Build, build, build smart not hard

Boris Johnson has issued a call to arms with “the most radical reforms to our planning system since the second world war.” “Build, build, build”; the message is as clear as the slogan. The UK is cutting the red tape surrounding residential development to allow quicker planning and to open up more unused or underused space to be developed into residential property. Not only this but the announcement of an increased £450million for The Home Building Fund creates an exciting prospect to see SME’s gain further support to build new homes.

An increase in supply is needed but through our use of analysis, our unique data sources and models CACI has been aware for a while that the “Field of dreams strategy” (build it and they will come) is no longer a suitable model. In fact, what is needed are developments that address the needs of the population at a localised level; needs assessed and measured against local population demographics. Although the new reforms that open up unused or underutilised space to transfer into residential should in theory address the supply issue, looking into the past few years of development I have good reason to be sceptical.

Below I will be addressing some of the key problems and solutions that all developers large or small should be planning and preparing for especially due to the uncertain times ahead:

- Understanding the catchment that your development will pull from, and who is likely to move to your location to inform what you build.

- Using a diverse source of data to set smart prices and rent based on demand rather than supply.

- How to get your development in front of the people most likely to move there and understand what messages resonate with them.

WHO WILL ACTUALLY MOVE TO YOUR DEVELOPMENT AND WHAT DO THEY WANT?

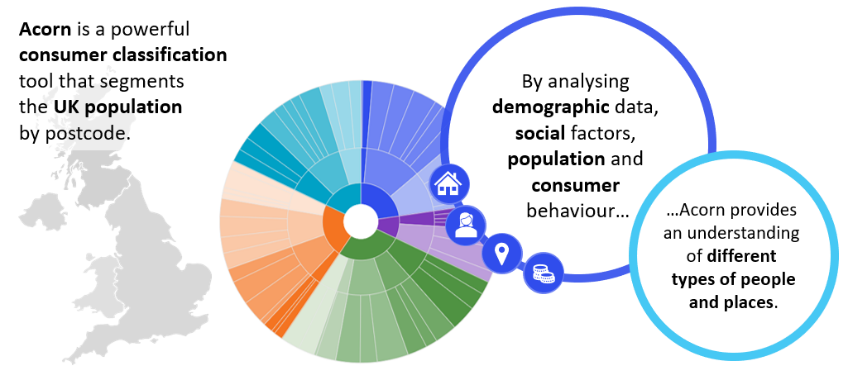

Tolga Necar, managing consultant at CACI, has profiled and Acorn coded new build houses across London and provided the following insight “50% of all New Build houses in London were Acorn Profiled as “City Sophisticates”; a group that accounts for just 25% of the London population. It is clear why these are an attractive target for developers; they are high earners and they are mobile (they are 67% more likely to move in a given year than the average person). But this oversupply of new builds means that each development is fighting for the same slice of the same pie; whilst other demographics across the spectrum are missed. Indeed, in London there are 49% more non-City Sophisticates movers than City Sophisticate movers so targeting just one narrow set of potential customers misses the substantial opportunity in winning with the 140,000 households from other demographic groups that will move.”

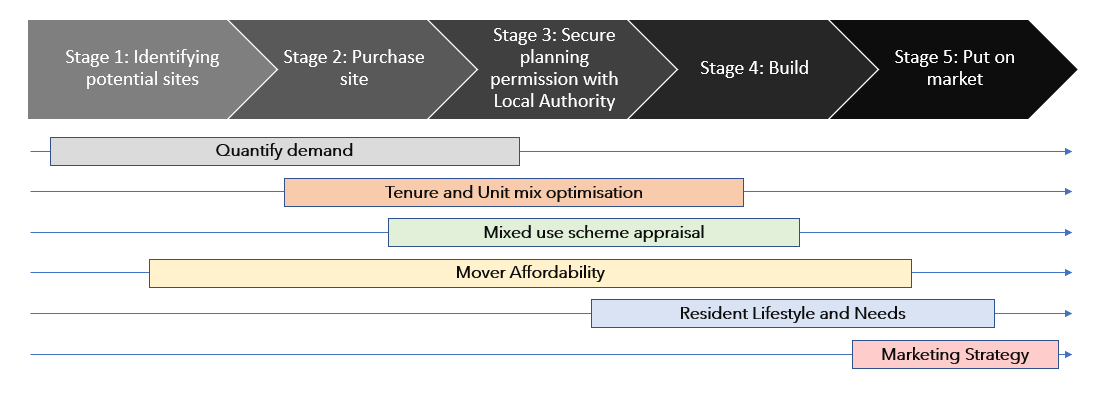

With this in mind it is no wonder that in London alone there was a value of £1 billion properties built but not sold last year. CACI is enabling developers to understand local demand by using our innovative catchment model to identify local demand and ultimately create an accurate correlation between the people likely to move and what they are actually looking for in a property across the UK. This in turn is successfully mitigating future risk and increasing profit margins for developers by increasing the volume of sales and occupancy on completion.

SETTING SMART PRICES AND RENT BASED ON DEMAND RATHER THAN SUPPLY

The margin for error has increased significantly this year and will do for years to come as the financial, societal situation and knock on effects of a pandemic are affecting individual households. Creating an accurate picture of affordability has been important but is now a necessity in a consumer led crisis. As a young private renter, I have witnessed first-hand the effect even the slightest difference in price can have on the decision of choosing between properties that on the surface are almost identical.

In 2019 Shelter conducted a study that found that almost half of working renters are only one paycheque away from losing their home. Carry that forward into 2020 with an increase in redundancy and lower salaries, the problem grows significantly. So why are we still so focused on pricing rental and sales on the supply rather than the demand? Within our models and analysis CACI has built in our product ‘Paycheck’ which is a dataset that provides consistent and reliable gross household income estimates from all sources including earnings, benefits and investments. We have also advanced this process to also look at disposable income which identifies: Income tax and national insurance, mortgage and rents, council tax, utilities, water bills and structural insurance, food and clothing costs, childcare, student loans and pension contributions and travel to work costs. This allows us to paint a more accurate picture of what your tenants and buyers can actually afford rather than what you expect they can afford or should be paying.

A more robust approach to affordability is not only important for the tenant but for the landlord/developer as competition for customers increases. With an expected increase in SME’s and a more diverse portfolio of developers it is important to make sure that you understand the customers in more detail than your competitors from a local to national level.

ENGAGE AND LOCATE THE RIGHT PEOPLE TO MITIGATE RISK

With new rental accommodation concepts hitting the market and increasing residential content in our feeds it is harder to stand out than ever. Unfortunately, blogs, brochures and videos are not going to make an impact if you don’t know where to market them or how to engage with your consumers. For years retailers and brands have been utilising location intelligence into their marketing so why aren’t developers? With the emergence of build to rent driving the property industries new concepts and features in a home, I would argue that properties in the private residential sector are as much a lifestyle choice as a roof over your head. So how do you know the difference between who is looking for a rental property with a gym and a balcony compared to a young family looking to invest in their first home. More importantly how do you find them?

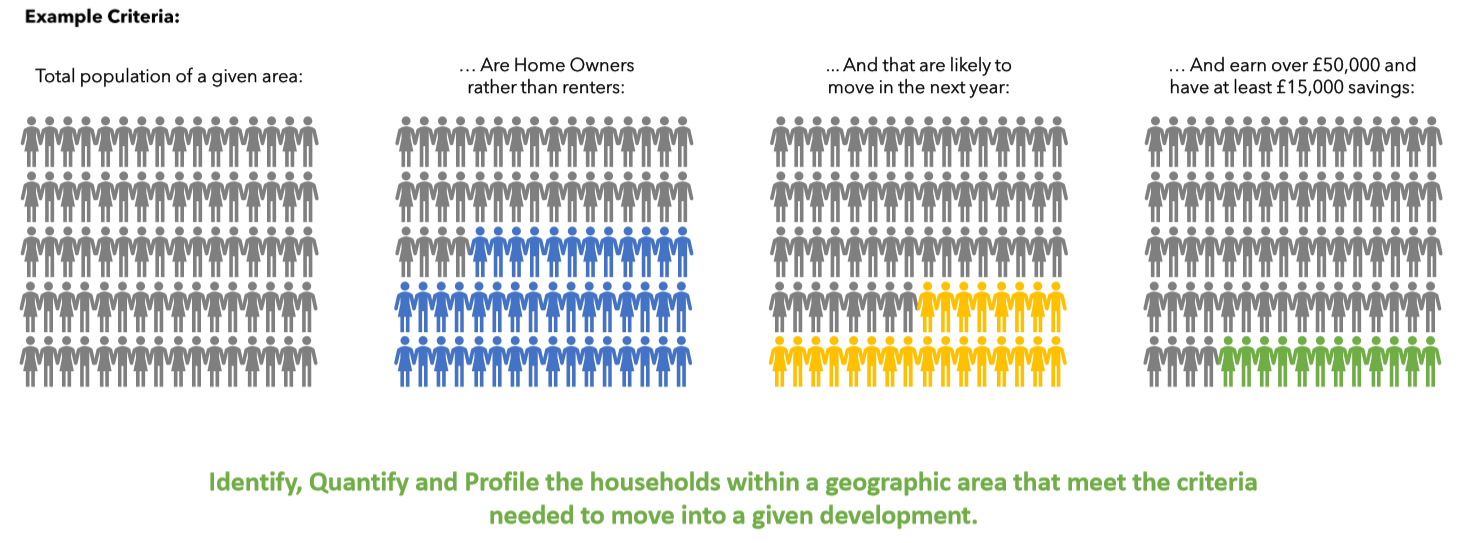

Combining multiple variables to identify your target market is a great way of identifying the perfect consumer for your new developments. By understanding financials, lifestyle choices and lifestage we can understand who we should be targeting. CACI uses our unique datasets that are geocoded to enable marketers to do this in the same way we would identify the right location to develop in.

Once areas with a higher density of these consumers is identified we then need to drill down into their lifestyle choices and media preferences to engage with them. This doesn’t mean “are they online or offline?” but really understanding what they are looking for. It could be price, local amenities, on site facilities, location or all of the above. CACI understands there is a direct correlation between where people work, play and live so all must be considered when creating content for this particular set of customers. Once motivations are understood and the correct content is created CACI can then apply variables to not only understand who has a higher propensity to engage with certain content or media preferences but who is more likely to respond to that content.

From a household to postcode level of geography we can then locate the people who have a far higher propensity to engage and ultimately view your developments.

CONCLUSION

More houses need to be built to meet demand. Not understanding localised demand and affordability has been the Achilles’ heel of the residential market for a number of years. Where there is a high supply of housing that doesn’t fully meet the needs of the local demand, it has become increasingly difficult to sell them to investors or customers. A higher level of competition and supply has also made it difficult to reach and engage with the desired target market causing developers to fluctuate price or miss out on opportunity as the right customers are not seeing the marketing messages.

CACI understands people and place and in doing so can enable developers to build the right homes, in the right location, at the right price for the right people. Our new residential model can mitigate risk and increase the value of your developments at any point in the development cycle from first identifying a site all the way through to marketing and letting/selling the individual units.

In response to the ongoing situation and the ever-present housing crisis across the UK we will be releasing a white paper on residential movers and where to find them. For more information get in touch at twilson@caci.co.uk