For any marketing activities to be successful, understanding consumers’ behaviours and whether a channel is oversaturated is essential. While data and analysis play undeniably important roles in this, marketing mix modelling (MMM) plays an even greater one, representing the merging point of data and analysis with the psychology of consumer understanding.

Marketing mix modelling (MMM) is a statistical tool that enables an understanding of how each part of an organisation’s marketing activity impacts consumers’ behaviours, sales, return on investment (ROI) and more. Through MMM, an organisation’s performance can be broken down by channel and various types of data can be incorporated to evaluate the effectiveness of marketing activities and determine which are making the most substantial differences to the organisation’s overall performance.

Benefits of marketing mix modelling (MMM)

- Enables organisations to quantify and measure marketing channels effectively to assess which drive the most sales and return on investment

- Equips organisations with long-term insights that will bolster planning through effective forecasting and marketing campaign generation based on previous performance

- Helps organisations allocate budgets according to the best performing channels due to measuring growth based on investments

- Instils confidence due to its statistical reliability and being privacy-safe, both of which are particularly important in a post-cookie world

- Offers organisations a holistic view of the impacts that various factors will have on achieving specific KPIs, ensuring marketers can make more informed decisions based on how and when marketing activities will impact KPIs.

How do marketing mix modelling (MMM) & commercial mix modelling (CMM) work?

Marketing mix modelling (MMM)

Marketing mix modelling (MMM) is used by organisations aiming to understand how marketing activities impact KPIs being measured. Its ability to measure the impact that certain pricing choices, promotional offers, product launches or advertising campaigns may have on sales makes it a game-changer for organisations.

In MMM, the dependent variable used to assess the relationship between sales and marketing activities is usually:

- Sales volume: to assess the impact of different marketing activities on sales

- Revenue: to track the amount of money generated by sales

- Competitor analysis: to understand how your organisation’s marketing activities are affecting your position in the market.

In contrast, the independent variables in MMM are the marketing activities or factors that might drive those results, such as:

- Advertising spend: the amount invested in promotion across various channels.

- Price: to explore the impact of price adjustments on sales

- Promotions: discounts, coupons, or offers that could increase sales

- Distribution: the potential impact of product availability across various locations on sales.

Commercial mix modelling (CMM)

Commercial mix modelling (CMM) is an analytical approach that examines a variety of commercial factors that drive an organisation’s performance. It begins with collecting data from across the organisation on pricing, promotions, distribution channels, products and more, combining the resulting data into a cohesive dataset. The insights presented within the dataset help organisations gauge which factors contribute most to performance and where investments result in the highest returns. It also enables organisations to test various scenarios— price changes, promotional adjustments, changes within distribution channels— to assess the potential impact on performance. Through this, organisations can optimise their overall commercial mix to grow and become more profitable.

How does commercial mix modelling (CMM) differ from marketing mix modelling (MMM)?

While both commercial mix modelling (CMM) and marketing mix modelling (MMM) are granular approaches that help organisations analyse the impact of marketing activities, their scope, methodology and applications differ.

Scope

CMM offers a broader approach when it comes to evaluating the marketing activities that would impact an organisation’s performance, integrating various functions to optimise revenue and profitability. It encompasses external, non-marketing data sources such as weather, seasonality, competitor pricing, interest rates, etc.

MMM, on the other hand, is more partial, purely marketing data that offers a more detailed and expansive result. As a statistical analysis method, it quantifies the impact that marketing activities— campaigns, paid advertisements, promotions, etc.— have on specific KPIs. Focusing more on media and investments rather than a wider marketing strategy, its granularity is what marks its stark contrast to CMM.

Despite the broad scope of CMM, it is just as granular and technical as MMM.

Methodology

CMM blends analytics, business intelligence and strategic insights, considering both internal and external factors that can affect an organisation’s growth. The approach entails:

- Scoping & data auditing: Understanding the KPIs and defining whether the model should target revenue, acquisitions, renewals or some combination form the scoping basis. Data auditing includes tech and journey mapping to determine the stages comprising the funnel for lead gen and closing, as well as the tools and tech used at each stage.

- Data collation & cleaning: This includes a data request to outline the full scope of what can be used in the model, with cleansing, organising and playback taken into consideration to check for completeness and broad accuracy. During this stage, data is also combined and reaggregated for ingestion into the model.

- Exploratory analysis & feature configuration: Plotting all the raw data to understand distribution and periodicity and exploring this raw data to identify gaps and anomalies is conducted during this stage. Correlation analysis helps find feature relationships and possible collinearity, feature types are configured for use in the model and decay is applied (AdStock) to channel features to simulate the memory effect of advertising. Diminishing returns to channel features simulate channel saturation and other transformations such as smoothing or feature combination.

- Pre-processing & feature engineering: Calendar and dummy variables can be included to represent milestones and seasonality, with each variable transforming across a range of parameters to find the most realistic behaviour.

- Commercial mix modelling (an iterative process with pre-processing & feature engineering): Once the model for the approach is scoped (e.g. logistic vs. linear, pooled, nested, hierarchical) and fit for processed features to optimise accuracy and generalising power, it is then checked against existing commercial knowledge and external priors and returned to feature processing to refine variables and tune parameters accordingly. All candidate variables are imported and tested from the pre-processing stage. Finally, the model is refined continually by adjusting variables to optimise statistical measures of accuracy.

- Optimisation & simulations: The present channel saturation is analysed, the optimal channel mix is delegated for specific budgets and results are presented from scenario simulations to understand which channels have headroom and which are oversaturated. A budget guide is provided for optimising revenue and the ability to plan for different scenarios: mitigating headwinds, capitalising on opportunity and planning contingencies.

- Next steps & recommendations: Recommendations are given based on budget optimisations and added value.

MMM, in comparison, focuses on econometric modelling and regression analysis to determine the contributions made by various marketing channels on an organisation’s outcomes. Econometric modelling is a statistical, mathematical approach that quantifies the relationship between marketing activities and business outcomes, built with historical data. Regression analysis is a technique used within econometric modelling to measure the impact of independent variables (marketing activities) on dependent variables (sales or revenue).

Application

Senior executives and C-suite employees may use CMM for longer-term strategic planning and decision-making, whereas MMM would be used by marketing teams to optimise spending and budget allocation towards campaigns or advertisements.

The broader scope of CMM enables senior executives and C-suite employees to gain a complete picture of the various commercial drivers and their impact on marketing rather than isolated results. On the other hand, the granularity of MMM ensures marketing teams strategically plan and forecast how changes in spending across channels might impact sales and plan scenarios accordingly.

How to build a marketing mix model

The first step in building a marketing mix model will be to collate and prepare your data. This will involve collecting historical data on sales and marketing spend across different channels and should go back far enough in time to effectively capture market conditions and seasonality fluctuations.

Next, selecting the appropriate model to facilitate this will be crucial. Selecting the model can come from its robustness or flexibility, catering to your organisation’s unique needs.

Building the model will come after this. This will include defining the relationship between marketing spend and sales or other KPIs and considering carryover effects, saturation or external factors.

Furthermore, fitting the model will use your historical data to estimate the parameters of the MMM. Once the model is fit, the results can be analysed to precisely determine their contributions towards each marketing channel.

Finally, the insights gleaned from these results can help you adjust marketing strategies accordingly, increase budgets within the highest-performing channels and reduce it in those underperforming.

Examples of marketing mix modelling (MMM)

Organisations across a variety of industries can apply marketing mix modelling (MMM) to lead to improved outcomes. A few of such examples include:

- Consumer Packaged Goods (CPG): Gathering data on sales, advertisements, campaigns and pricing can help CPG organisations understand which channels—digital advertising, TV campaigns, etc.— drive the most overall return on investment.

- Retailers: From seasonal promotions to discounts and the influence of both in-store and online presence, retailers can leverage MMM to understand peak performance periods, digital sales and foot traffic to allocate budgets accordingly or reassess promotional calendars.

- Financial Services: Financial institutions can use MMM to evaluate their multi-channel advertising efforts and ensure they are reaching the appropriate audiences, encouraging sign-ups.

Why businesses should choose CACI to carry out CMM

CACI supports businesses in their delivery of optimised marketing efficiency by:

- Determining the value and performance of activity through evolved multi-touch and econometric modelling

- Producing results to sustain and increase growth through targeted investment and improved marketing performance

- Delivering improved accuracy, consistency and availability of marketing performance insights

- Enhancing capability by evolving data, technology and process

- Supporting the provision of ongoing strategic and delivery resource

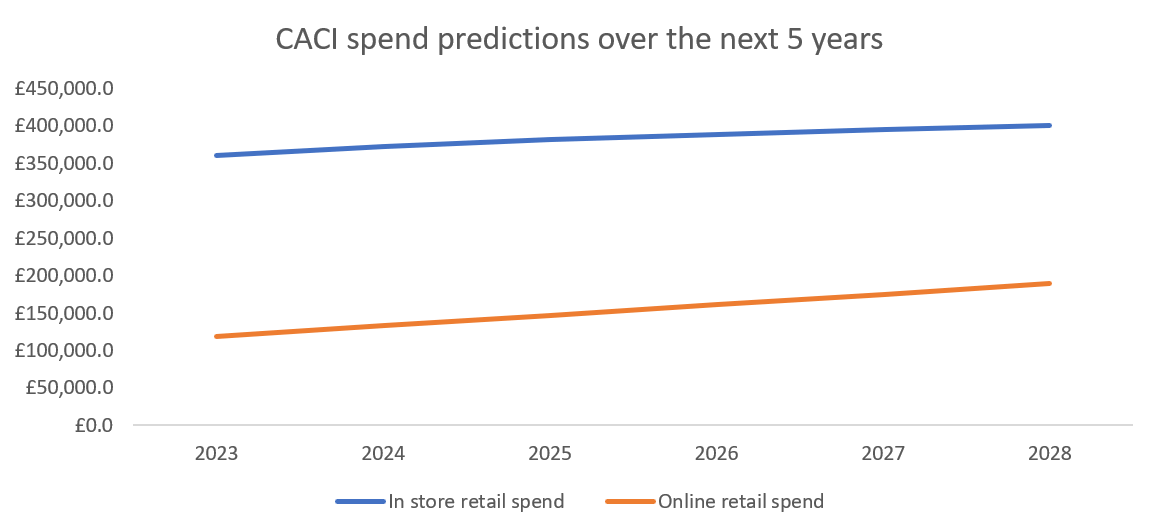

- Helping businesses dig into bespoke segments and utilise in-house data products to unlock insights

- Offer businesses location-based insights into the effects that marketing has at various levels, from stores to regions.

Find out more about the impact that marketing mix modelling can have on your business by contacting us today.

SOURCES:

- https://www.ruleranalytics.com/blog/analytics/marketing-mix-modelling/

- https://kleene.ai/marketing-mix-modelling/

- https://www.ruleranalytics.com/blog/analytics/marketing-mix-modelling/

- https://gaintheory.com/marketing-mix-modeling/

- https://medium.com/@nialloulton/building-a-marketing-mix-model-a-guide-for-marketers-37cc5e41e459

- https://www.ruleranalytics.com/blog/analytics/marketing-mix-modelling/