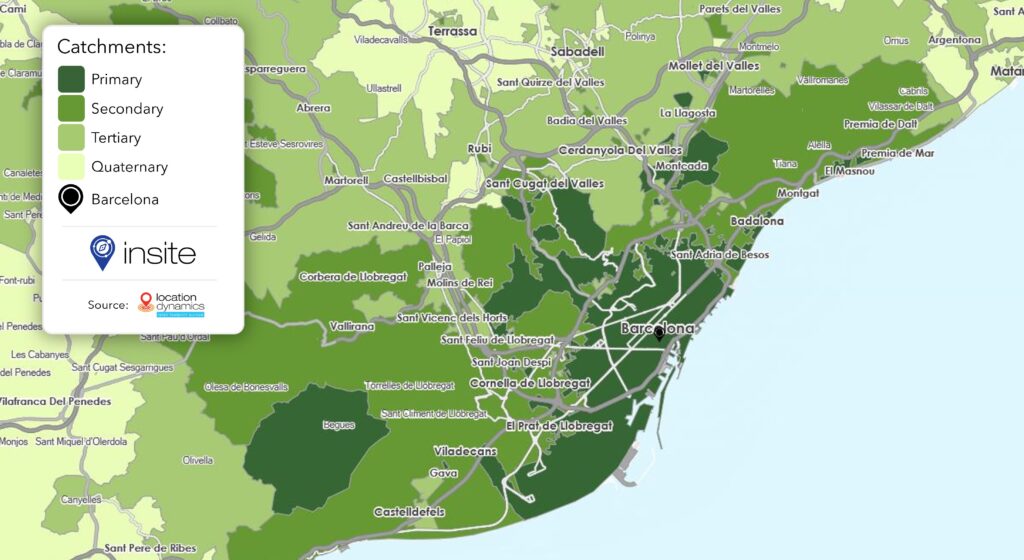

Retail Footprint is a spatial interaction model defining the catchments of over 70,000 retail locations across the UK and Europe. Built using sophisticated AI and machine-learning techniques, it uses factors such as the quality and quantity of retail provision, centre function, travel time and level of competition to uniquely define the catchment and opportunity for each centre.

Retail Footprint collates this information as well as the potential expenditure for each centre, with a breakdown of residential, worker, tourist and online spending, giving users unparalleled access to robust and detailed retail centre information.

Granular insights into how people interact with place

Through Retail Footprint, you can also see each destination’s market size, catchment, retail mix, consumer profile and channel mix. Available through many channels, insights can be accessed in whichever capacity suits your needs.

Retail Footprint can be licensed as raw data, as part of our location intelligence mapping software, InSite or integrated into a dashboard and carried out as a bespoke analysis with our expert team of consultants.

Each centre has been carefully evaluated and classified to determine how it interacts with others in its classification. The retail provision in each centre is broken down into ‘premium’, ‘mass’, and ‘value’, enabling each centre to be scored relative to one another based on both the quality and quantity of provision.

Related datasets

Leisure Footprint

Defining and ranking the opportunity for thousands of leisure locations across the UK

Location Dynamics

A comprehensive location intelligence suite providing insights into the relationships between places and people

Grocery Footprint

Assessing catchments and spend potential for grocery stores

Local Footprint

Insights for 38,000+ UK centres offering retail, leisure, convenience shopping and local services

Financial Footprint

Defining and ranking the opportunity for thousands of financial centres