In our previous blog in this series, we assessed the impact of the grey belt initiative on housing nationally. In this blog, we turn our attention to two regions: North West England and Scotland, assessing the potential impact of the grey belt initiative on both regions.

How will the grey belt initiative affect North West England?

The North West represents one of the biggest opportunities for the grey belt, where 69,820 new homes could be delivered across the 951 potential grey belt locations identified by VirginLand. While the North West is not, in fact, the region with the largest number of individual sites (Scotland has 5,960 sites and South East England has 3,207 identified locations), it is home to the largest sites, with each location able to accommodate 73 units on average across 2.4 hectares.

What makes the grey belt a good bet for the North West is not just the number and size of sites identified, but their location relative to potential movers. In fact, 58% of all home movers in the North West live within the grey belt catchment, comprising over 1 million movers.

Using CACI’s Paycheck and StreetValue datasets, the affordability levels within the catchment of the grey belt sites can be assessed to better understand the regional role that the grey belt can play. At five times the average household income, house-price-to-earning ratios within the catchment area of the grey belt are in line with the North West average (5.1 times income) and below the national average of 6.8 times income. At the same time, private rents sit at just 18.3% of the average earnings, against a regional backdrop of 21.1% and national averages of 27.6% of earnings. The requirements of the grey belt in the North West are not necessarily to deliver dramatically more affordable housing than is already available in the area, but to increase the overall supply of housing.

How will the grey belt initiative affect Scotland?

As with the North West, the grey belt is well located to serve the needs of many home movers in Scotland, with 54% of all movers living within easy reach of the 5,960 sites identified by VirginLand. Although numerous, the sites in Scotland are the smallest of any region, averaging at just 0.4 hectares that could accommodate 12 new dwellings.

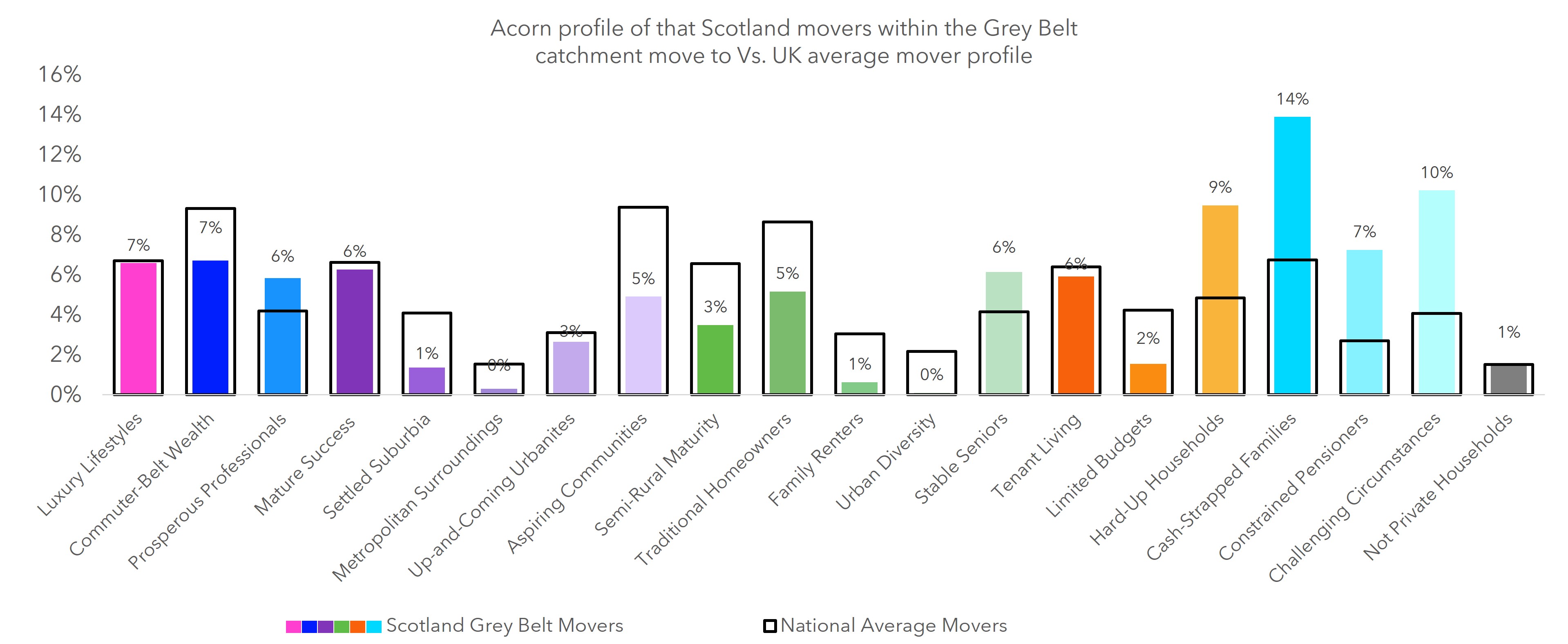

Unlike the North West, there is a clear set of characteristics among catchment movers that provide clear guidance on the type of housing that is needed of Scotland’s grey belt. Of the 665,000 potential catchment movers, 44% are expected to move to flats (against a national average of 18%) and 28% to move to social rented accommodation (against a national average of 19%). CACI’s geodemographic segmentation of the UK, Acorn, provides further clarity, with high concentrations of people moving to “Hard Up Household”, “Cash Strapped Family”, “Constrained Pensioner” and “Challenged Circumstances” neighbourhoods.

These demographic groups are some of the most economically strained within our society, and audiences that we have demonstrated in previous articles have had relatively little new housing delivery in recent years. On a practical sense, it has proved hard for private enterprise to make truly affordable new housing projects for these groups commercially viable because of the prices that they can afford to pay relative to project costs. However, this is a challenge that will need to be overcome to unlock the full potential of the grey belt in Scotland, either through closer collaboration or the delivery of blended neighbourhoods.

What conclusions can be drawn from these two regions and applies to the grey belt initiative on a national scale?

Contained within these two regions are the following important conclusions that can be applied to the national picture:

- The grey belt does indeed represent a significant opportunity to accelerate housing delivery in areas that need it.

- Effective delivery of housing within the grey belt will come from a place of understanding and designing for the intended audience from the outset.

How CACI can help?

To learn more about how you can ensure that your developments are meeting the demands of local movers, contact CACI.

Missed the previous blogs? Find the links to the series so far below:

How grey belt sites will help tackle the UK housing crisis

Grey belt sites: what they are, locations & impact on housing

Assessing the impact of the grey belt initiative on a National scale