How online shopping is changing the habits of UK consumers

As part of our series delving into the UK’s shopping habits, we’re looking into online shopping and click and collect – and how bricks-and-mortar retailers and landlords should respond.

Shopper Dimensions, our aggregated database of over 600,000 interviews with shoppers at leading UK retail centres, has revealed several significant shifts in shopping behaviour.

Here, we’re exploring an important question for retailers and landlords alike: how is online shopping and click and collect changing the behaviours of UK shoppers – and does it present a new opportunity?

The Rise of Click and Collect

Online spend has grown an average of 14% each year since 2013, and it shows no sign of slowing down. Between 2017 and 2026, we anticipate that the amount we spend online will grow a further 127% in total.

This growth can arguably be attributed to convenience, as retailers invest more in multichannel approaches, offering increasingly diverse and convenient ways to buy. For both the retailer and their customer, the line between physical and online has blurred – for some demographics it doesn’t exist at all.

Previously the playground of high street giants, click and collect is increasingly standard for smaller retailers too, with those not offering collection or home delivery finding themselves the minority. Online shopping has created a culture of ‘now now now’, with consumers expecting retailers to keep up with their desire for immediacy.

Online shopping has created a culture of ‘now now now’ with consumers expecting retailers to keep up with their desire for immediacy

Next-day (and even same-day) delivery, collect immediately in store, and buy-now-pay-later options are becoming the norm, as retailers compete on convenience as well as price. And this is where click and collect provides an opportunity for physical retailers.

In 2017, 2.8% of all shoppers we interviewed were using click and collect services during their trip – a growth of 23% since 2014. Someone using click and collect is worth 90% more on a shopping trip than someone who isn’t. It’s important to note that, where click and collect was previously almost exclusively in-store (and therefore in-centre), it’s now offered through a variety of channels. A rapidly developed network of Collect+ points, self-service delivery lockers and supermarket collection options has likely diluted true popularity of the service.

The Click and Collect Opportunity

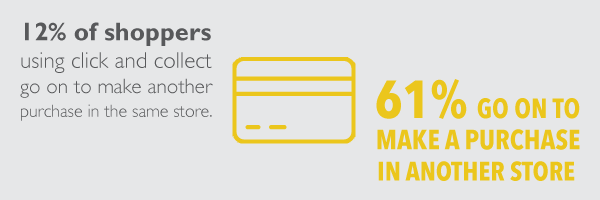

Though click and collect poses logistical and operational challenges for retailers, and potentially reduces rent for landlords, it actually presents a significant opportunity for in-store conversion. Our research found that 12% of shoppers that collect in store go on to make another purchase in the same store – and, interestingly for centre owners, 61% go on to make a purchase in another store in the same retail centre.

In particular, we believe that – as click and collect becomes more ingrained in the everyday shopping experience – local retail centres that provide fast access to practical everyday essentials will have a key opportunity to cement themselves as vital parts of retailers’ multichannel strategy.

For retailers, the next steps are simple: taking advantage of the conversion opportunities offered by click and collect sales means making the purchasing process as simple as possible – and ideally, taking the complexity out of returns, too.

Much like click and collect, using physical centres to simplify the onerous returns process gives multichannel retailers the opportunity to steal a march on digital and bricks and mortar competitors alike – increasing centre footfall and conversions in the process.

Discover More

If you want to hear more about how CACI’s Property expertise can help you, get in contact now.