Paycheck Disposable Income provides an estimate of the average available household disposable income after tax for every postcode across the UK, breaking down costs for essential outgoings.

It equips industries from financial services, public sector, to retail & grocery with the necessary insights to understand and plan around the genuine income available to each household.

Struggling to understand the disposable income available once various outgoings have been accounted for?

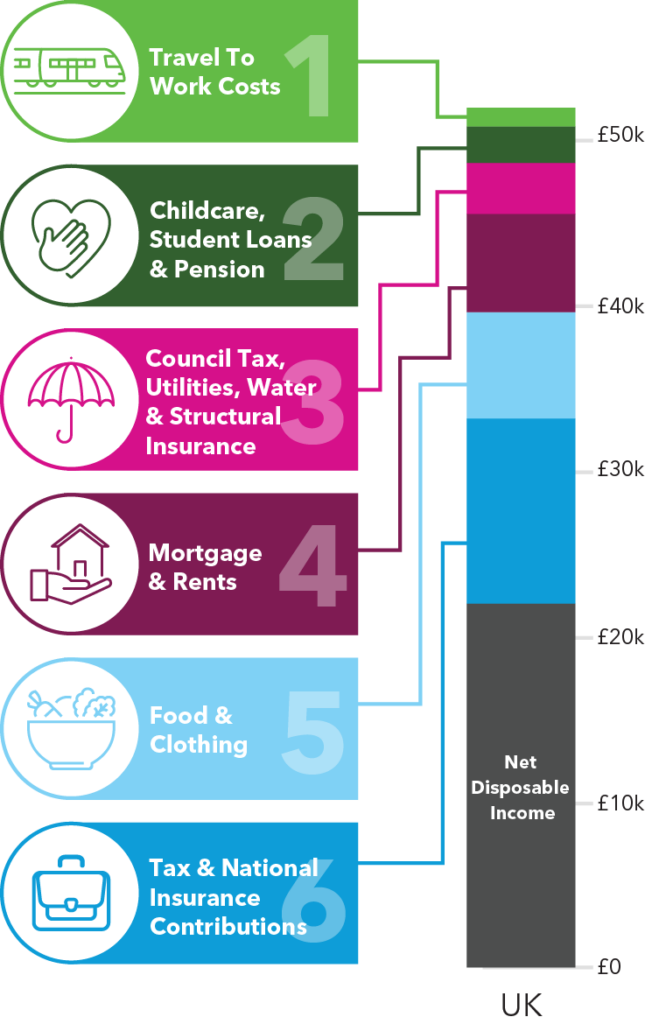

Measure how much is spent towards essential outgoings including housing costs, childcare and general living costs, to calculate disposable income.

Lacking insight into tailoring products or services that align to the affluence of households within your catchment?

Understand the genuine disposable income available to the customers you’re targeting at a local level to tailor your product or service offerings accordingly and achieve your business goals.

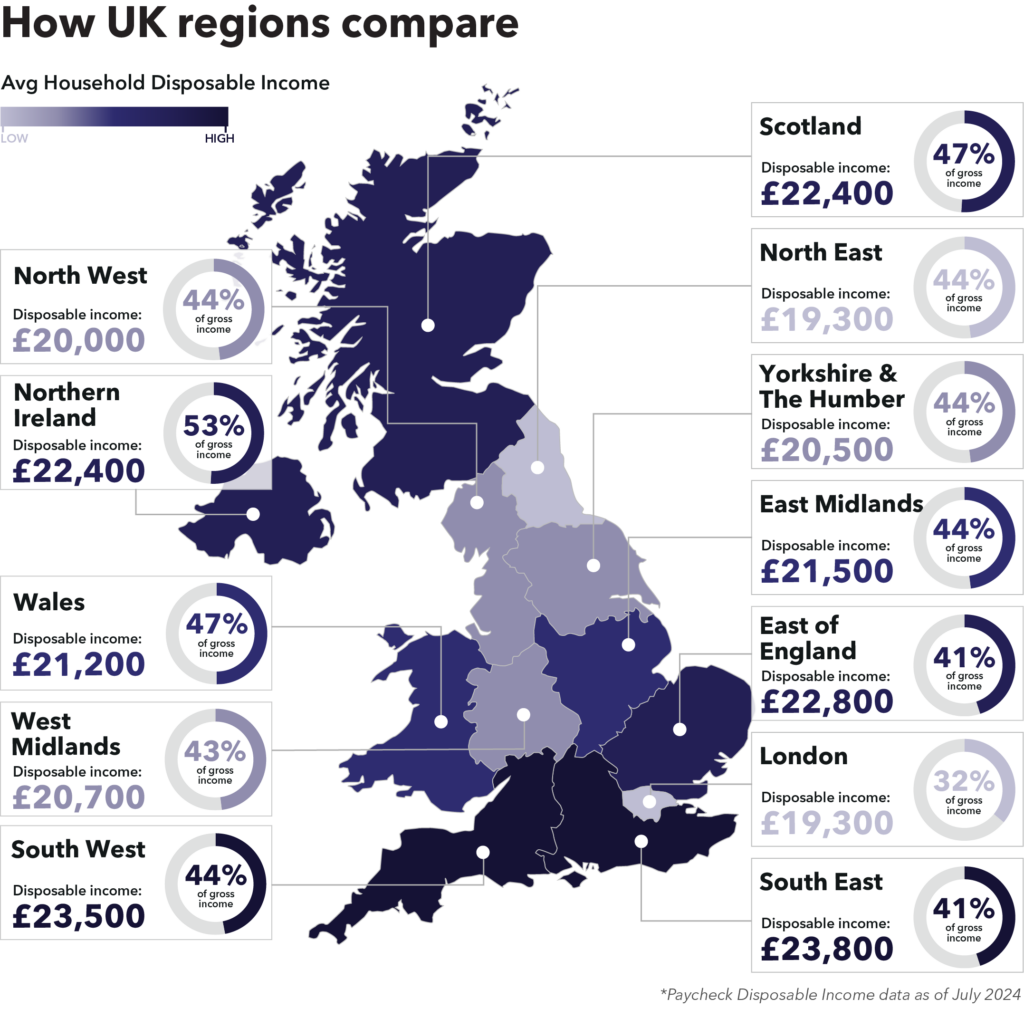

Showcasing household disposable income variations across the UK

Paycheck Disposable Income provides an estimate of the average available household income after tax, National Insurance and other essential outgoings for each of the UK’s household postcodes. It serves as a wealth of knowledge that delivers a breakdown of costs for essential outgoings and the resulting net disposable income.

Essential outgoings include:

- Tax & National Insurance contributions

- Council tax, utilities, water and structural insurance

- Food and clothing costs

- Mortgage and rent

- Childcare, student loans & pension contributions

- Travel to work costs.

Granular & statistically reliable insight into disposable income

Built by using data from Ocean, CACI’s lifestyle database, combined with official statistics and survey data, Paycheck Disposable Income offers unparalleled insight into household disposable income.

It consistently equips you with the latest view into comprehensive audiences through its annual updates, which is especially critical as society faces constant change.

Helping countless industries understand & plan around household disposable income

Financial Services

Through Paycheck Disposable Income, the planning and provision of banking services and advisors can take place.

Public Sector

Paycheck Disposable Income enables local authorities and public sector organisations to analyse affluence and deprivation at postcode level, ensuring at-risk and vulnerable communities in need of social support can be identified and social care funding applications can be properly processed. By offering a view into negative disposable income, local authorities can also better understand who is at the acute end of financial hardship and may require specific support.

Residential Developers

Paycheck Disposable Income can bolster affordability assessments and planning for residential and commercial developments. It also provides an evidence-base for Housing Needs Studies and Housing Market Assessments.

Retail & Grocery

Paycheck Disposable Income helps organisations within the retail and grocery sector tailor offers based on the true disposable income of customers.

Leisure & Travel

Paycheck Disposable Income helps organisations within the leisure and travel sector tailor offers based on the true disposable income of customers.

Related datasets

Fresco

The UK’s leading consumer finance classification, data profiling & marketing segmentation

Ocean

A dynamic database of the UK population with hundreds of attributes characterising at an individual level within a household

Paycheck

Household income estimates for every postcode in the UK

Household Acorn

Household level geodemographic segmentation of the UK’s population

Wellbeing Acorn

Unique consumer health & wellbeing segmentation

Acorn

Understanding your audience through a geodemographic segmentation of the UK’s population