Background

Zero Gravity is a digital platform connecting low-income students in years 12 and 13 with undergraduate mentors for app-based mentoring into highly selective universities. Zero Gravity has previously worked with CACI to enrich their understanding of the backgrounds of thousands of applicants through CACI’s Acorn. This is a geodemographic segmentation of the wider UK population used to assess students’ socio-economic backgrounds based on their postcodes.

Challenge

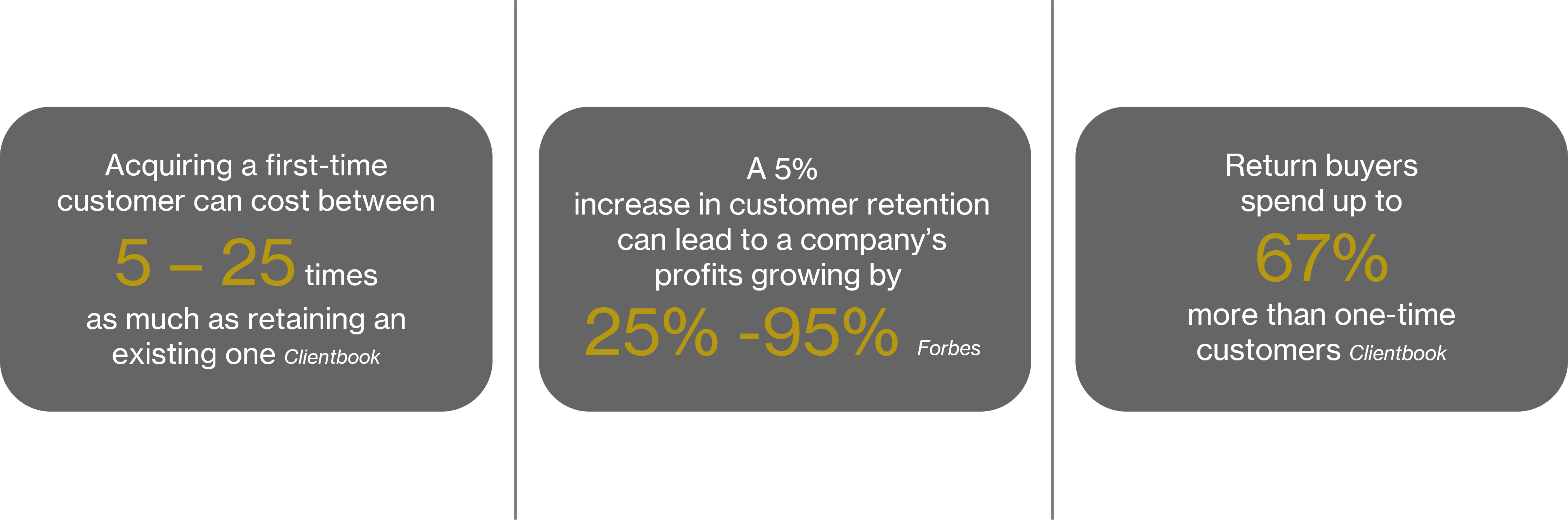

Matching social and economic needs with educational and career opportunities is one of the major challenges that Zero Gravity has sought to address. Every year, around 50,000 students from socially mobile backgrounds achieve top GCSEs. However, only a third of these students make it to highly selective universities, and even fewer progress into top graduate careers. This discrepancy underscores a prevalent issue: while talent is evenly distributed across socio-economic backgrounds, opportunity is not.

The underrepresentation of socially mobile talent at elite universities and in prestigious careers is not due to a lack of ability. Instead, factors such as the “Network Advantage” (the intangible advantage of having access to a broad professional network identified in Zero Gravity’s Gap Zero report), resource shortages and imposter syndrome often hold these students back. The challenge for Zero Gravity is to bridge this gap, ensuring that talent from low-opportunity backgrounds can access the education and careers they deserve.

Solution

To address this challenge, Zero Gravity developed a sophisticated ‘potential identification system’ to identify and support socially mobile talent. A key component of this algorithm is the integration of contextual student profiling from Acorn. Insights drawn from Acorn provide a granular understanding of the socio-economic environment faced by students at home, enabling Zero Gravity to accurately evaluate their academic potential and their challenges.

By combining this information with Zero Gravity’s own academic performance data, the algorithm indexes top-performing students within the bottom groups of social advantage. This allows Zero Gravity to connect with socially mobile talent at the earliest stages of their educational journey.

By providing rich socio-economic insights, Acorn enhances the precision of Zero Gravity’s talent identification process, ensuring that support is directed towards students who are not only high achieving, but also from disadvantaged backgrounds.

Benefits

In the most recent academic cycle, Zero Gravity has achieved remarkable success by helping over 8,000 students from low-opportunity backgrounds secure places at top-tier universities – all free of charge – due to the social value the organisation drives. Notably, 800 of these students gained admission to Oxford and Cambridge, both of which rank among the top 10 higher education institutions globally. Additionally, Zero Gravity has launched the Zero Gravity Fund, directing nearly £1.5 million towards scholarships for its latest cohort of students.

The success of the current model has enabled Zero Gravity to focus on other opportunities to support disadvantaged students. The university mentoring platform has been such a success that they’ve now developed an innovative new service to help students into the workplace following graduation. Zero Gravity now pairs these young people with industry mentors and provides them with tailored support to access leading universities and, ultimately, successful careers. This enhanced approach not only equips students with the tools and guidance needed to reach their full potential but also contributes to a more diverse and inclusive talent pipeline for employers.

Find out more

Please view the full customer story here. If you want to learn more or have any questions please get in touch with us.