When allocating your marketing budget, how do you really know how much you should be spending on display? Your last-click attribution model suggests that it performs terribly, costing over £500 for every acquisition. However, it does appear to drive a lot of traffic to your website.

If this resonates with your business, you are not alone. This is a challenge faced by many brands – what is the true impact of each of your digital channels and how much do they contribute to someone becoming a customer?

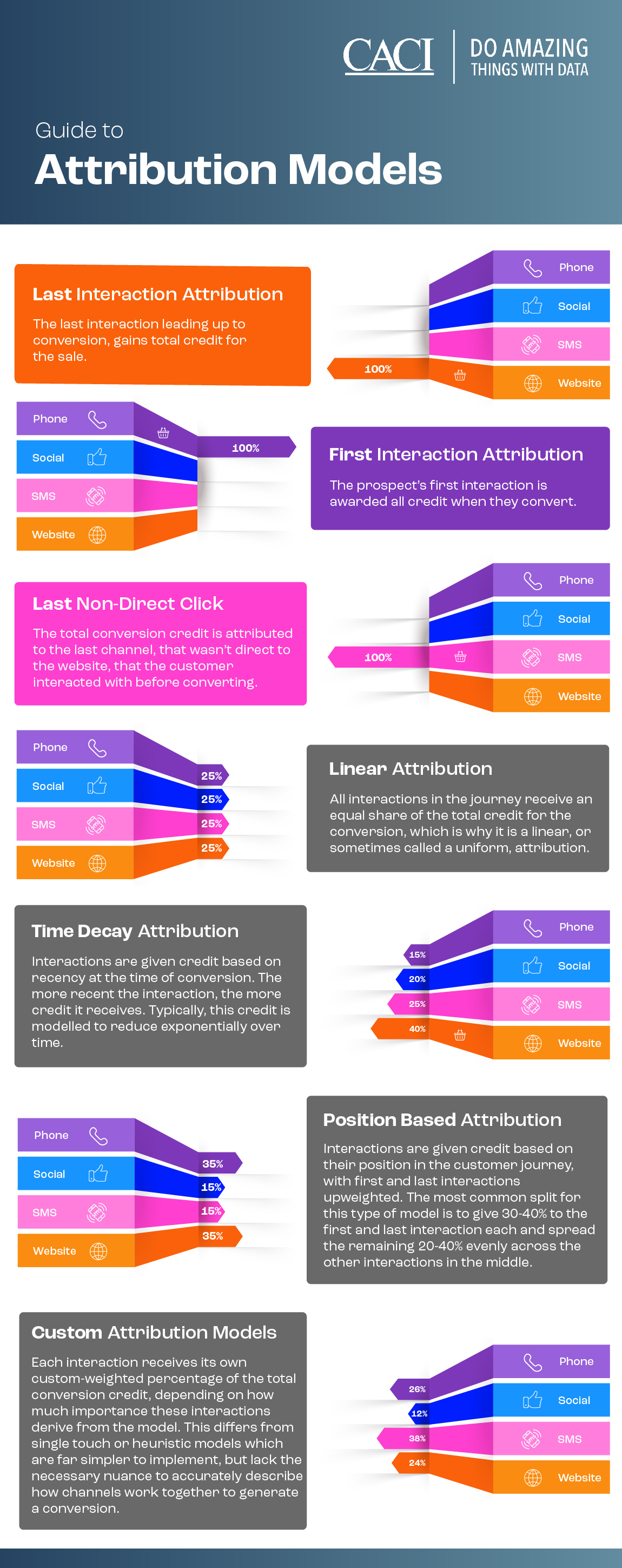

Digital attribution models are used to measure the performance of digital marketing channels, but there is a wide variety of them out there, and they can be set up in many ways. Which is the right approach for your organisation?

Click on the image to view in full screen

While there are several attribution models to choose from, choosing the model that will best suit your objectives and goals can be determined based on your business’ unique needs and your available data.

Four steps CACI take to implement a multi-touch digital attribution model, to determine the true value and performance of marketing activity

Step 1: Understanding your business goals and objectives

- Building an effective and valuable multi-touch attribution (MTA) model is grounded in having a full understanding of a few key points, including:

- The wider business objectives – how does this project help to achieve these?

- The exact point of conversion in a consumer’s journey, often where they cease being a lead, and are acquired as a customer

- Any fundamental differences in marketing activity across different regions or markets

- The definition of a successful MTA project for your organisation

Step 2: Evaluation of current capability

A comprehensive review of your brands data and technology used to support digital marketing must be carried out before modelling can begin. This includes:

- Evaluating your digital analytics platforms to ensure:

- All necessary tracking and tagging are implemented

- Relevant metrics and goals have been set up in line with best practice

- Channel/sub-channel and campaign data is recorded correctly

- An understanding of the past and present media activity:

- Organic, paid and app

- A complete understanding of a customer’s path-to-conversion

- Understanding the current measurement framework and any Key Performance Indicators (KPIs) that are reported back to the business

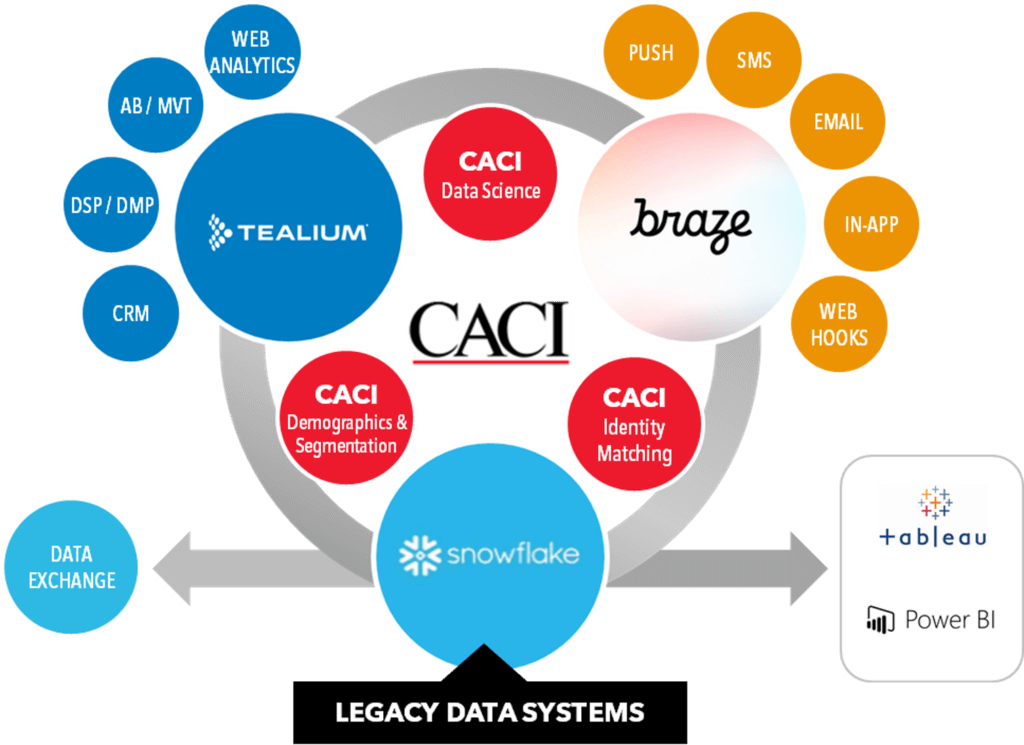

- A complete review of the technology to be used to develop and implement attribution

Upon completing an assessment of the existing digital data and technology stack, CACI will make recommendations to ensure the MTA model runs optimally and follows best practice.

By establishing what is in place, what can be optimised, and what needs to be adapted, we can identify the most suitable solution to develop.

Step 3: Building a Multi-Touch Attribution model

Preparation is key, but finally, the fun can begin! Build and validation of an MTA model includes the following steps:

- Identify & collate all data for the paths a customer can take on their way to making a purchase/converting

- Evaluation of the most suitable modelling method to be used (e.g. Shapley Value vs. Markov Chain)

- Build, test and validate the MTA model

- Integration into your technology platform for a fully automated solution

- Assess model performance and produce insights tailored to your KPIs (e.g. channel share, cost per acquisition, return on investment)

Your MTA model will now deliver the insights required for you make informed decisions. Results from MTA models feed into:

- Media planning: giving you confidence in budgeting and channel allocation

- Optimisation: determine the most effective channels and campaigns for you to invest in

- Granular insights: derive insights on your marketing activity per segment

Step 4: Evolution to best-in-class

Results from your MTA model need to be consumed on a regular basis. There needs to be a continuous closed loop of feedback into strategic decision-making and campaign planning, to improve targeting, and ultimately ensure you’re reaching your customers at the right time. As well as ongoing optimisation, CACI can support you in further enhancing your marketing through data and insights, including:

- Integration of new channels

- Model refreshes at optimal times

- Technology selection and integration

- Econometric modelling

- Insight strategy

What are the major barriers affecting digital attribution modelling?

Non-digital media & in-store visits

Online results are easy to generate when businesses have a website and application analytics account. However, tracking and customising the customer journey for non-digital media and customers’ visits to physical stores becomes rather complicated. Customer engagement that can otherwise be tracked online is met with a challenge, and if any campaign efforts have been in place, a different approach such as econometrics would be required.

Third-Party Cookies

Cookies allow attribution models to function by identifying and tracking a user across their website-visiting journey. A lack of cookies translates to a lack of standards for advertisers, causing brands and businesses to question whether media planning and optimisation efforts can or will be successful.

Cookies underpin much of how digital marketers track and target individuals – small snippets of data which can demonstrate a user’s online activity over time. The third-party cookie specifically has been on its way out for some time, with Safari and Firefox already having phased these cookies out. Google initially announced to follow suit with their browser, Chrome, in 2022, but has since delayed this to 2024. This means that the functionality that has long been taken for granted in attribution and other digital analytics will change.

Marketers and analysts may have to adapt how tracking users across digital properties and devices takes place, which may make getting a cohesive picture of the user journey more difficult to deduce in attribution. Google has stated their intention to replace this with a first-party counterpart, forcing marketers to leverage walled-garden ecosystems like Google even more. The way other sectors will react to first party cookies in the future remains unclear.

Why your business would benefit from digital attribution modelling

- CACI supports businesses in their delivery of optimised marketing efficiency by:

- Determining the value and performance of activity through evolved multi-touch & econometric modelling

- Producing results to sustain & increase growth through targeted investment & improved marketing performance

- Delivering improved accuracy, consistency and availability of marketing performance insights

- Enhancing capability by evolving Data, Technology & Process

- Supporting the provision of ongoing Strategic & Delivery resource

Find out more about the impact that digital attribution modelling can have on your business in our whitepaper here.