The impact of Covid on customer behaviour and nursery growth strategies

As the country learns to live with Covid, CACI’s data and consumer research is revealing what the new normal looks like for the nursery market.

Customer Movement is on the Rise

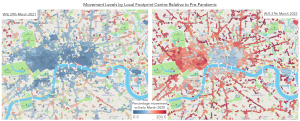

Let’s start with the positives. Remember just how much more freedom we have than we did this time last year. The contrast between the two maps based on anonymised Mobile App data are stark. The map on the left shows movement activity levels in the last week of March 2021 relative to pre-Covid (Early March 2020) for Central London.

Source: CACI / Digital Envoy

Dark blue shading shows areas that movement levels were way down on pre-pandemic across much of London – not surprising given that restrictions were really only lifted in early April 2021 for all but essential activities (albeit including trips to nurseries). The map on the right is the same week this year, and shows swathes of red across much of London, highlighting that activity and visits to many of these areas has returned to almost pre-Covid levels as we learn to live with life after Covid.

Despite the fact that we are seeing record numbers testing positive for the new variant there is no doubt that many are back out and getting on with their lives after a painful couple of years.

New Behaviours and Attitudes

But we have emerged into a different world. The right-hand map shows that the recovery in movement is not universal. There are still clear areas of blue and lighter red in office dominated parts of the city, and around the major stations of London. The same pattern is seen in cities across our county.

Analysis of the data reveals that our city centres are only now returning to something close to what we would have called normal before the pandemic, and transport hubs are seeing visits about 25% down. But regional towns have grown in popularity, with visits up by about 40%. So, clearly we have changed our activities, and it looks like many of these behaviours are set to remain.

Our towns and cities are changing, and we can see it happening around us. But it’s a complex picture. Whilst some have speculated that we are going to witness a long-term boom in the suburbs as everyone moves out of our towns and cities – this is not the case. Despite the jolt that Covid brought there are too many interactions at play for all the old links to be broken.

CACI’s research, carried out as restrictions were eased, revealed that many 18 to 34 year olds, many in the target age groups for nurseries, were keen to return to our towns and cities. These included people from across the demographic spectrum with groups with very different lifestyles – from ‘City Sophisticates’ to ‘Struggling Estates’ in CACI’s Acorn classification amongst those most keen to return to urban living.

Consumers are listing eating out, entertainment and leisure activities as the top reasons for wanting to return.

In short, for many our towns and cities remain places of fun, choice and opportunity – and this hasn’t changed with the pandemic. What we are seeing is that towns and cities are responding to this need. At CACI we have never been so busy in supporting our leisure clients who are busy trying to extend their portfolios, filling the units vacated by retailers hit by the step change in online shopping triggered by the pandemic. And other urban offices and former retail units are being repurposed as urban living – a clear sign that everyone is not heading for the countryside and suburbs.

For many, working patterns look like they have changed for the long-term. Evidenced in the conversion of office space to other purposes and in the areas of blue on the map of central London in worker dominated areas. Our research revealed that workers claim that 2 to 3 days is the optimum number of days they would like to spend in the office, and this seems to be becoming the norm for many. But, it is important to remember that not everyone has this option, including most workers in the nursery sector. It is very easy to think everyone can work from home easily, but affluence, age, location and job role all clearly play a part.

Source: CACI / Digital Envoy

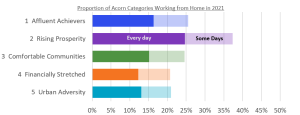

Analysing Kantar’s TGI survey data from 2021 shows that, even in a year scattered with various work from home advice, only 25% of those surveyed said that they worked from home every day, or some days, as their ‘normal’ behaviour.

The chart, using CACI’s broad Acorn Categories to dissect responses, clearly illustrates that it is the ‘Rising Prosperity’ that are most likely to be working from home. These are younger, well educated professionals moving up the career ladder and living in our major towns and cities. 38% of this segment claim to work from home at least some days, and 25% of this is made up of those working from home every day. In contrast only 20 or 21% of lower paid, lower qualified segments ‘Financially Stretched’ and ‘Urban Adversity’ have the luxury of even working from home some days.

Source: CACI / Kantar

As a result of this shift workplace nurseries will no doubt continue to suffer, as many will prefer the flexibility of nurseries closer to home, in line with the shift to ‘hybrid’ working, with many neighbourhood nurseries benefiting from this change. The number of parents requiring nursery spaces is unlikely to be impacted by the rise in home working, as many learnt during the Covid lockdowns that working from home and providing childcare don’t mix. However, many nurseries are likely to see increasing staffing and pricing complexity with parents expecting a level of flexibility that reflects the new-found flexibility in their working hours and location.

So, despite big changes there is no evidence to suggest a need for wholesale changes in where acquisitive nursery groups should be focussing their attention. The big urban to rural shift is not happening and indeed CACI’s research shows that even at the peak of the pandemic 10% of house moves were from villages to towns and cities. Tracking planning applications reveals huge amounts of new dwellings under construction or being proposed in our urban areas and, whilst much of this will have been planned before the pandemic, it’s not that easy to turn a tanker. It is simply not possible for such a shift to happen without fundamental changes in planning policy and housing stock.

So, in summary whilst the change in residential patterns are moderate it is the behaviours of those residents that have changed, and the following are just a few more key behaviour changes that CACI expect to remain:

- Communities are eager to stay local

- This is good news for nurseries operating well-run community nurseries. But it is increasingly important for nurseries to engage with their wider communities and larger groups need to take care not to look like corporate outsiders

- Social governance is increasingly in the spotlight

- With consumers expecting their suppliers to behave ethically and transparently

- Minimising waste and environmental impact is mainstream

- All nurseries now need to ensure that they are meeting parents’ expectations here and that they are living out the values of care for the environment that the children will inherit

- Digital is critical to recruitment and engagement

- There is no doubt that digital is here to stay – so if you are not happy with your website you can be sure that it is putting off potential customers and if you are not sharing key messages with your parents via emails and portals then you may get left behind

New Challenges and Opportunities

Unfortunately, with inflation and rising rocketing fuel prices, there is no doubt that many families are going to be facing increasingly tough decisions about where to prioritise their spending in the year ahead. This could impact customers’ ability to afford childcare, especially if their salaries rise above the eligibility threshold for free places, but their true disposable incomes fall.

Rising fuel costs for nurseries will compound the challenges of rising wages already driven by the shortfall in staffing that so many in the sector are facing and these need to be factored into nurseries strategic plans.

Successful nurseries should take note of these consumer and market changes, play to their strengths in these areas and they will thrive. But ignore them at their peril as the sector faces the two emerging, and partly inter-related challenges of staffing and the cost-of-living crisis.