Vulnerability in the water sector

Covid-19 has meant that 2020 has been a challenging year for all sectors. With a lack of historical data to forward forecast the impact on consumers and their behaviour, there is no way to know what impact this will have on regulatory and business objectives.

For the water sector, this has been particularly challenging. Water companies have spent years building demand and leakage models to ensure that they are as accurate as possible. With a significant shift in working patterns and individuals furloughed, working from home or made redundant; household consumption has increased dramatically, with a significant drop in non-household use.

On top of this, the UK saw a record breaking dry and sunny spring across the UK, quickly following the wettest February on record – adding further complicating factors to demand models.

Furthermore, UKWIR are working with the water sector to develop a strategy to “achieve zero customers in water poverty by 2030”. With more customers at risk of becoming financially vulnerable, especially with the furlough scheme due to end this month nd further redundancies on the horizon, understanding which customers are at risk and how you can protect them is more important than ever.

Recently, CACI ran a roundtable to explore this latter point in detail and discuss how water companies can understand vulnerable customers and address water poverty.

We addressed this in 4 key areas:

- Understanding those that are at risk of becoming financially vulnerable, pre-Covid

- Using CACI’s movement of people reports to understand who is moving vs pre-Covid levels

- Understanding how this movement compares to demographic groups

- What water companies are doing to support vulnerable customers

UNDERSTANDING THOSE THAT ARE AT RISK OF BECOMING FINANCIALLY VULNERABLE, PRE-COVID

In January, CACI released Vulnerability Indicators to support organisations in understanding customers who are at risk of vulnerability from a financial and digital perspective. The purpose of these indicators is to ensure that organisations are supporting those on lower incomes with appropriate tariffs and ensuring that those that can’t (or won’t) access services digitally are able to access services.

The Financial Indicators include the below attributes, as well as a combined score:

- Basic Bank Account

- Disposable Income

- Young Dependents

- Financial Situation

- Likely to Borrow

- Minimum Payments on Credit Card

- Equivalised Income

- Has a Loan

- No Savings or Investments

- No Pension

- Distance to Bank Branch

The Digital Indicators include (as well as a combined score):

- Broadband Access/Speed

- Does not Have Mobile

- Does not Buy Online

- Does not Use Internet

- Online Finance

- “Computers Confuse Me”

USING CACI’S MOVEMENT OF PEOPLE DATA TO UNDERSTAND WHO IS MOVING VS PRE-COVID LEVELS

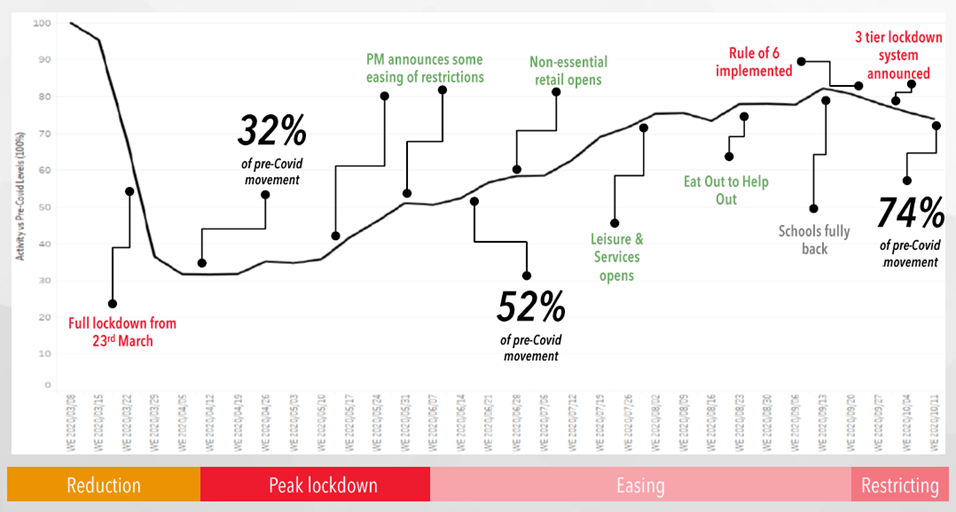

CACI has been running regular research surveys to a nationally representative sample on an ongoing basis, to see how consumer behaviour is changing. In terms of the latest movement, this is currently sitting at around 74% of pre-Covid movement, with decreased movement following the introduction of the tiered system in the UK:

UNDERSTANDING HOW THIS MOVEMENT COMPARES TO DEMOGRAPHIC GROUPS

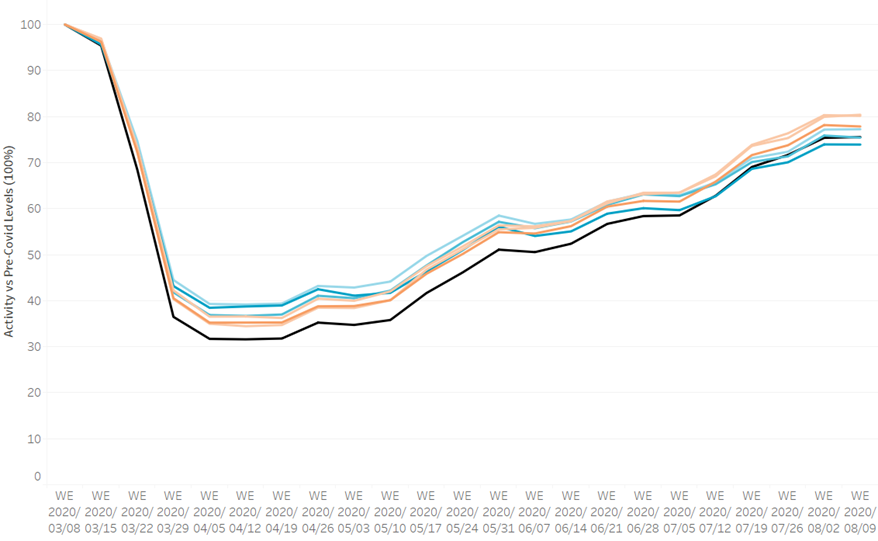

When comparing this to Acorn Demographics, movement is highly correlated to affluence, as you can see from this chart below. During Peak Lockdown the lower affluence groups were moving more than the national average (the black line in the chart below). These groups are highly correlated to those working in the “essential” category, such as Care Workers and Retail Workers:

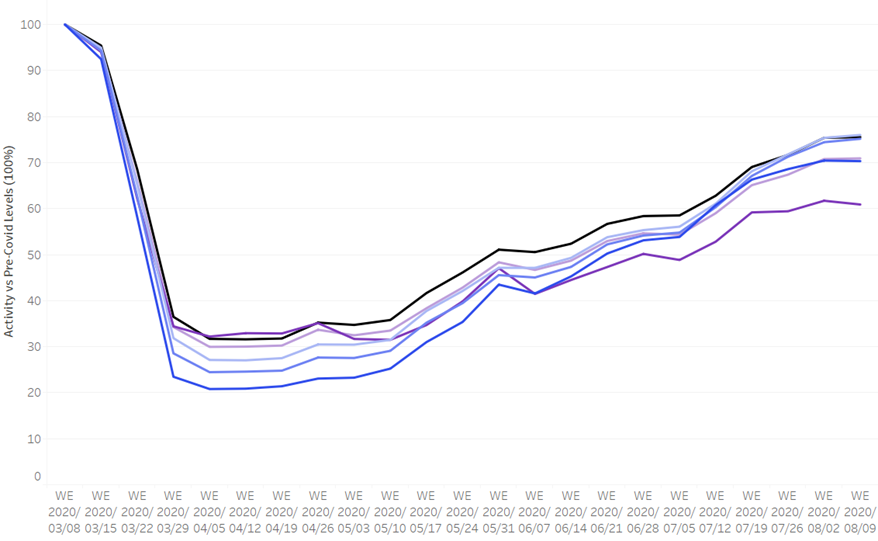

Compared to the more affluent, who were moving less frequently than the national average (the black line). This is highly correlated to those that are “Office Workers” so are more likely to be able to work easily from home:

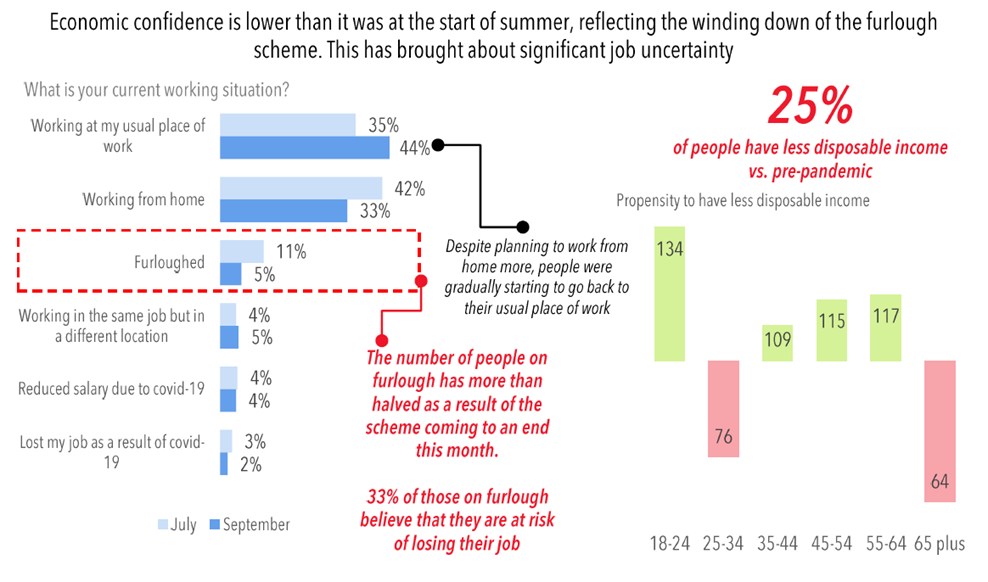

In addition, when we compliment this further with the research we are running, we can see that although the number of those on furlough is reducing, 33% of those on furlough believe they are at risk of losing their job, with 25% of people having less disposable income vs pre-pandemic:

WHAT WATER COMPANIES ARE DOING TO SUPPORT VULNERABLE CUSTOMERS

During the roundtable, we discussed a number of key areas that the attendees are focused on, to support customers:

- A desire to be more proactive, rather than reactive and use data intelligently to understand those that are at risk. Some organisations are already using demographic, behavioural and contact centre data to understand vulnerable customers and how to support them – others are struggling to make sense of a very busy data world.

- Consider partnering with organisations where consumers may go if they have not been financially vulnerable before. Linking with organisations such as Citizens Advice is a good place to start.

- Some organisations where data is not easy to access are looking to partner with other utility companies to present a united front for consumers to access support.

- Using additional channels such as Social Media and Press Releases partnered with National Debtline is a good way to reach audiences who may be at risk of becoming vulnerable in the future.

- Also using direct channels such as pro-active emails to promote PSR and alternative ways to pay so you’re directly speaking to all customers (you can of course personalise this using CACI’s segmentations!)

WHAT’S NEXT?

Our next blog will be focussed on the impact of Covid on demand forecasting, following a recent roundtable we ran with Anglian Water and Badger Meter.

Following our next Roundtable on “Identifying the New Wave of Vulnerability” we’ll be releasing the key thoughts and findings.

Please do not hesitate to get in touch should you want to hear more!