Who are Londoners and how do they shop?

Greater London is just over 40 miles wide yet has a larger population than Scotland & Wales combined. The capital makes up 13% of all retail spend in the UK and has a significant overrepresentation of the country’s most affluent urban demographic groups.

People often talk about London being its own bubble, and Londoners’ behaviour certainly reflects that. London consumer behaviour is unique and reflects the extensive supply of retail, catering and leisure compared to anywhere else in the UK.

CACI research sheds some light on just how different the London consumer is, both demographically and behaviourally, compared to the rest of the UK.

Polarised London

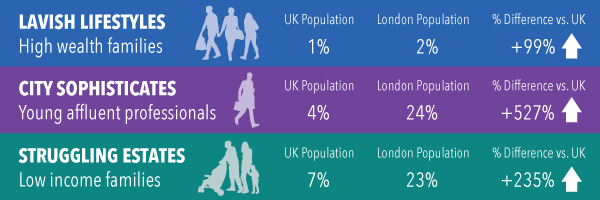

London’s demographic profile is the most polarised in the UK; there are more of the country’s most affluent demographic groups, as well as the younger affluent groups, but there are also high volumes of the least affluent members of the country.

What is Acorn?

Acorn is a geodemographic segmentation of the UK’s population. It segments households, postcodes and neighbourhoods into 6 key categories, 18 groups and 62 types. By analysing significant social factors and population behaviour, it provides precise information and an in-depth understanding of different types of people.

The younger and affluent consumer groups have the most significant impact on London shopping locations. They are in abundance, they have money to spend, they are brand conscious and they are constantly seeking experience. It is the way these shoppers interact with a centre which ultimately shapes the London retail and catering landscape.

To help quantify the scale of wealth of some of London’s key Acorn groups, CACI compared house prices and income in London to their counterparts elsewhere in the UK. For example, Lavish Lifestyles have an average house value of £3.8m with savings and investments in excess of £100k. City Sophisticates, the most prevalent group in London, live in houses valued at £1.5m on average and incomes 56% higher than the UK average. At the other end of the scale Struggling Estates feel the brunt of London house prices, more likely to be renting accommodation with a not-so-modest value of £426k, paired with an average income -22% lower than the UK average.

The Promiscuous Shopper

London shoppers have a higher frequency of visit compared to the UK average. This is a function of the nation’s capital having everything on their doorstep which means that they can be promiscuous in where they choose to shop. For example, in a week it is possible to pick up some jeans in Shoreditch, collect groceries on the way home to Brixton and stop by Oxford Street the next day to get a top to match the jeans from yesterday.

This is why average retail spend per trip sits marginally lower in London than the rest of the UK (-6%), but when you consider their behaviour over the course of a year they are more valuable shoppers given the frequency in which they engage with retail. As ‘nownownow’ consumers they expect retailers to keep up with their needs and expectations.

A Culinary Scene

The most defining trend shaping Londoners’ consumer behaviour in the past year, is their propensity to spend on catering. Londoners’ average catering spend during Christmas peak season is 56% higher than elsewhere in the UK, despite their smaller party size. This is partly attributed to the abundance of cash rich, time poor consumers (e.g. frequently grabbing some breakfast or lunch while on the go), but it is also a function of post-work time routine, where dining out and experiencing London’s ever-growing culinary scene is becoming an embedded part of London culture.

This is especially true amongst young, professional groups who dominate the London demographic and are key users of the evening economy. The older affluent groups, who tend to live on the outskirts of London, are less likely to engage with the post-work offer given they are more likely to be tied to catching trains home. As such, these groups are much more likely to be found utilising the ever-growing grab ‘n’ go culture during the day.

What This Means

London has been and will always be a driver of innovation across multiple sectors and channels. There is a need to adapt quickly and smartly to cater for an increasingly demanding consumer; recognising the differences and intricacies between the different demographic groups is key. Staying on top of this is challenging, but those who keep up with the pace will continue to reap the greatest rewards.

If you have any questions on how customer insight can help your business, please get in touch.

If you want to hear more about how CACI’s Property expertise can help you, get in contact now.