Your customers and prospects want and expect you to communicate with them as individuals. It’s a very natural human desire – no-one wants to feel like they’re just a data point.

Today’s sophisticated data management and campaign delivery technology makes this possible in theory. But effective personalised communication has become more complex in recent times because of the challenges of identity resolution.

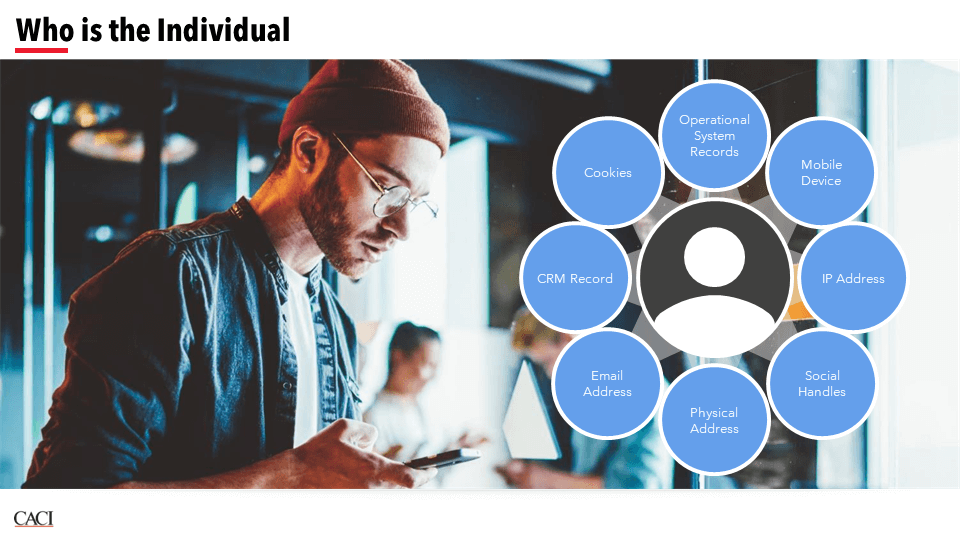

Identity resolution has always been important. It means matching identities across different touchpoints to create a unified profile for every customer. The advent of GDPR intensified the need to use identity resolution to manage data preferences robustly across channels and media, to comply with data protection laws.

But legal compliance is only one reason for the extreme complexity of the identity resolution challenge today. For marketing personalisation and for analytics, you need an accurate view of an individual, so you can always communicate with them in context of who they are and what matters to them.

We need to be able to resolve identities better, faster and more efficiently across a much greater amount of data to keep pace with competitive pressures and market demands.

CONSUMERS ARE UNFORGIVING

Your customers are ever more demanding – they want and expect to know about the right products and services at the right time and to be served content that’s relevant to their current preferences. 63% of customers say they will stop using companies who deliver poor individual marketing, according to data cited by the Forbes CMO network.

DIGITAL BEHAVIOUR IS CONSTANTLY EVOLVING

There’s an ever-growing number of channels enabling consumer engagement with brands. Consumers also have more devices. They use them to graze across a range of channels and media – frequently their interactions are superficial and transient. They no longer adopt a consistent pattern of behaviour, nor do they always log in or identify themselves directly when they view content.

YOU CAN’T RELY ON THIRD PARTY COOKIES

The third-party cookie is on its way out. That makes it harder to connect interactions through online advertising on third party sites. First party data is becoming more important, and it must be accurately resolved with other sources.

SOPHISTICATED TECH CAN OVERREACH YOUR CAPABILITIES

Technology is at hand to help and many vendors are pushing their solutions. These are based on complex data science and may include visualisations, digital reporting platforms and next best action platforms. Many are excellent tools, but you need to bring your data together in a consistent, de-duplicated way before you can obtain value from them.

THERE ARE SHADES OF GREY IN DIGITAL IDENTITIES

In the previous digital era, identity resolution was relatively simple – you either knew or did not know who a person was. But it’s no longer black and white. You can also personalise and understand preferences without knowing exactly who the individual is, learning about them through behaviour and touchpoints.

These factors all create obstacles to delivering the personalised content and marketing that fuel sales and retention in competitive consumer markets.

Organisations need to upweight their data science and marketing analytics expertise to deal with the ever-evolving challenges of identity resolution and get the best value and differentiation from their digital marketing campaign tools and tech.

Increasingly, clients are asking CACI to step in as an expert third party resource to tackle these challenges, using the purpose-build ResolvID solution.

CACI is a frontrunner in identity resolution and has pioneered innovative ways to consolidate customer data since the issue first arose. We started with matching services based on name, surname, address. Today, we have built far beyond that expertise to create ResolvID, a real time API-driven product that learns as it resolves a wide range of different data sets. It can also address digital applications where there may be no first party identifiers, instead using IP addresses and device IDs.

Our next blog will be to find out exactly how identity resolution supports advanced personalisation, compliance and accurate analytics, and why this is crucial for your success in today’s digital marketplace. Or get in touch if you’d like to discuss how we can help you tackle the challenges of identity resolution in your customer data.