Building on the data-driven revolution

In our last piece, we examined how data has become indispensable to successful brand activation within the FMCG industry. As brands grapple with intensifying competition, shifting consumer behaviours, and tighter marketing budgets, one thing has become clear: data-driven insights aren’t just helpful, they’re essential.

Mobility and demographic data have already proven their worth in helping FMCG brands enhance precision targeting and campaign execution. But despite these advances, a fundamental challenge remains attributing success. Many FMCG leaders continue to invest heavily in brand activations, yet struggle to confidently answer the question, “What’s actually driving impact?” This is where Commercial Mixed Modelling (CMM) steps in as a transformational solution.

What is CMM and why does it matter for FMCG leaders?

CMM is a sophisticated analytical approach that blends multiple data sources to evaluate marketing effectiveness across a variety of channels and activities. Unlike traditional attribution models, which can falter in the face of complex, multi-touchpoint campaigns, CMM offers a holistic view. It considers how different factors, both controllable (e.g., media spend, promotions) and uncontrollable (e.g., seasonality, economic conditions) interact to influence outcomes such as sales, brand awareness, or loyalty.

For FMCG brands, where activations are rarely isolated events and often coincide with in-store promotions, retailer initiatives, or national campaigns, CMM provides the clarity needed to truly understand what’s working and why.

Addressing core challenges in FMCG brand activation

CMM directly tackles some of the most pressing issues faced by FMCG marketers today:

- Attributing impact with precision

FMCG activations often form part of a wider marketing ecosystem, running alongside digital ads, trade promotions, and in-store merchandising. CMM enables marketers to untangle this web, isolating the effects of specific activations and understanding their contribution to brand and commercial outcomes, whether that’s increased footfall, improved sentiment, or uplift in sales.

- Integrating diverse data for better decisions

Through the integration of sales performance data, mobility patterns (understood as aggregated, anonymised consumer movement trends), demographic profiles, retailer-level data, and external influences such as weather or inflation, CMM offers a multi-layered understanding of campaign effectiveness. This enables evidence-led planning and removes the guesswork from decision-making.

- Optimising future campaigns for ROI

With the pressure to do more with less, FMCG brands need certainty that their activation investments will deliver. CMM highlights not just what worked, but where diminishing returns begin to set in, helping avoid oversaturation and refine budget allocation. By identifying the channels, formats, and regions that generate the strongest return, brands can maximise every pound spent.

Unlocking further value through scenario simulation and segmentation

One of the most powerful aspects of CMM is its ability to simulate potential future scenarios. This allows FMCG brands to explore “what-if” situations, such as reallocating spend between digital and experiential or launching activations in a different retailer network, before committing budgets. These simulations go beyond mere optimisation and support strategic foresight.

Additionally, CMM supports multi-level modelling. This means performance can be assessed not just in aggregate, but across segments such as:

- Retailer chains (e.g. how does an activation perform in Tesco vs. Sainsbury’s?)

- Geographic regions (e.g. urban vs. rural engagement)

- Product types (e.g. impulse snacks vs. household essentials)

Such granularity helps marketers fine-tune activations for maximum relevance and resonance with their audience.

Transforming FMCG brand activation with CMM

For FMCG brands, the integration of CMM into brand activation strategies is not just a step forward, it’s a game changer. By enabling detailed impact attribution, uncovering insights at multiple levels, and offering predictive simulations, CMM elevates brand activations from tactical campaigns to strategic growth levers.

Whether you’re determining the true uplift from a sampling campaign, planning activations across national retailers, or seeking to avoid overspend through better budget control, CMM gives you the confidence to act with clarity.

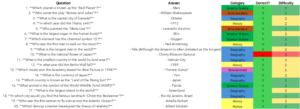

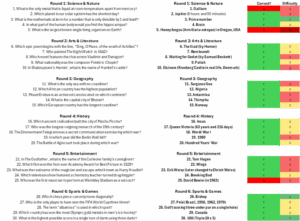

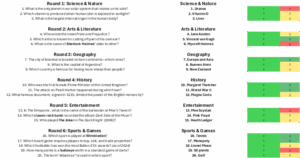

Read our short infographic to learn how CACI’s Commercial Mix Modelling can transform your business strategy.

Ready to take your activations further?

Our FMCG experts are here to help you unlock the full potential of data-driven brand engagement. Get in touch today to discover how CMM can transform your next campaign into a measurable success.